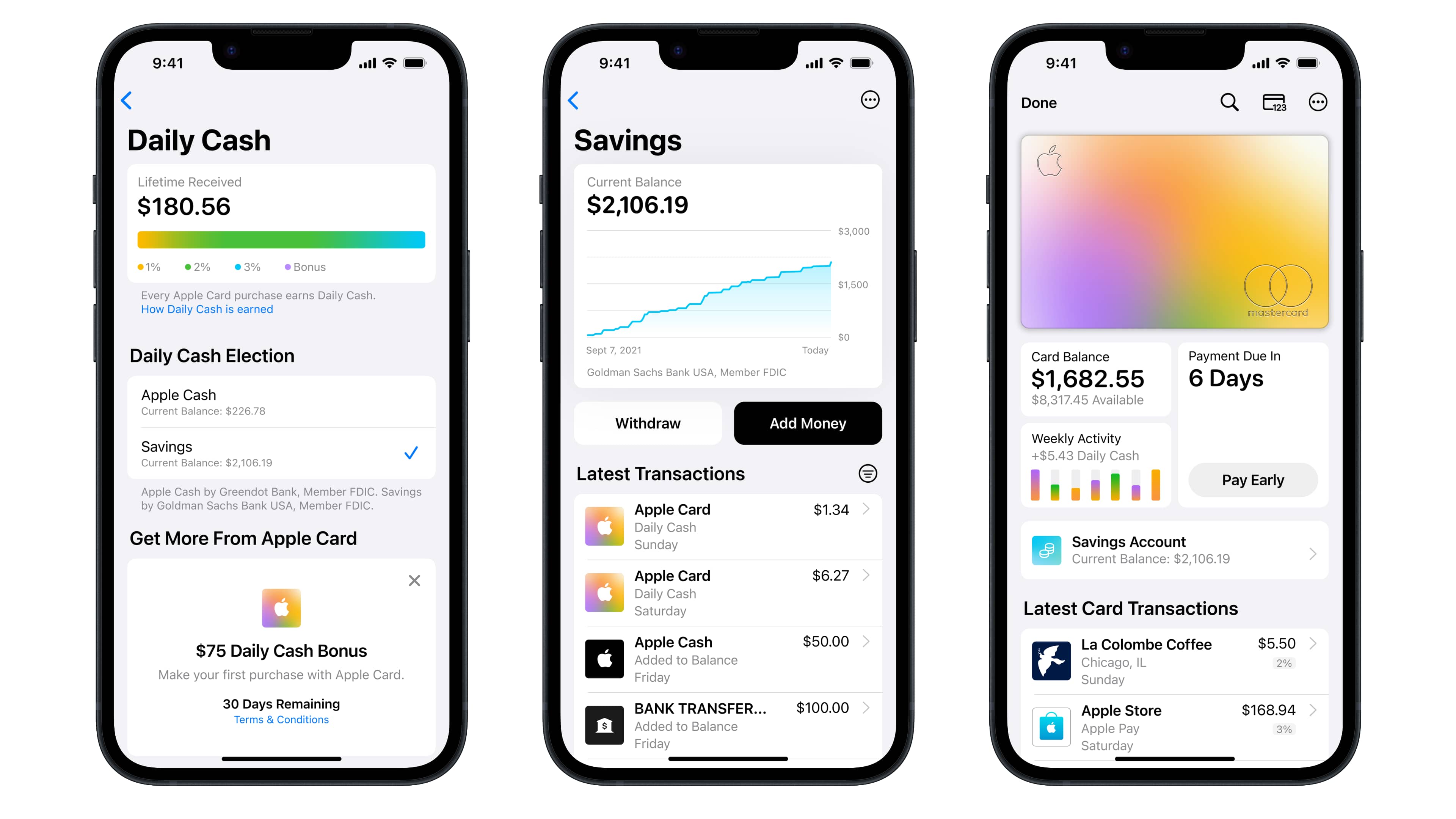

Deposit your Daily Cash automatically into the Apple Card savings account, or transfer funds from Apple Cash balance or your linked bank account.

- Following the recent preview, the no-fees Apple Card savings accounts are now available to eligible Apple Card customers in the United States.

- Spend money in your savings account via your Apple Card or Apple Pay.

- Transfer funds to Apple Cash or a linked external bank account.

- The maximum balance allowed for this account is $250,000.

- The interest rate is set at 4.15 percent.

The Apple Card savings account is now available in Wallet

The announcement in the Apple Newsroom explains that savings accounts are issued and provided by Goldman Sachs Bank, with a maximum deposit capped at $250,000. At the four percent interest rate, that’s $10,000 per year in interest rates.

You could get the same investment by going directly with Goldman Sachs, but Apple’s solution is available directly from the iPhone without installing any apps.

“Apple is not a financial institution,” the company cautions.

Daily Cash will be automatically deposited into your savings account (you can change that). In addition to earning interest on the Daily Cash from Apple Card purchases, you also make interest on funds you add to your savings account from a linked external bank account or your Apple Cash card. Withdrawing funds to an Apple Cash card or external bank account is supported, too.

How to set up an Apple Card savings account

You can find the option to set up a savings account on the Daily Cash screen in your Apple Card settings within the iPhone’s Wallet app.

- Launch the Wallet app on your iPhone.

- Touch your Apple Card in Wallet.

- Touch the … (More) button, then select Daily Cash from the menu.

- Hit Set Up next to Savings and follow the instructions.

You can instantly transfer funds from your Apple Cash balance to your new savings account or do this later. To see the current balance, available balance, interest earned this year and your current Annual Percentage Yield (APY), hit your Apple Card in the Wallet app and select the savings account.

To deposit money into the account, touch the Add Money option on the Apple Card settings screen. You can use your Apple Cash card or a linked external bank account to deposit money into your savings account.

Who’s eligible for a savings account?

You must be an owner or co-owner of an active Apple Card account to use this feature. You also must be 18 years or older, have a social security number or individual taxpayer identification number and be a resident of the United States with a valid, physical US address. Lastly, the Apple Card must be added to the Wallet app on your iPhone, and your Apple ID account must use two-factor authentication.

A newly published support document on the Apple website provides more information on how to set up and use the Savings feature in the Wallet app. Be sure to read the deposit account agreement available on the Goldman Sachs website for further details about maximum balance and transfer limits, and other fine print.