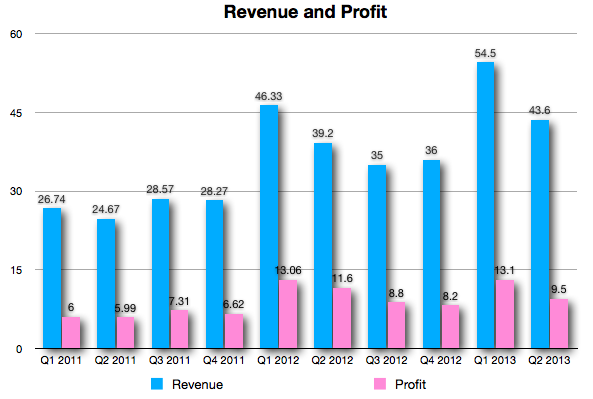

Wall Street is nothing if not fickle. Questions over Apple’s future profits sent the company’s stock into a tailspin for the past six months, then a recovery of sorts is now underway.

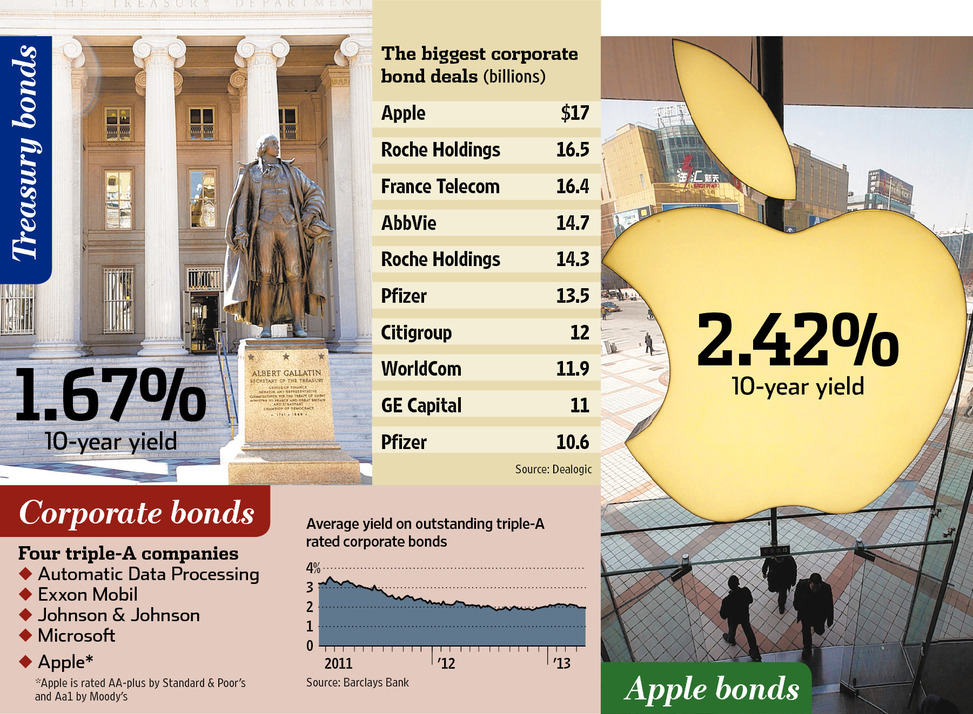

The iPhone maker Tuesday floated a record $17 billion in debt, an action that literally had investors falling over themselves.

Consider that Apple up until now was literally the only major technology corporation with zero debt on its books. By the end of yesterday, $50 billion in orders were received for what now looks to be Apple’s latest hot product: the iDebt…

Reuters has the story:

Sources said investors barely submit orders fast enough to get in on the deal from Apple, the only major tech company without a single penny of debt on its books.

In one of those ironies lost on many, Apple’s debt issuance is directly related to last week’s news of cooling profits. The bond sale is the Street’s largest since November 2012, when Abbott Laboratories issued $14.7 billion in debt when it spun off AbbVie.

After Apple announced it would return $100 billion in cash to investors, the firm’s stock price shot up by more than twelve percent, gaining three percent just yesterday.

Aside from Apple being a great name to have in your bond portfolio, the iPhone maker unleashed its iDebt during a time of historic low interest. “Apple bonds are a low-risk alternative to Treasury,” one portfolio manager told the Wall Street Journal.

Little wonder that by Tuesday morning there were enough investors that Apple could have sold its debt twice, according to the report.

Why is Apple going into the debt market when it has $145 billion in cash?

As we explained recently, the majority of that money is in other countries, where taxes are low. Only $45 billion of that cache is in the U.S., according to Reuters.

But there is a threat of building too much debt.

Although Apple has enviable metrics, including the cash, it did not receive the highest rating from credit evaluation firms Standard & Poors and Moody’s. Instead, S&P issued an AA rating and Moody’s gave Apple’s offering Aa1.

The highest rating makes it less costly to offer debt.

Why?

Fitch, another credit rating firm that has yet to issue a ranking for the iDebt, said Apple’s hefty bank account was “overshadowed by the threat of volatile consumer preferences, significant competition and rapid technology changes.”

Although Reuters reports Tuesday’s debt sale could be the iPhone maker’s only bond deal for this year, it is uncertain what the company will do if profits do not pick up during the next quarter.

Goosing the stock with another buyback would make friends on Wall Street, but too much debt could impinge on Apple’s ability to adapt or produce new consumer devices.

Are you concerned that Apple may be risking its future with iDebt?

And should the company just go private like Dell did?