In the latest lesson on how to be a smart tech news consumer, we focus on why research pointing to Apple gains somehow is trumpeted as losses for the iPad maker.

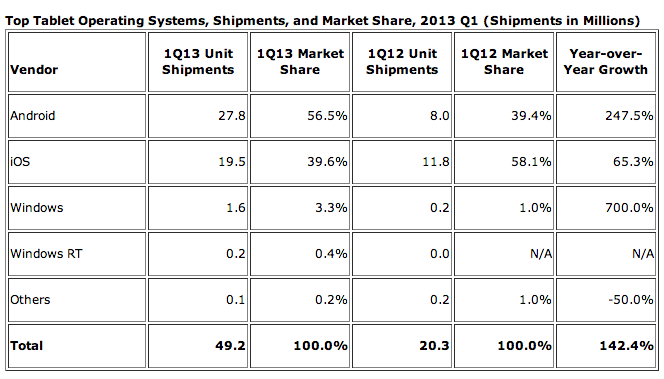

Wednesday, research firm IDC announced Apple’s tablet saw a 65 percent year-over-year gain in first-quarter shipments.

Yet several news outlets blared headlines of the iPad’s market share falling below 40 percent. How was Apple’s strong growth spun into an Android win?

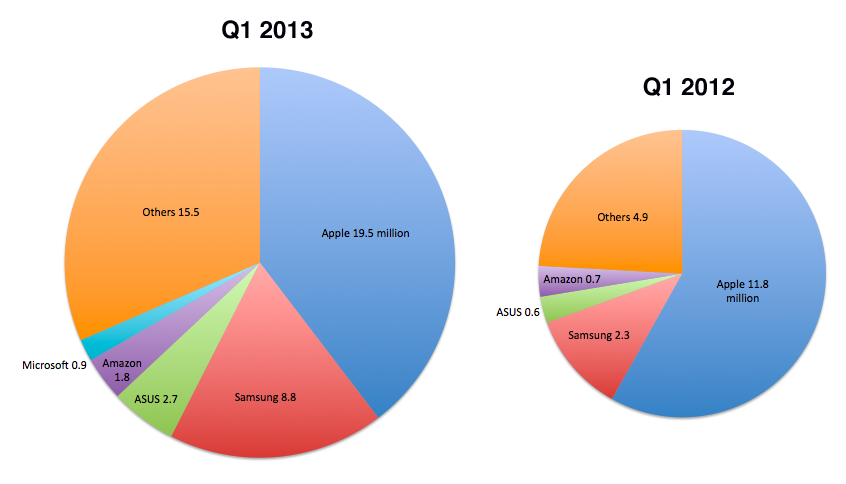

According to IDC data, Apple shipped 19.5 million iPads during the first quarter of 2013. The figure not only topped the firm’s 11.8 million tablets shipped during the same period in 2012, but beat the research firm’s own estimate of 18.7 million devices.

There’s no denying that Apple was the top tablet maker by both units shipped and market share.

This seems like good news.

IDC explains:

The company, which historically has experienced a steep drop off in first quarter shipments (following strong holiday sales in the fourth quarter), saw some smoothing of that seasonality this year.

Apparently, more good news:

Sustained demand for the iPad mini and increasingly strong commercial shipments led to a better-than-expected first quarter for Apple.

This could be interpreted as being positives for Apple.

Where is all the doom-and-gloom coming from?

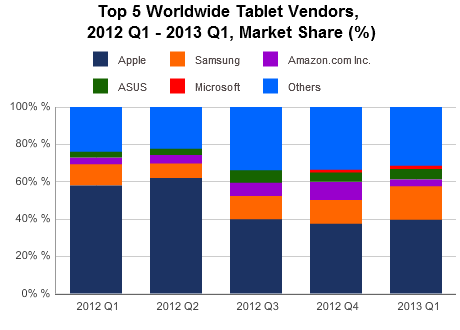

Although Apple’s unit shipments (usually a figure highlighted in news of Android gains) rose during the first quarter, Apple’s share of the worldwide tablet market fell from around 60 percent to a fraction below 40 percent.

By comparison, Android had 56.5 percent of the tablet market, up from 39.4 percent in the first quarter of 2012.

Does that mean Apple’s loss resulted in Android’s direct gains?

Let’s check back with IDC.

Samsung, the South Korean firm which drives most Android sales, “used its recent Android smartphone growth to help bring its tablet product line into new markets and channels, leveraging the opportunity to package and bundle,” the market research firm announced.

Doing so moved Samsung’s share of the tablet market to 17.9 percent in the first quarter, up from 11.3 percent. In other words, Apple held more than double the market share and units shipped.

Helping Samsung: increased smartphone distribution, allowing the firm to stuff the channel with more tablets as well. It’s important to remember that Apple disclose iPad sales in quarterly earnings while Samsung does not so IDC’s Samsung numbers are basically estimates.

Another important caveat: several Samsung tablets, such as the Galaxy Tab 2, are in the sub-$300 market, an area in which Apple so far doesn’t play.

But what about Asus, which according to IDC experienced 350 percent growth from Q1 of 2012 and 2013, making it the No. 3 tablet vendor?

Asus managed to move into the number 3 vendor spot as it continued to see decent tablet shipment demand from the highly marketed Nexus 7 device.

Google’s tablet has a $199 price tag, a number that could fall even more when an expected refresh occurs. So, Android’s gains in the tablet market come largely from the sub-$300 sector, an area where Apple isn’t competing.

The phrase “comparing Apples to Oranges” comes to mind.

Of course, if we remove the sub-$300 tablets from Android’s gains, comparing Apples to Apples, a different picture may emerge.

Secondarily, comparing the Android tablet market against the Apple iPad market is akin to comparing Chevy (no offense intended to Chevy fans) against Porsche to determine which has the largest share of auto purchases.

Thoughts?