Disney+ subscriber count continues rising as the entertainment conglomerate added an impressive 16 million subscribers in the June quarter for a total of 116 million paying customers.

Disney+ now has 116 million subscribers

Disney+ subscriber count continues rising as the entertainment conglomerate added an impressive 16 million subscribers in the June quarter for a total of 116 million paying customers.

The Apple Investor Relations website was updated yesterday to announce that Apple's next quarterly earnings for the holiday 2020 quarter will be presented Wednesday, January 27.

Apple investors should brace themselves for a revenue miss in the March quarter due to the coronavirus outbreak in China hat shows no signs of slowing down.

Famous Wall Street investor Warren Buffett, also known as the Oracle of Omaha, has sold more than $800 million worth of Apple stock last quarter, SEC filings published Friday have it, but that represents less than one percent of his Apple holdings.

Apple's boss Tim Cook has admitted in yesterday's conference call following the latest quarterly earnings report that—aside from China—other factors such as higher prices, death of subsidies in many countries and customers holding on to their handset a bit longer than usual have all contributed to a decline in iPhone upgrades.

Jason Snell has transcribed Apple’s earnings call on Six Colors, here's what Cook said when an analyst pressed him on Apple's pricing strategy (emphasis mine):

Steve Milunovich, Wolfe Research: Some have the perception that you priced the new products, the new iPhones, too high. What have you learned about price elasticity and do you feel that perhaps you pushed the envelope a little bit too far and might have to bring that down in the future?

Tim Cook: Steve, it’s Tim. If you look at what we did this past year, we priced iPhone XS in the US the same as we’d priced iPhone X a year ago. iPhone XS Max, which was new, was a hundred dollars more than the XS, and then we priced the XR right in the middle of where the entry iPhone 8 and entry iPhone 8 Plus had been priced. So it’s actually a pretty small difference in the United States compared to last year.

He continued:

However, the foreign exchange issue that Luca spoke of in the call amplified that difference in international markets, in particular the emerging markets, which tended to move much more significantly versus the dollar.

And so what we have done in January in some locations and some products is essentially absorb part or all of the foreign currency move as compared to last year and therefore get close or perhaps right on the local price from a year ago.

So yes, I do think the price is a factor.

I remember Apple executives arguing in the past that iPhones weren't just for the rich people. But I digress, here's what Cook had to say about the death of the smartphone subsidy.

Secondly, in some markets, as I had talked about in my prepared remarks, the subsidy is probably the bigger of the issues in the developed markets.

I had mentioned Japan, but also even in this country, even though the subsidy has gone away for a period of time, if you’re a customer that your last purchase was a 6S or a 6 or in some cases even a 7, you may have paid 199 dollars for it. And now, in the unbundled world it’s obviously much more than that.

Cook says they have a number of actions to address the decline in iPhone upgrade rates, including the aggressive trade-in offers and and installment payments.

The Apple story is shifting from iPhone units to ecosystems and services.The CEO concluded:

So where it goes in the future, I don't know. But I am convinced that making a great product that is high quality, that is the best thing for the customer. We work for the user and so that's the way that we look at it.

In the press release announcing quarterly earnings, Cook praised other aspects of Apple's business that have experienced healthy growth.

While it was disappointing to miss our revenue guidance, we manage Apple for the long term, and this quarter’s results demonstrate that the underlying strength of our business runs deep and wide.

Our active installed base of devices reached an all-time high of 1.4 billion in the first quarter, growing in each of our geographic segments. That’s a great testament to the satisfaction and loyalty of our customers, and it’s driving our Services business to new records thanks to our large and fast-growing ecosystem.

Apple no longer reports units sales for iPhone and other products, robbing investors of the most important metric as the company transitions its story from one heavily dependent on iPhone to a combined products + services business.

During the holiday quarter, the Cupertino company pulled in $84.3 billion in revenue, a decline of 5% from the year-ago quarter. Strategy Analytics estimates that 65.9 million iPhones were shipped during the quarter, or 11.4 million fewer handsets versus the year-ago quarter.

Apple will officially announce earnings results for the June quarter, its third 2018 fiscal quarter, on Tuesday, July 31, 2018 at 2pm Pacific Time / 5pm Eastern Time.

Tim Cook spoke at length regarding succession planning, divisent distribution, Apple Pay success, and more at Apple's annual shareholder's meeting today.

Apple yesterday refreshed its Investor Relations webpage to inform investors that it will be holding its 2018 annual shareholders meeting at the Steve Jobs Theater in Apple Park on Monday, February 13 of next year.

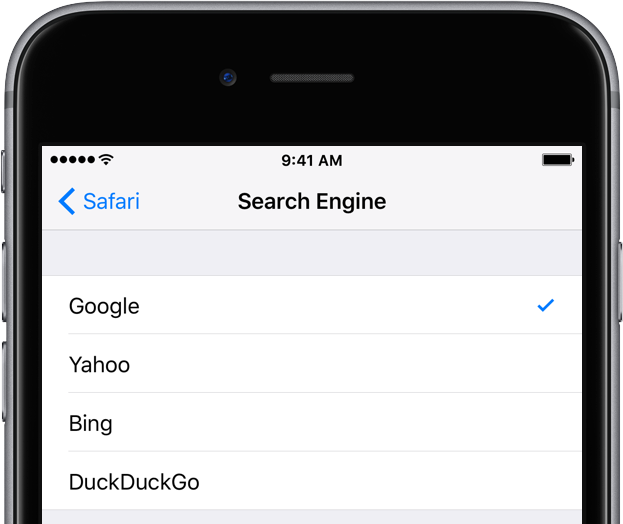

A long-running deal with Apple that makes Google the default search engine in the mobile and desktop Safari browser is becoming more and more expensive for the search giant.

According to an update on the Investor Relations website, Apple is scheduled to report its fiscal 2017 third quarter earnings on August 1. The Cupertino technology giant has scheduled a conference call with Wall Street analysts and investors to discuss the quarterly results for Tuesday, August 1, at 2pm Pacific Time / 5pm Easter Time.

A press release announcing the earnings typically goes out 30 minutes ahead of the earnings call. You'll be able to listen to the conference call live via Apple's website. Apple states that live audio streaming uses its HTTP Live Streaming (HLS) technology.

HLS requires an iPhone, iPad, or iPod touch with Safari on iOS 7.0 or later, a Mac with Safari 6.0.5 or later on OS X 10.8.5 or later or a PC with Microsoft Edge on Windows 10.

We'll be covering the earnings and any interesting tidbits from the conference call.

Berkshire Hathaway's position in Apple is now more than twice as large as previously disclosed at $18.2 billion, investment tycoon Warren Buffett told CNBC in an interview on Monday. At the end of last year, Berkshire Hathaway owned 61 million Apple shares, worth $7 billion at the time.

Buffet's annual letter to shareholders, which included a regulatory disclosure of its long positions, has revealed that his conglomerate had purchased about 120 million shares of Apple in 2017.

Apple is planning to announce its earnings results for Q1 of [fiscal] 2017 on January 31. The company on Wednesday updated its investor website to show that it will be hosting a conference call to discuss the quarter that Tuesday at 2:00pm PT.

Apple's first quarter is of course its holiday quarter, which covers the popular 3-month holiday shopping period between October and December. And as usual, all eyes will be on the company to see if it was able to solve its recent growth problems.