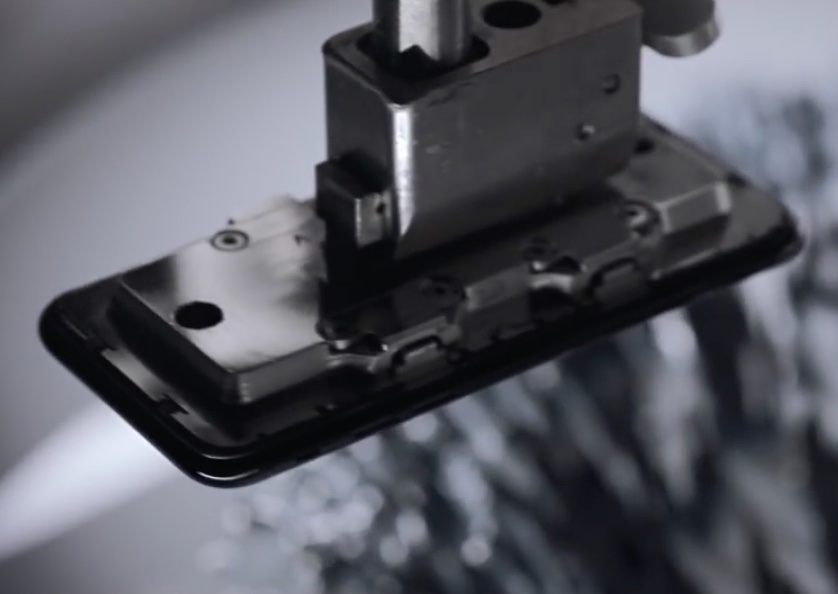

Apple has begun production on the iPhone 6s in India. This is the second Apple handset after the iPhone SE to be manufactured in the second most populous nation in the world. The Economic Times says this move will help Apple avoid paying import duties in the country.

Apple begins iPhone 6s production in India