Apple’s savings account may delay large transfers or withdrawals from new accounts as part of the standard anti-money-laundering security audit.

- The Wall Street Journal reports that some Apple Card users have complained about long delays with cash withdrawals from their Apple savings accounts.

- One customer got so upset with a transfer delay that they went as far as closing their savings account, moving all $200,000 back to Amex.

- Goldman Sachs operates Apple’s savings accounts, and the investment bank explained that these delays are part of standard security measures.

Why do some Apple savings accounts delay transfers?

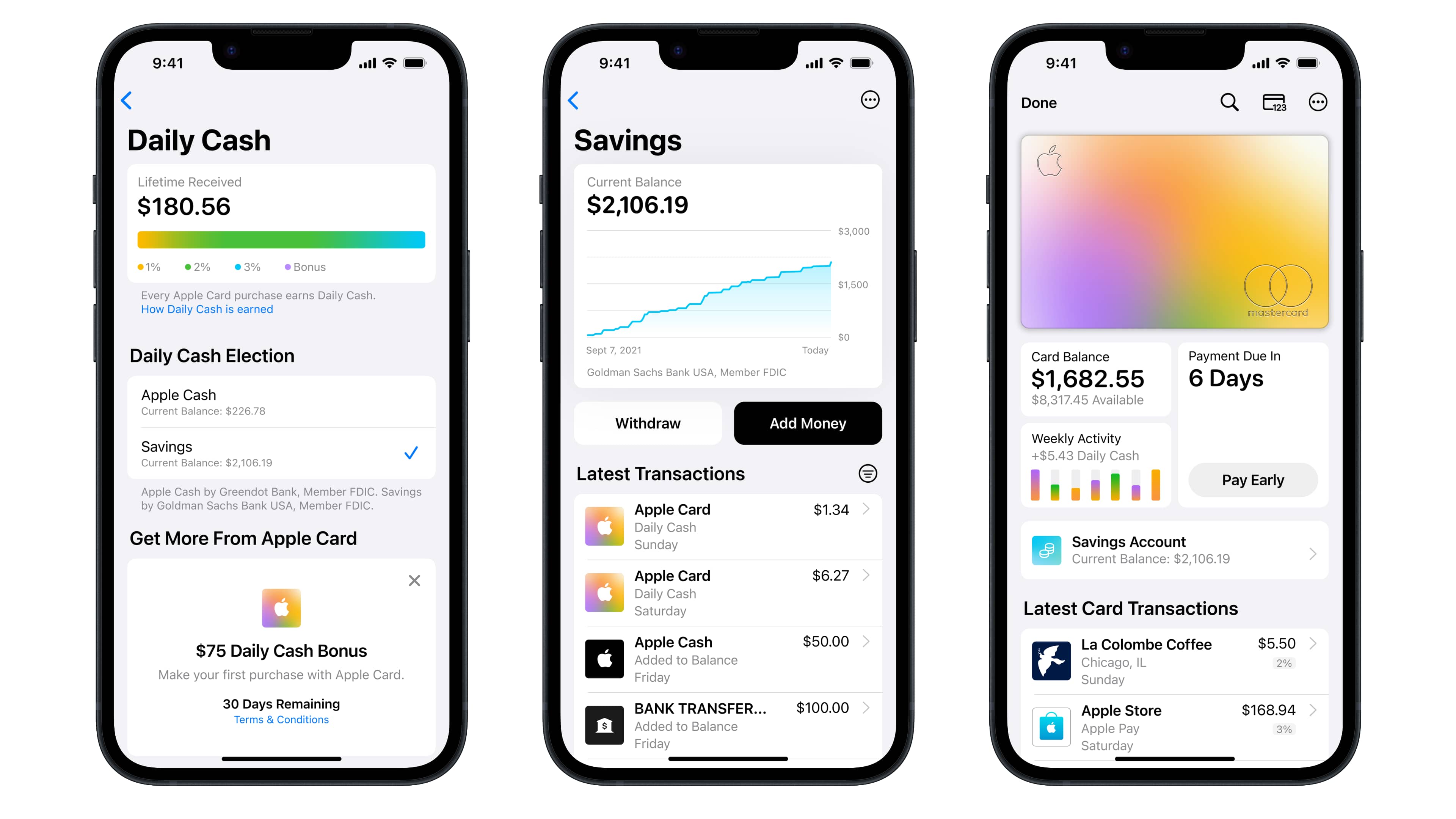

The Apple Card savings account has enticed many customers with its high interest rate of 4.15 percent, but some customers have complained about a delay when trying to move their money to a linked external bank account.

This issue isn’t related to the transfer amount as people reported delays with transfers ranging from as low as $1,700 to as much as $100,000.

In some cases, delays stretch weeks. At least one customer closed their account because of the delay and moved their money elsewhere. In one case, a customer’s balance was unavailable in both their savings and bank accounts. The report notes that the vast majority of Apple Card customers don’t experience this problem.

Apple didn’t provide a comment at publication time, but Goldman Sachs’s Vice President Nick Carcaterra gave this statement to the Wall Street Journal:

While the vast majority of customers see no delays in transferring their funds, in a limited number of cases, a user may experience a delayed transfer due to processes in place designed to help protect their accounts.

And:

While we would not comment on specific customer interactions, we take our obligation to protect our customers deposits very seriously and work to create a balance between a seamless customer experience and that protection.

Carcaterra added that customers responded to Apple’s new savings account “beyond our expectations.” Forbes reported that the service attracted nearly $1 billion in deposits in its first four days.

This is a security measure rather than a technical issue:

On brand-new accounts, like Apple’s, transfers that make up a large share of the overall balance can trigger anti–money-laundering alerts or other security concerns that require additional review, according to people in the AML field. Those delays usually last five or so days, they said.

Initiating a large transfer from a brand-new account will also trigger scrutiny.

What is the Apple Card savings account?

The iPhone maker unveiled a new savings account for users in the United States in April 2023. The account is provided by Goldman Sachs, with the Apple Newsroom announcement acknowledging that “Apple is not a financial institution.”

Daily Cash collected using an Apple Card is automatically deposited into the savings account. You can transfer funds from your Apple Cash balance or a linked bank account. You can spend money in your savings account via Apple Pay or Apple Card and withdraw funds to Apple Cash or a connected external bank account.

The savings account is currently unavailable outside of the United States, with the maximum allowed balance set to $250,000 per account.