Apple has scheduled its next quarterly earnings report on Thursday, April 20, 2020.

Apple’s March quarter earnings due on April 30

Apple has scheduled its next quarterly earnings report on Thursday, April 20, 2020.

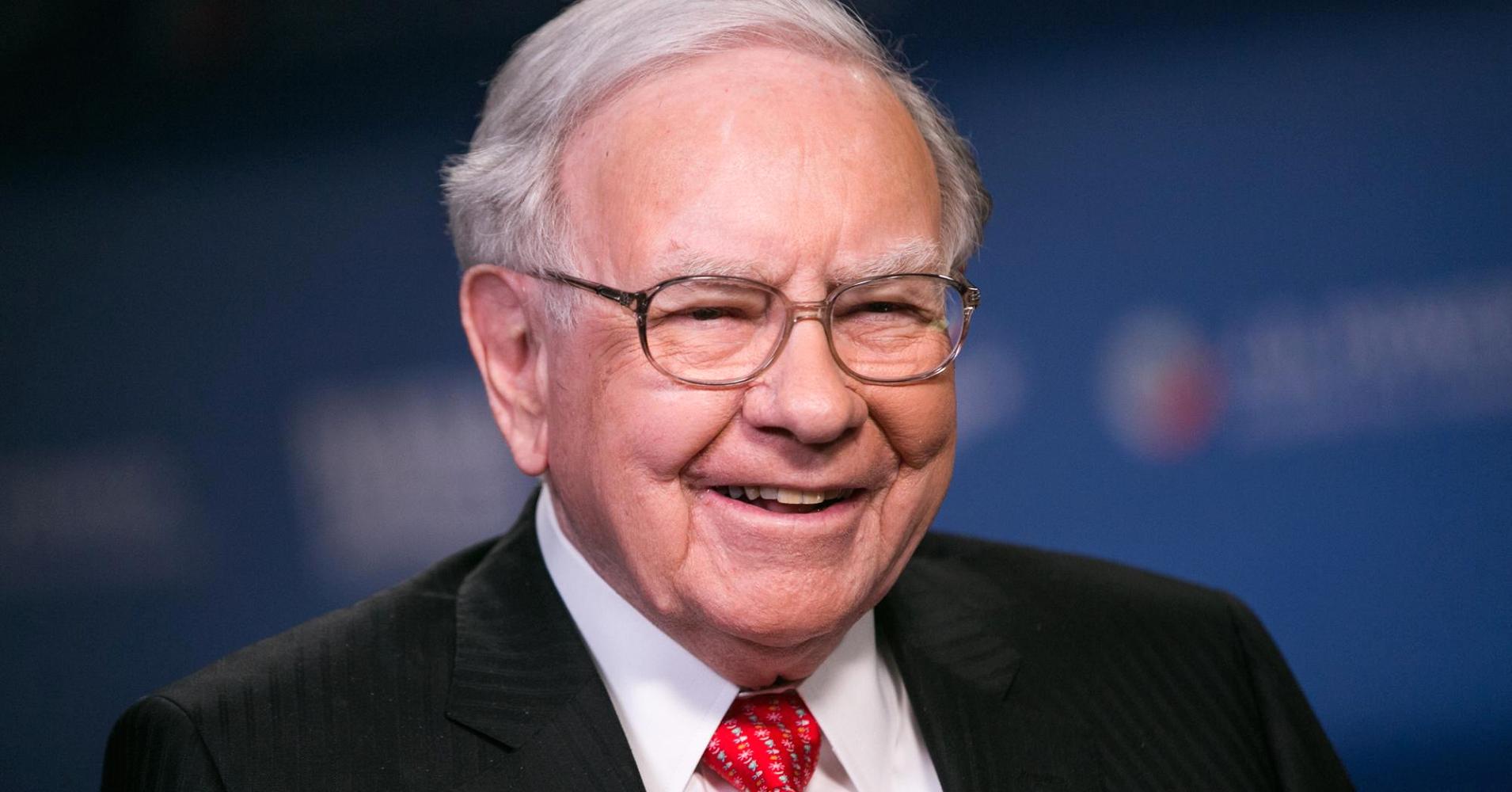

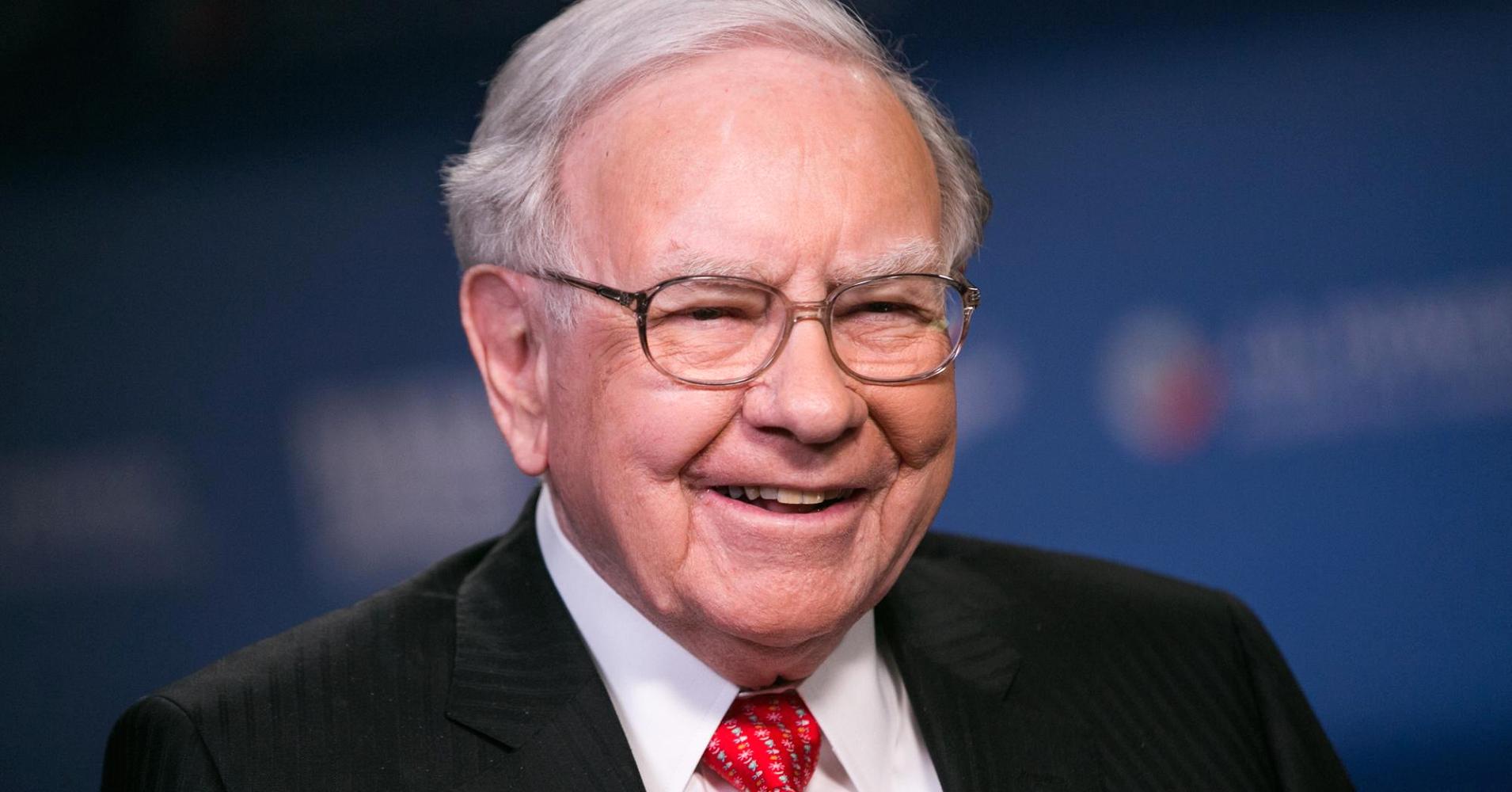

Following after Berkshire Hathaway's annual shareholder meeting, investor Warren Buffett sat down with CNBC's Becky Quick to discuss Apple, one of his biggest holdings, with CEO Tim Cook commenting that the fund's sizable holding in his company shows that the iPhone producer isn't really a traditional technology company anymore.

Payments for the British Government's Global Entry Service can now be made through Apple Pay, meaning transactions can be approved with fingerprints or facial recognition.

Samsung today announced its 2019 first-quarter earnings and the numbers don't look good: operating profits fell to $5.4 billion, a 60 percent decline marking the weakest results since late 2016 and a far cry from the $13.4 billion in operating profits it captured in the year-ago quarter.

Whether you’re taking a trip abroad or need to know the exchange rate for business, a currency converter for your iOS device can come in super handy.

To help you out on your search, we’ve scoured the App Store for the best currency converter apps for iPhone and iPad that don’t cost a dime, peso, or euro.

Spotify today announced that its 2018 holiday quarter earnings grew by thirty percent while giving investors a few newsworthy updates about the scope and breadth of its business.

Despite its revenue miss and revised guidance, Apple has topped financial targets for fiscal 2018 so the company's board has decided to give CEO Tim cook a 22% increase in pay.

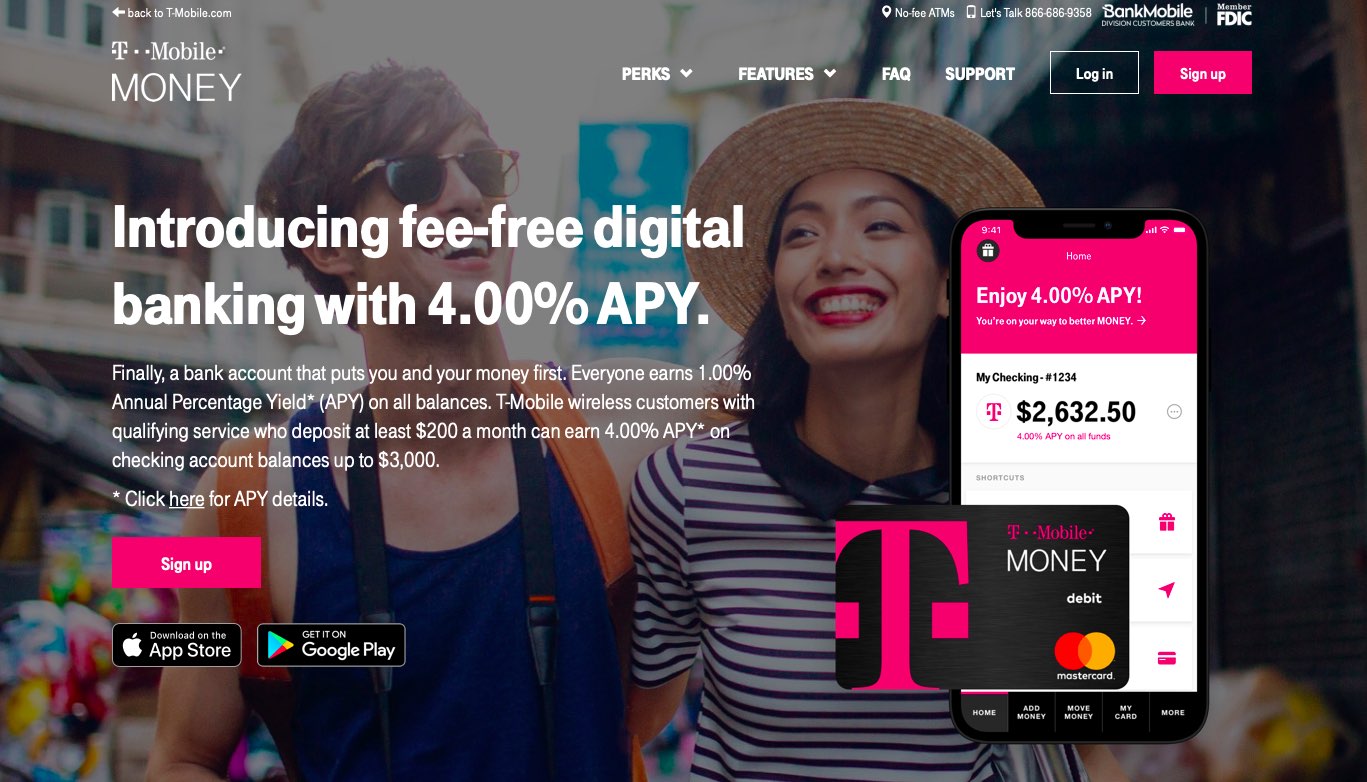

Wireless carrier T-Mobile on Wednesday quietly unveiled a mobile banking service of its own, T-Mobile Money, available as a free mobile app for iPhone and Android.

Apple will report earnings and other financial metrics pertaining to its fourth fiscal quarter (which corresponds to the third calendar quarter) on Thursday, November 1.

Tim Cook's about to collect a huge financial reward. On Friday, Aug. 24, the Apple CEO will receive additional shares in Apple worth around $120 million. The award is tied to Cook's continued service at the world's largest publicly traded company and Apple's relative performance on the stock market during his tenure as CEO, according to Bloomberg.

As part of its quarterly earnings announcement yesterday, Snap, Inc. has revealed that its number of daily active users fell by two percent to about 188 million.

Warren Buffett's Berkshire Hathaway recently revealed its increased stake in Apple. With 239.3 million shares, the company is now the second largest Apple shareholder behind Vanguard Group, according to Reuters.