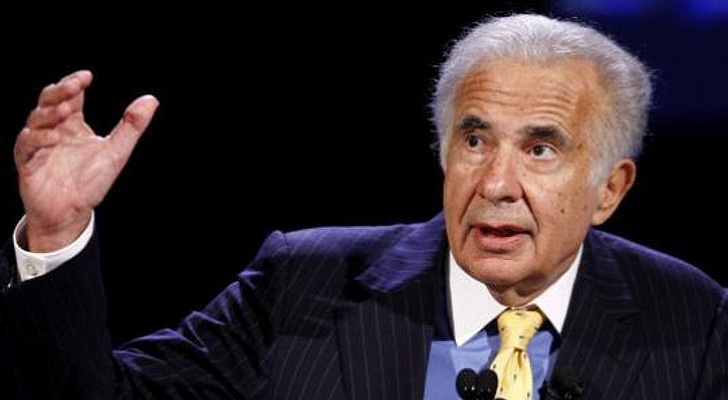

Greedy activist investor Carl Icahn has escalated his anti-Apple rhetoric on Wednesday after recently filing a proposal to put his aggressive stock buyback proposal up for a vote. Apple responded by confirming that any changes to its own corporate stock buyback program will be discussed in the “first part of calendar 2014,” likely at the upcoming shareholder meeting in February.

Be that as it may, Icahn now feels the Apple board is “doing great disservice to shareholders” by refusing to boost the company’s buyback markedly, according to a tweet today. An in-depth letter will follow soon, the shark investor ominously announced.

At the same time, Icahn announced buying an additional half a billion dollars worth of shares, pushing his stake in the iPhone maker to north of a respectable $3 billion. He called the latest investment a “no brainer”…

Icahn last August announced that he’d taken a large position in $AAPL. He’s been presumptuously pushing for a significant increase of Apple’s buyback ever since.

We feel $APPL board is doing great disservice to shareholders by not having markedly increased its buyback. In-depth letter to follow soon.

— Carl Icahn (@Carl_C_Icahn) January 22, 2014

After meeting with Tim Cook on several occasions, Icahn discovered that the Apple CEO wouldn’t budge so he scaled back his original $150 billion proposal to “only” $50 billion.

If Apple appeased to Icahn’s requests, the company would borrow many more billions of dollars, in turn exposing itself to uncertainty and increasing risk. Apple’s $150+ billion cash horde works out to about one percent of the U.S. gross domestic product.

Having purchased $500 million more $AAPL shares in the last two weeks, our investment has crossed the $3 billion mark yesterday.

— Carl Icahn (@Carl_C_Icahn) January 22, 2014

As Richard Waters of Financial Times points out, with nearly $150 billion in its coffers, “Apple is sitting on close to ten per cent of corporate America’s cash“.

By the way, a precatory proposal does not bind Apple executives to implement Icahn’s buyback proposal, even if the majority of shareholders approved it.

The problem with Icahn: predatory tactics.

Since tweeting about our large position in $AAPL on Aug 13, when the stock was 468 per share, we’ve kept buying shares of this ‘no brainer.’

— Carl Icahn (@Carl_C_Icahn) January 22, 2014

He typically buys massive amounts of shares, essentially buying himself the right to install minions on a company’s board, which gives him a leverage to seek concessions and even push for board/CEO changes, as is his wont.

Speaking to CNBC today, Icahn argued that he’s actually better off if Apple does nothing because “I plan on buying more of Apple’s stock”.

Apple is a culture with a great ecosystem. What bothers me a hell of a lot is that billions of dollars is just sitting there.

“What they’re doing I think is ludicrous in not taking it up right now,” Icahn said of the Apple board’s reticence to raise the company’s ongoing share buyback.

He insists he’s not criticizing the Apple board or the management, but points out “there’s no on on Apple’s board that’s finance guy”. I will not go into when the last time I spoke to Apple CEO Tim Cook was,” he said. “We have a good relationship.”

Luckily, Cook has proven thus far that he can’t be pushed around – the Apple board is all Steve Jobs people – and I hope that the company won’t cave in to Icahn’s pressure.

Otherwise, he could ruin the only truly thriving American corporation left standing, which brings me to my thought of the day: Apple should pull a Dell and take itself private.

This would disentangle Apple from nonsensensical pressure from big shot investors. If anyone is working against Apple and its shareholders’ interest, it’s Icahn himself.