This tutorial shows you how to use the built-in Stocks app on your Apple Watch to keep track of your favorite stocks right from your wrist.

How to track stocks on your Apple Watch

This tutorial shows you how to use the built-in Stocks app on your Apple Watch to keep track of your favorite stocks right from your wrist.

Apple announced its financial results for its fiscal second quarter of 2015 this afternoon, and the numbers are impressive. The company sold 61.2 million iPhones and earned $58 billion in revenue, breaking March quarter records and beating Wall Street expectations.

We just finished up the conference call, where Tim Cook and other executives team discussed Apple’s performance over the three-month period, and offered up some insights into its future. And as usual, we’ve rounded up the 15 most interesting points from the call below.

Apple has posted its [fiscal] second quarter earnings report for 2015 this afternoon, and they are impressive. The Cupertino company beat Wall Street estimates, recording $58.01 billion in revenue on the back of strong iPhone sales.

More than 61 million iPhones were purchased during the usually-slow, post-holiday second quarter. That's over 4 million above analyst estimates, and it looks like the handset did particularly well in China—up 72% year-over-year.

Would Apple consider acquiring electric car-maker Tesla? That was the question posed to Tim Cook by two Apple investors during the company's annual shareholder meeting today. And as you'd imagine, the chief executive gracefully deflected the question.

Recode attended the meeting, and noted Cook responded to the query by talking about CarPlay and its 40+ model rollout this year. "Was that a good way to avoid the question?" When pressed he joked, "let me think if there’s another way to give a non-answer."

Apple was the biggest buyback spender among the S&P 500 this year, according to MarketWatch. Citing data from FactSet, the outlet reports the iPhone-maker has bought back more than $56 billion worth of shares from stockholders in 2014.

That's a staggering amount, especially when you consider that the company that came in second place among buyback spenders in 2014, IBM, only spent $19.2 billion. Apple spent almost that much ($18.6 billion) during its first quarter this year.

Shares of Apple dropped 4% today, closing this afternoon at $98.94. That's the stock's worst percentage slump since late January, and its worst value since it began its march towards its highest price ever in early August.

The news comes amidst the recent iCloud scandal, in which Apple's cloud security was blamed for the leaking of several revealing celebrity photos, and ahead of the company's highly anticipated iPhone event next week.

After hovering just under the $100 mark for several weeks, shares of Apple finally surpassed the mark today and closed at an all-time high of $100.56. That breaks the Cupertino company stock's previous closing record of $100.30, set on September 19, 2012 in the run up to the launch of the iPhone 5.

Today's news comes just a few months after Apple authorized a 7-1 stock split (before the split, today's closing price would be shown as $703.92), and amidst a barrage of rumors regarding the company's plans for product releases this fall which include two new iPhones and possibly a smartwatch...

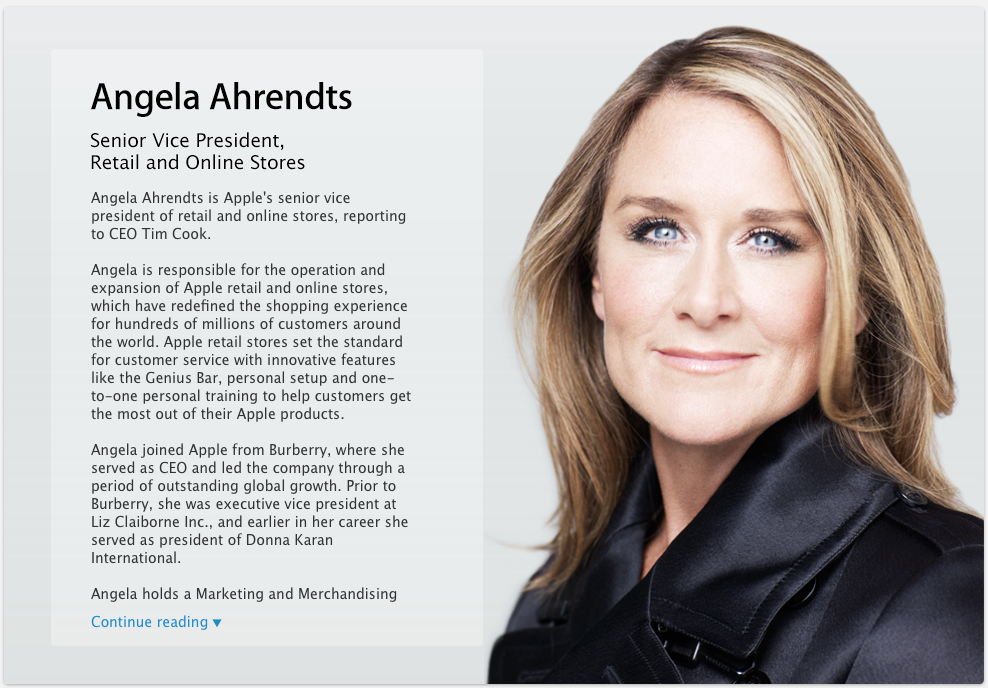

Talk about a signing bonus. After officially joining Apple last week, word got out today that Angela Ahrendts has already received 113 thousand units of restricted stock. At today's prices—remember, APPL is back up around $600—the shares would be worth roughly $68 million.

This makes the company's new SVP of retail and online stores one of the highest-paid executives in the industry, but of course, she'll have to wait to cash in. According to a filing with the U.S. Securities and Exchange Commission, the full amount won't be available until 2018...

Investors are liking Apple's direction lately, pushing the stock to $600 per share for the first time since 2012. Shares of AAPL closed at $600.96 each on Monday, a nice hike up from the under $400 price the stock was sitting at in April 2013.

Apple's shares were up more than $8 for the day to reach the 52 week high, bringing the Cupertino-based company's market capitalization to a hefty $517.65 billion.

Apple reports its quarterly earnings on Wednesday for the January to March quarter - a typically slow time for technology companies following the Christmas quarter crunch.

On its last earnings call in January, Apple told investors to expect revenue between $42 billion and $44 billion, gross margin between 37 percent and 38 percent, operating expenses between $4.3 billion and $4.4 billion, other income/(expense) of $200 million, and a tax rate of 26.2 percent. Really, no better than the company did last year.

Analysts have been checking with industry sources, looking at retail logs, and number crunching to predict what Apple will announce on Wednesday. Whether the company misses or beats the expectations could have a big impact on the stock price, which is up roughly 36 percent year-over-year. Last quarter, the stock tanked in after hours following a bad guidance for the numbers that are set to be report on Wednesday. Here's what analysts are expecting:

Controversial activist investor Carl Icahn continues to aggressively purchase shares of Apple while insisting that the company increase the size of its share buyback program. His proposal for a $50 billion buyback has been met with resistance by proxy advisory firm Institutional Shareholder Services (ISS) which now recommends voting against the plan.

ISS argues that the Apple board has already returned the bulk of its U.S.-generated cash to shareholders through the company's aggressive stock buybacks and dividends payouts. As a result of large institutional investors siding with Apple, Icahn has withdrawn his proposal...