The European Commission publicized its ruling that Apple benefited from a favorable Irish tax rate, arguing that Apple’s funneling of revenues and earnings to Ireland, where the Cupertino firm cut a favorable tax deal with the Irish government in the late 1980s and early 1990s, constitutes illegal state aid, The Wall Street Journal reported Tuesday.

Responding to these accusations, Apple issued a written statement denying it’s received preferential treatment from the government of Ireland. Apple is urging the need for corporate tax reform, insisting its tax arrangements in Ireland are perfectly legal.

Here’s Apple’s response in its entirety:

Apple is proud of its long history in Ireland and the 4,000 people we employ in Cork. They serve our customers through manufacturing, tech support and other important functions. Our success in Europe and around the world is the result of hard work and innovation by our employees, not any special arrangements with the government.

Apple has received no selective treatment from Irish officials over the years. We’re subject to the same tax laws as the countless other companies who do business in Ireland.

Since the iPhone launched in 2007, our tax payments in Ireland and around the world have increased tenfold. To continue that growth and the benefits it brings to the communities where we work and live, we believe comprehensive corporate tax reform is badly needed.

At the heart of the problem is a deal Steve Jobs and the Irish government cut in the late 1980s and early 1990s. The arrangement was implemented in 1991 and the European Commission is now looking at a ten-year period between 2004 and 2014.

In exchange for low corporate tax rates that in some years were as low as two percent (versus 35 percent in the United States), Apple allegedly agreed to funnel its revenues using its facility in Cork, Ireland.

Apple’s finance chief Luca Maestri told The Financial Times that “there’s never been any special deal” with the Irish government that would be construed as state aid.

“We were simply trying to understand what was the right amount of taxes that we would have to pay in Ireland,” Maestri said, describing Apple’s approach as “very responsible, transparent and prudent”.

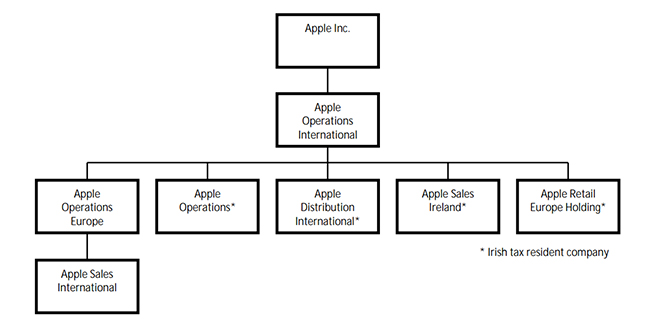

The European Commission shared this chart illustrating Apple’s tax schemes in Europe.

Adam Smith Institute Fellow Tim Worstall in his Forbes article opines that Ireland, not Apple, is to blame here, insisting there’s no possibility of a fine upon Apple.

“For in cases of illegal state aid there never is a fine levied upon the company or recipient of such aid,” writes Worstall. “The government that allowed or paid out the aid must recover it, that’s true, but there’s no fines over and above that even if there’s a finding of said illegal aid”.

The PDF of the ruling posted by the European Commission accuses the Cupertino firm’s Apple Sales International and Apple Operations Europe subsidiaries of profit allocation which has resulted “from a negotiation rather than a pricing methodology”.

In short, Apple is on the firing line for negotiated a favorable tax deal with the government of Ireland and EU wants to put an end to the practice.

Therefore, the European Commission (EC) has decided to initiate the procedure “laid down in Article 108(2) TFEU with respect to the measures in question”. The EC is seeking comments from the Irish government, and tax-related documents, effectively auditing both Ireland and Apple.

The arrangement has enabled Apple to relocate a whopping $102 billion in cash offshore, saving up to $9 billion per year in the process, CNBC estimated.

In defending Apple’s offshore practices, CEO Tim Cook told Politico in May 2013 that “Apple does not funnel its domestic profits overseas,” adding his company pays taxes on “all the products we sell in the U.S., and we pay every dollar that we owe”.

And what’s your position on this matter?

Should the European Commission come down hard on Apple’s tax deal with the government of Ireland? And should Uncle Sam come up with a way to force companies like Apple to repatriate their overseas cash?