Apple Cash now uses the Visa network instead of Discover, with all new virtual Apple Cash debit cards being created on the Visa network.

Apple Cash virtual cards are switching networks from Discover to Visa

Apple Cash now uses the Visa network instead of Discover, with all new virtual Apple Cash debit cards being created on the Visa network.

A handy feature for folks using the Apple Card is Daily Cash Back. This will automatically deposit your earned cash back from purchases onto the Apple Cash card saved in your Wallet. From there, you can choose to use those funds to help pay down the Apple Card's balance, pay for items when using Apple Pay, or transfer the money to a bank.

The financial services corporation Visa has announced that folks in Japan can now add their Visa debit or credit cards to the Wallet app for use with contactless payments via Apple Pay.

Financial and payment cards company Visa on Friday announced that it will be eliminating signature requirement for Apple Pay and chip-equipped cards starting April of this year.

Sources speaking with Recode reiterated today that Apple is still planning to debut its own money-transfer service akin to PayPal's Venmo that could launch later this year. Tentatively named Apple Cash, the peer-to-peer service would zap payments from users' checking accounts to recipients through their Apple devices, basically allowing iPhone owners to send cash to friends and family members digitally.

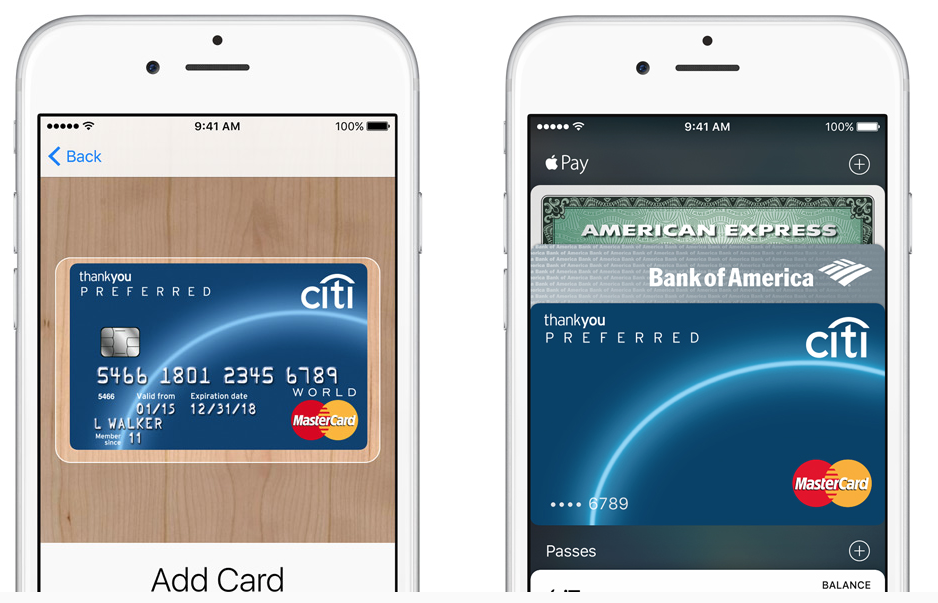

The Cupertino giant could partner with Visa on a system that would let users obtain virtual Apple-branded prepaid cards. Running on Visa's debit network, those digital cards could be tied directly into the firm's rumored peer-to-peer thing.

Moreover, users would be permitted to register them with Apple Pay to use when making credit-card and debit-card payments in stores with their Apple devices. The card number could also be used to make purchases on websites and in apps.

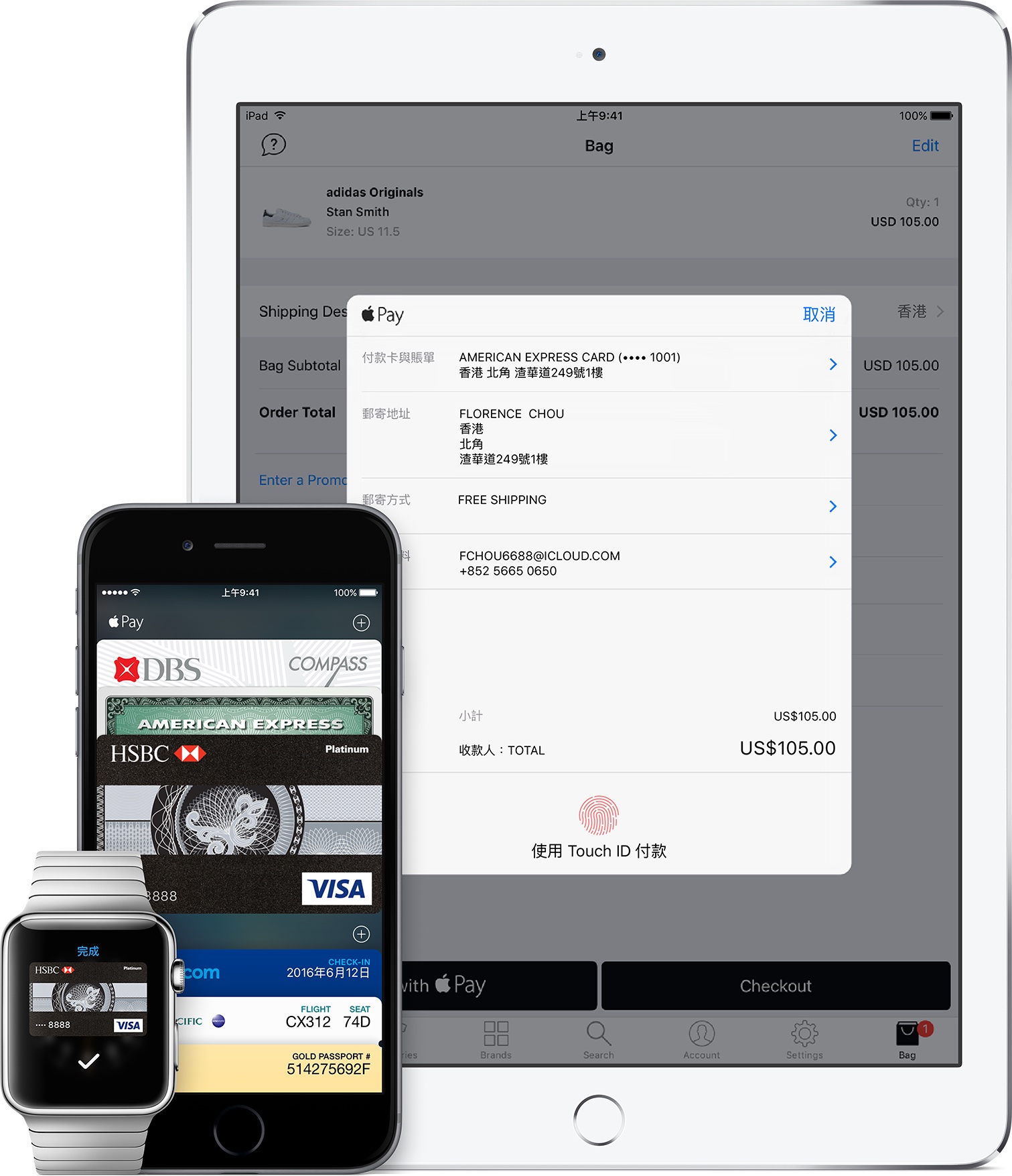

Apple Pay expansion in international markets has accelerated lately, with the mobile payment system launching in France yesterday and now, just 24 hours later, in Hong Kong. According to Apple Pay's Hong Kong website, the service is supported at launch by all three major credit card companies: Visa, American Express and MasterCard, with cards issued by Hang Seng Bank, Bank of China (Hong Kong), DBS Bank (Hong Kong), HSBC, Standard Chartered and AmEx.

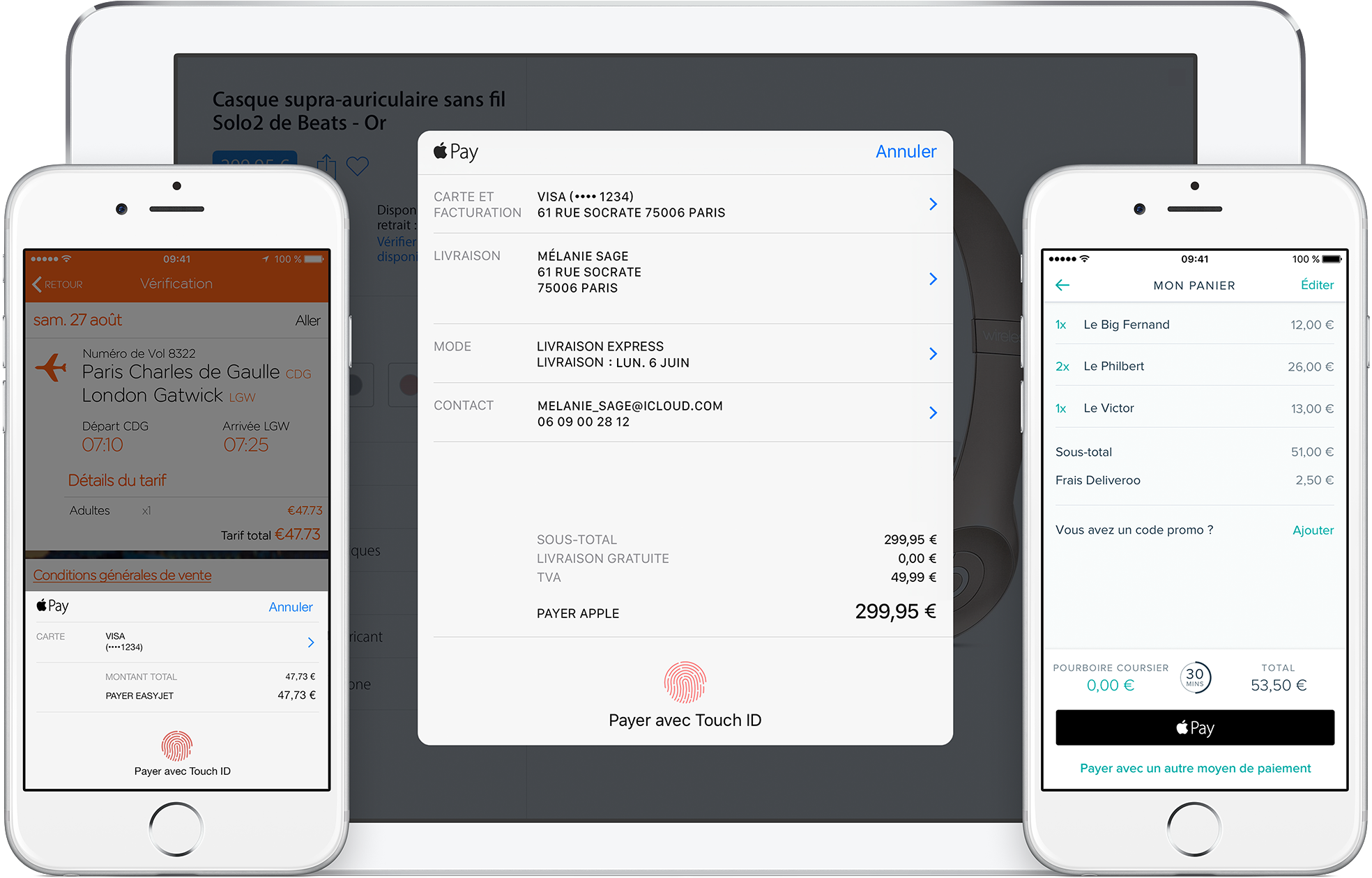

Apple today announced that its mobile payments service, called Apple Pay, is now accepted in France through launch partnerships established with card issuers Visa and MasterCard. Customers in France can now add their MasterCard and Visa cards to the Wallet app on their iPhone and start paying for goods and service in stores and apps with Apple Pay.

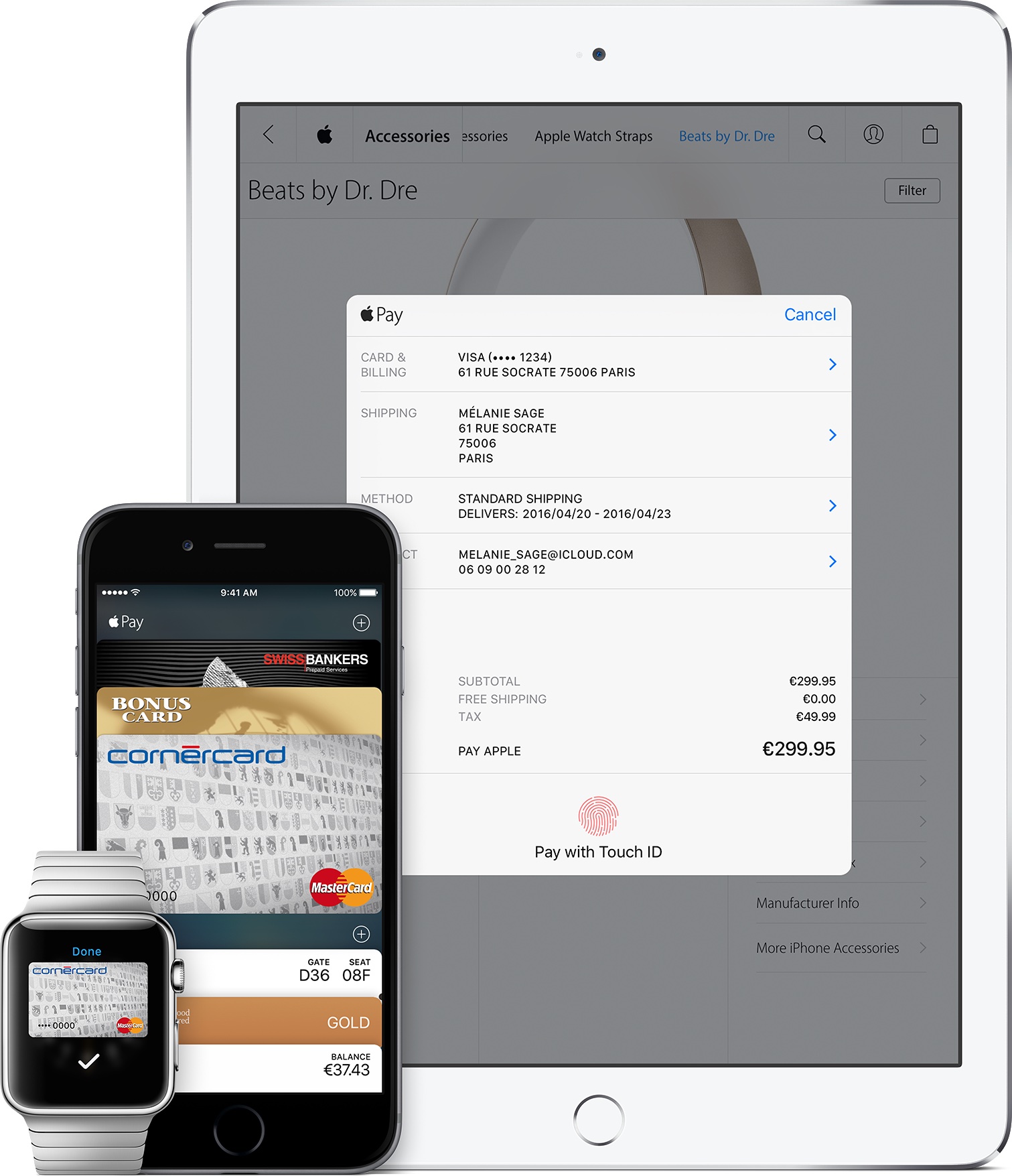

As rumored, Apple's mobile payment system on Thursday went live in Switzerland, its seventh country, expanding the European footprint for Apple Pay beyond the United Kingdom. The firm announced the service is available with initial support for MasterCard and Visa credit and debit cards issued by Bonus Card, Corner Bank and Swiss Bankers, with additional banks and credit card issuers to be added at a later stage. Apple Pay boss, Jennifer Bailey, said the company plans to bring Apple Pay to every major market in which its products are sold.

After debuting in Singapore last month with initial support from American Express, Apple Pay today launched fully in the country with five major banks on board. According to Apple's support document highlighting participating banks and store cards, the following financial institutions in the country support adding credit cards to Apple Pay: DBS, OCBS, POSB, Standard Chartered Bank, United Overseas Bank and American Express.

Through launch partnership with American Express, customers in Singapore can now take advantage of Apple's mobile payment system to pay for goods and services in stores with a touch of their finger. Adding Singapore to the list of countries that support Apple Pay was advertised earlier today on the local Apple Pay website in Singapore.

Local retailers like FairPrice, Starbucks, TopShop, TopMan, StarHub, Shaw Theaters and several others will now take Apple Pay as a form of payment. In the coming months, outlets like 7 Eleven, The Coffee Bean and Tea Leaf, Food Republic and Toast Box will roll out support for Apple Pay in the 5.4 million people country.

Tuesday, financial services corporation and credit card issuer Visa announced that it will be rolling out tokenization technology in Europe by mid-April, a move that could speed up the arrival of Apple Pay and other new contactless payment services to the 743 million people continent.

The payment tokenization technology will be “be at the heart of new mobile payment solutions.” Needless to say, Apple Pay has mainstreamed tokenization, which basically replaces sensitive credit card and payment information with a one-time digital token exchanged between your iPhone and an NFC-enabled payment terminal.

America First Credit Union said in a media release Thursday that cardholders can now use its America First Visa credit and debit cards with Apple Pay. In addition, as explained in a FAQ outlining the service, customers can also use their Visa Business credit and debit cards with Apple's mobile payment service.

Apple Pay is accepted at more than 220,000 retailers and does not require any special merchant equipment aside from a standard NFC-enabled terminal.