Not only pundits, but big media outlets such as Bloomberg and WSJ have been pushing the narrative that the “bad news is piling up for Apple” due to production cuts, supplier woes, the end of unit sales reporting and so forth. If you read those stories, all that writers seem to be obsessed with are things like unit sales, billions in revenue, margins and stuff like that.

Reading those stories almost makes me feel as if Apple under Tim Cook’s leadership became a monster money-making machine at the expense of all innovation and great products, which isn’t true at all. But as Apple gets richer and richer, that narrative won’t go away. With that in mind, I’m glad I’ve stumbled upon a March 2018 piece by Fast Company’s Mark Sullivan which debates whether Apple is still worth believing in.

It’s a legitimate question. It’s true that Apple product releases aren’t the magical events they used to be. The blinding flashes of innovation–the “one more things”–have become rarer. We hear more these days about how much money Apple is raking in on services, vacuuming up the smartphone industry, saving in taxes, potentially spending on media companies, returning to shareholders, buying back in stock value, and on and on.

It is a legitimate question, indeed.

https://twitter.com/SophiaCannon/status/1025245403430772737

Turns out it’s already been answered, not by Sullivan but Apple’s design guru Jony Ive.

Commenting on Apple’s ’90s rebirth after the company almost went out of business before Steve Jobs returned from exile to right the managerial wrongs, Ive said this four years ago:

There is business and there is commerce, but we are very clear about the hierarchies here. And so, we’ve been very clear that we expect those concerns to be consequences of us doing our job right. And so, our job isn’t to make money for Apple. Our job is to try and make the very best products that we can.

Now, we trust if they are good and we trust if we are competent and we do our jobs in trying to describe them. And if we are competent in making them they will be attractive and bought and they will be bought in volume and that we will eventually make money.

It sounds banal, but is so simple—focus on the products, not the money:

Now, I am aware of course that can sound incredibly simplistic. I am aware that that can sound… easy to say given our advantage point right now. But that’s actually what we said in ’98, when the company was struggling.

You see, we didn’t say that the goal was to turn the company around because if we’d said the goal back then in the late ’90s was to turn the company around, that’s all about money. You can turn a company around by spending less and trying to make a bit more money. What we said back in the ’90s was the goal was to stop making products that weren’t great. And the goal was to focus on trying to make a great consumer product.

Or, to quote Jobs, innovation is saying ‘no’ to a thousand things.

When Steve came back, that’s how he articulated what the goals of the company needed to be. And this wasn’t some subtle–this wasn’t an exercise… this was describing profoundly different attitudes and approaches to what the problem was at hand. It takes a tremendous courage when you are losing fabulously large amounts of money to say our goal isn’t to turn around, our goal is to make a great product. That’s not a natural sort of reflex to that situation.

When Apple first passed the $1 trillion market cap, the CEO sent a memo to employees to remind them that the money is not the most important measure of success.

Today Apple passed a significant milestone. At our closing share price of $207.39, the stock market now values Apple at more than $1 trillion. While we have much to be proud of in this achievement, it’s not the most important measure of our success. Financial returns are simply the result of Apple’s innovation, putting our products and customers first, and always staying true to our values.

I agree with Cook on principle, with one caveat.

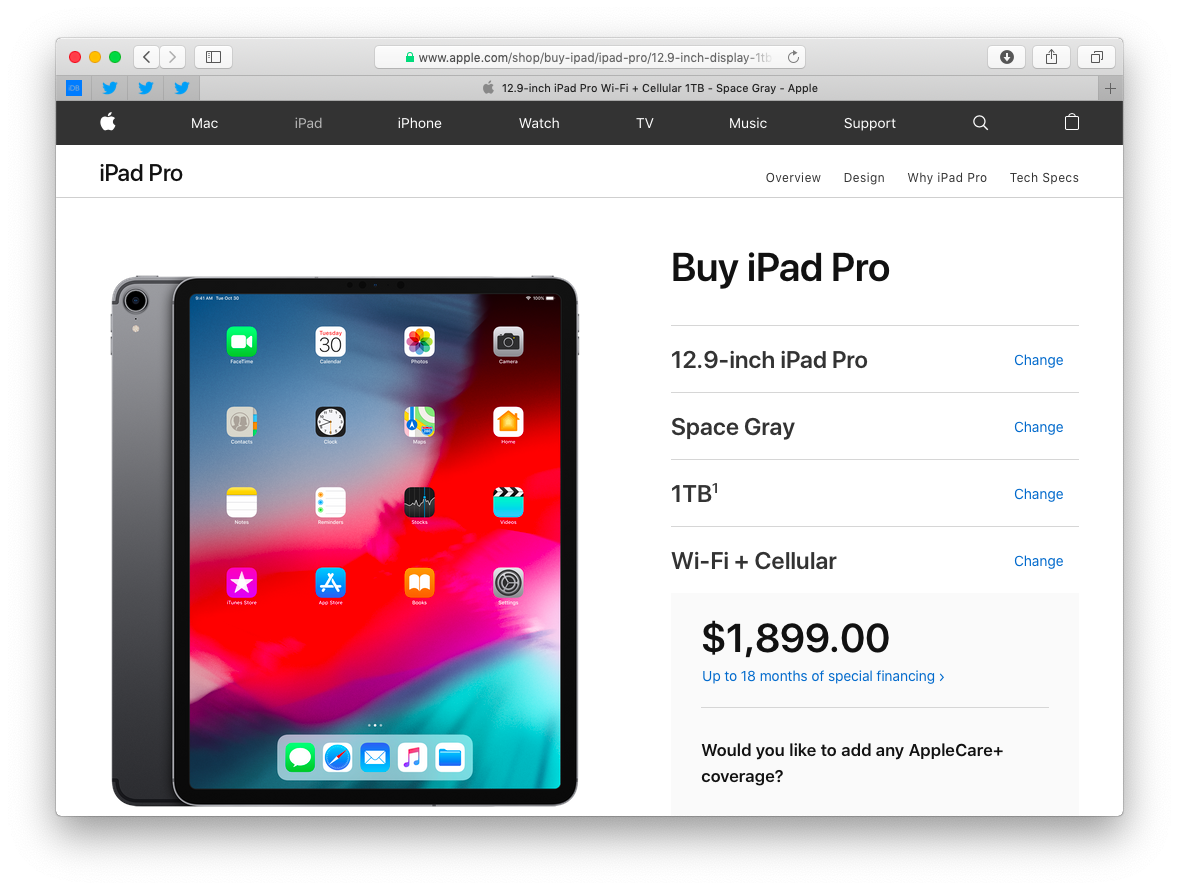

Under Cook’s leadership, Apple indeed seems to be obsessed with money and has become this “entirely selfish monster”, as Queen guitarist Brian May put it recently. And in my personal opinion, Cook has been spending customer goodwill like it’s water by constantly rising prices across the board, from iPhones and iPads to Macs, Magic accessories and beyond.

Apple from the onset has been something of a fashionable brand, thanks to its unique sense of style and industrial design. Nowadays, the company feels like it’s turning into a luxury brand with all the recent stretching of its top-end prices.

And with iPhone peaked and the stagnant smartphone market, Cook & Co. have been doing what every greedy corporation does when faced with strong headwinds: after repatriating all those billions it used to park overseas, Apple has decided to spend them on—more stock buybacks.

Buying back stock reduces the number of shares in the market, which then artificially boosts the value of those remaining. In other words, management typically resorts to stock buybacks when all the major growth avenues have dried up.

I like Apple but that’s one aspect of Tim Cook’s leadership I’m not fond of.

How about you?