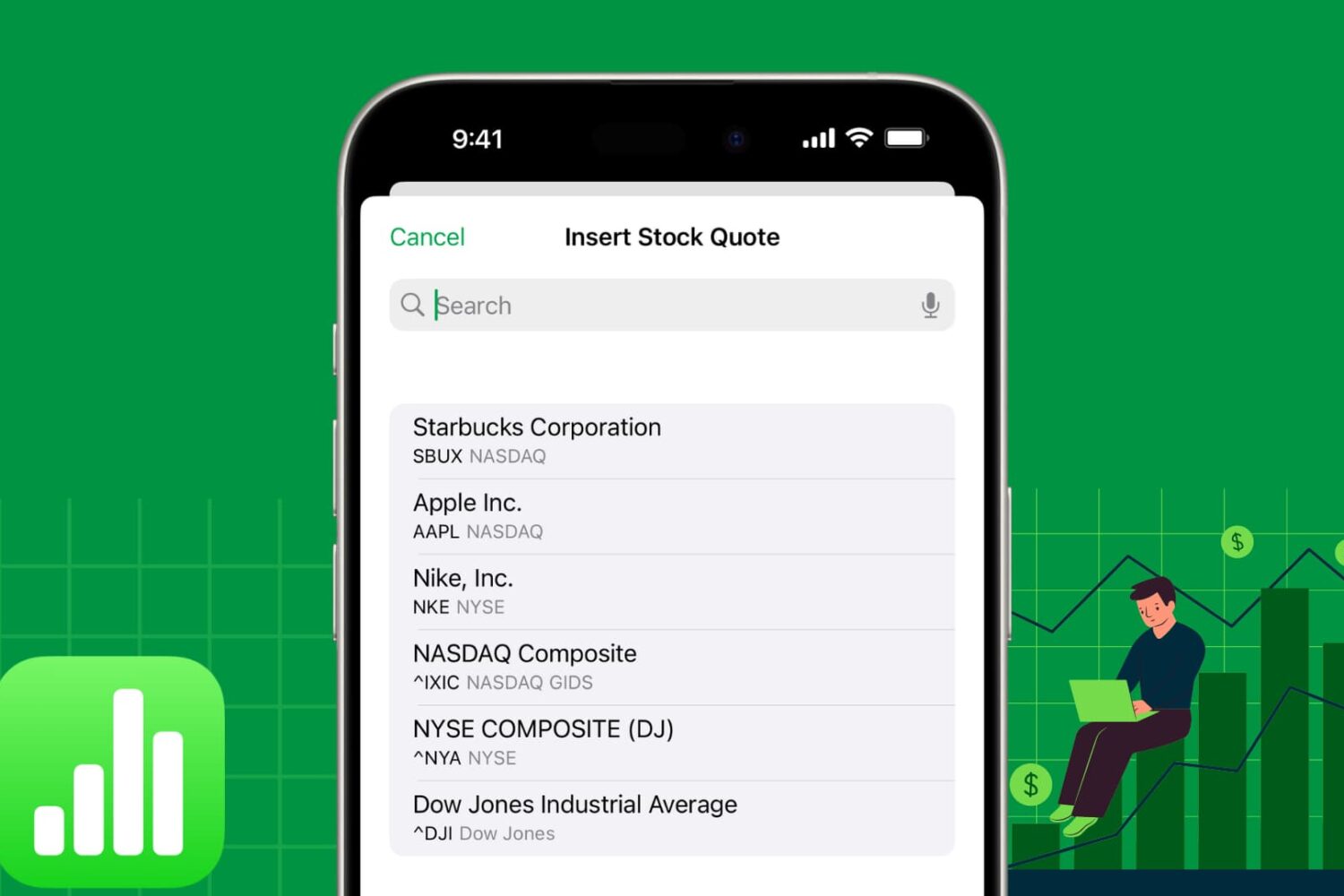

Learn how to add stock quotes in the Numbers app for Mac, iPhone, and iPad to keep track of your investments in the stock market.

How to add stock quotes and information to your Numbers sheet

Learn how to add stock quotes in the Numbers app for Mac, iPhone, and iPad to keep track of your investments in the stock market.

The United States-based supplier Finisar Corp will receive a cool $390 million investment from Apple's Advanced Manufacturing Fund which was set up back in the summer to help create manufacturing jobs in the country.

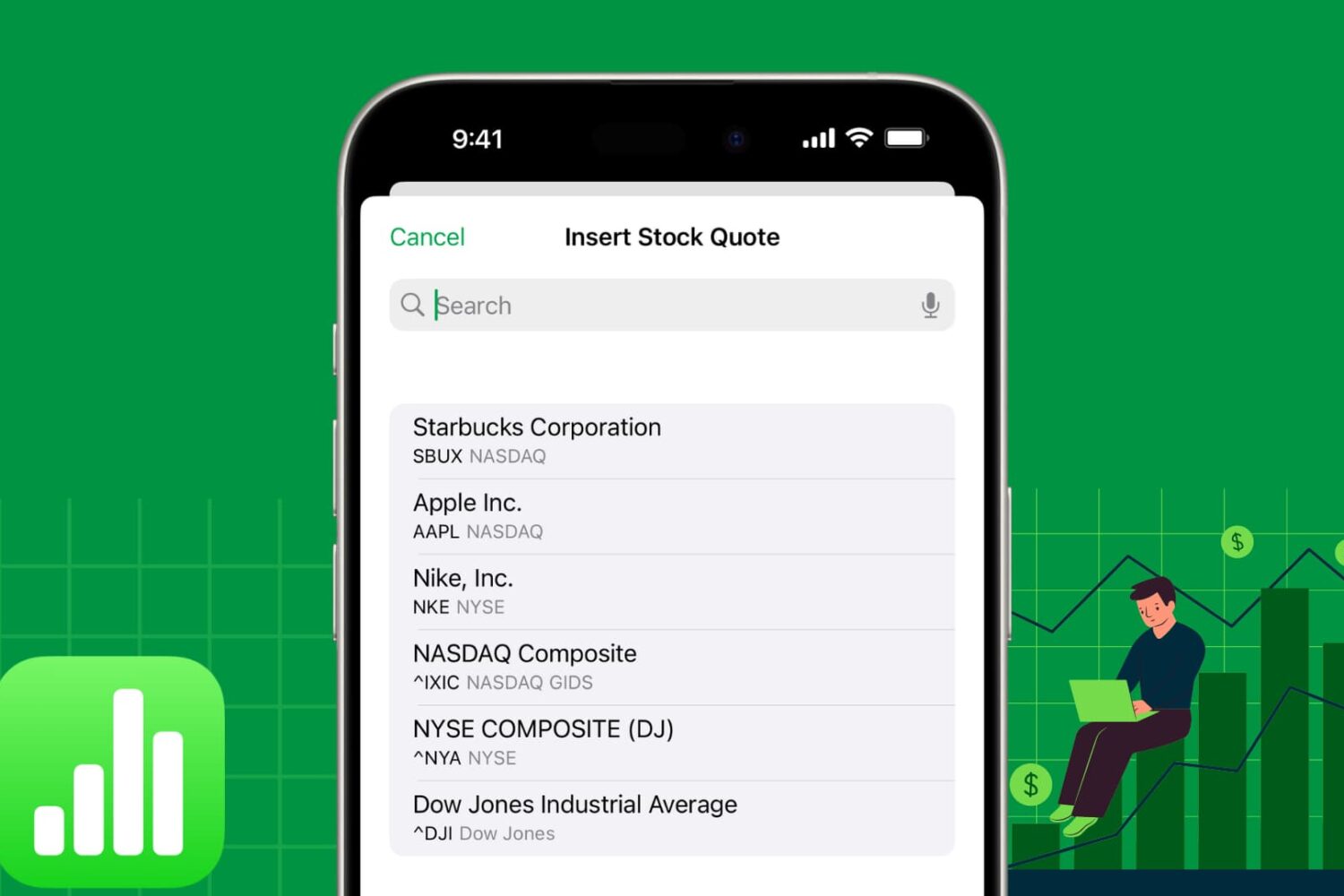

The price of Bitcoin has reached insanely ridiculous levels in the past few weeks, and no one knows exactly why. And as the popular blockchain cryptocurrency continues its surge, the Coinbase app for iPhone has now risen to the top of the free apps chart in App Store.

According to an update on the Investor Relations website, Apple is scheduled to report its fiscal 2017 third quarter earnings on August 1. The Cupertino technology giant has scheduled a conference call with Wall Street analysts and investors to discuss the quarterly results for Tuesday, August 1, at 2pm Pacific Time / 5pm Easter Time.

A press release announcing the earnings typically goes out 30 minutes ahead of the earnings call. You'll be able to listen to the conference call live via Apple's website. Apple states that live audio streaming uses its HTTP Live Streaming (HLS) technology.

HLS requires an iPhone, iPad, or iPod touch with Safari on iOS 7.0 or later, a Mac with Safari 6.0.5 or later on OS X 10.8.5 or later or a PC with Microsoft Edge on Windows 10.

We'll be covering the earnings and any interesting tidbits from the conference call.

Gorilla Glass maker Corning Incorporated shall receive a cool $200 million from Apple's new $1 billion fund aimed at creating advanced manufacturing jobs in the United States.

The investment will support the Kentucky-based company’s R&D, capital equipment needs and “state-of-the-art glass processing,” Apple said Friday.

For over a decade, Corning employees have helped create the protective glass found on iOS devices, with its 65-year-old Harrodsburg facility having been integral to the collaboration between the two companies.

Since the inception of Gorilla Glass in 2007, the Apple-Corning partnership has created and sustained nearly 1,000 US jobs across Corning’s R&D, manufacturing and commercial functions, including over 400 in Harrodsburg, said the iPhone maker.

Corning's procured enough renewable energy to cover all of its Apple manufacturing in US.

Jeff Williams, Apple’s chief operating officer, said:

Corning is a great example of a supplier that has continued to innovate and they are one of Apple's long-standing suppliers.

This partnership started 10 years ago with the very first iPhone, and today every customer that buys an iPhone or iPad anywhere in the world touches glass that was developed in America.

We’re extremely proud of our collaboration over the years and we are investing further with Corning who has such a rich legacy of innovative manufacturing practices.

Corning recaptures glass material for use in the production process and to help reduce waste.

Corning developed its durable type of glass back in the 1960s.

Aptly dubbed Gorilla Glass, it was a financial flop at the time so the company stopped making it. Fast forward to 2005, when Corning CEO Wendell Weeks gave Steve Jobs a demonstration of his company's glass material.

Jobs was impressed and decided to use Corning's glass protection for the original iPhone, as explained in Walter Isaacson's authorized biography of the late Apple co-founder:

Jobs said he wanted as much Gorilla Glass as Corning could make within six months. 'We don't have the capacity,' Weeks replied. 'None of our plants make the glass now.'

'Don't be afraid,' Jobs replied.

This stunned Weeks, who was good-humored and confident but not used to Jobs' reality distortion field. He tried to explain that a false sense of confidence would not overcome engineering challenges, but that was a premise that Jobs had repeatedly shown he didn't accept.

He stared at Weeks unblinking. 'Yes, you can do it,' he said. 'Get your mind around it. You can do it."

As Weeks retold this story, he shook his head in astonishment. 'We did it in under six months,' he said. 'We produced a glass that had never been made.'

Corning's facility in Harrisburg, Kentucky, which had been making LCD displays, was converted almost overnight to make Gorilla Glass full-time.

'We put our best scientists and engineers on it, and we just made it work.'

In his airy office, Weeks has just one framed memento on display. It's a message Jobs sent the day the iPhone came out: 'We couldn't have done it without you.'

In the US, Apple now supports two million jobs across all 50 states.

This includes 450,000 jobs attributable to the firm’s spend and investment with US-based suppliers. In 2016, the Cupertino firm spent over $50 billion with more than 9,000 domestic suppliers and manufacturers.

Apple is investing in SoftBank Group's new technology fund, reports The Wall Street Journal. The company confirmed its plans with the outlet to invest $1 billion in the SoftBank Vision Fund to help finance new technologies that it could use in the future.

“We believe their new fund will speed the development of technologies which may be strategically important to Apple,” Apple spokeswoman Kristin Huguet told The Journal. She also noted that Apple has been working with SoftBank for several years.

Activist investor Carl Icahn earlier this year sold his position in Apple, but that doesn't mean he no longer thinks Apple is a lucrative stock to invest in. Quite the contrary, he's made several billion dollars on Apple!

That being said, he would invest back in the Cupertino firm were it not for Apple's prospects in China, which he doesn't feel secure about although he's adamant that CEO Tim Cook is “doing a good job”.

Apple on Thursday announced that it has invested $1 billion in Chinese Uber competitor Didi Chuxing, reports Reuters. Speaking with the outlet, Tim Cook said the venture will help his company "better understand the critical Chinese market."

The move comes amidst slumping iPhone sales, which has driven Apple's stock price down to $90 per share, and other struggles in China. Last month, the State Administration shut down the iBooks Store and iTunes Movie sales in the country.

Apple CEO Tim Cook has invested some of his personal money in Nebia, a six-person start-up based in San Francisco which has developed a water-conserving shower head.

The startup has also received funding from the Schmidt Family Foundation, which was co-founded by Eric Schmidt, chairman of Google. Apple confirmed to The New York Times that its CEO's stake in Nebia was a personal investment, not on behalf of the company.

Apple has plans to announce a $200 billion program to buy back shares and raise its dividend, heavily upgrading its current buyback program announced three years ago, analyst Kulbinder Garcha of Credit Suisse told CNBC. Furthermore, Garcha raised the stock to "outperform" from "neutral", seeing the stock rising 19 percent over the next year.