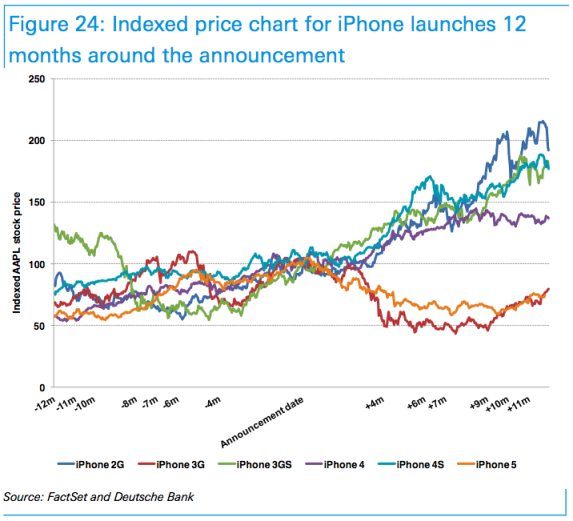

Apple reported the financial results for its holiday quarter late last month, and for the most part they killed it—the company set records for revenue, iPhone sales, and iPad sales during the 3-month period. But all Wall Street saw was declining growth.

The Cupertino tech giant's stock dropped 8% that day in after-hours trading, falling from $550 per share to $500, and it has yet to rebound. But Tim Cook says Apple's taking advantage of the unexpected price drop by going on a major buyback spree...