Some people collects rocks, other people collect stamps. Apple, however, likes cash. Turns out the iPhone maker, all by itself, controls ten percent of all corporate cash in the United States.

Just how much is that? New data shows Apple’s bank account of $147 billion represents ten percent of the $1.48 trillion held by non-banking U.S. companies.

Here’s another factoid to make you even more uneasy about that measly savings account of yours: all together, Microsoft, Google, Cisco and Pfizer – not exactly nickel and dime operations – account for another fifteen percent of all U.S. corporate cash…

The numbers come from Moody’s and cited by the Wall Street Journal.

In an illustration of the top one percent of the top one percent, the figures also show that the top 50 non-financial U.S. corporations account for 62 percent of corporate wealth.

To be fair, as TechCrunch points out, some of Apple’s cash is not mobile, and might not be the correct way to compare apples to apples, as it were. If we compare Apple’s $43 billion in domestic cash to the $1.48 billion in all non-financial U.S. corporate cash, the iPad maker ends up with around three percent of all the chips.

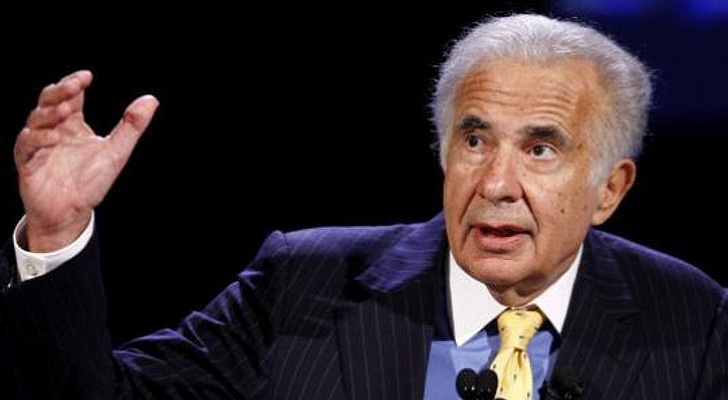

The report comes as activist investor Carl Icahn gave his new buddy Apple CEO Tim Cook some advice: buy back $150 billion worth of the iPhone maker’s stock.

Although Icahn originally tweeted his Manhattan dinner with Cook and Apple CFO Peter Oppenheimer was cordial, he admitted on CNBC’s “Halftime Report” with Scott Wapner that things got “a little testy.”

This is akin to a shark having a cordial conversation with a tuna before it attempted to swallow the fish whole. While even Icahn could not down Apple in one bite, getting Cook to double the size of its stock purchases would mean a tidy return on the investor’s $2 billion stake in Apple.

He said:

It makes no sense for this company with their multiples not to do a major buyback. And there’s another thing I mentioned: the fact that you can borrow money so cheaply today. I don’t know when we’ll see this again. Apple can borrow money and buy stock at such a low valuation.

“The board is not God,” Icahn said. “And the board, in this kind of a case, should be listening to what the shareholders want.”

Why would Icahn even float the idea of raising Apple’s buyback commitment?

Consider the company’s embarrassment of riches. Between the end of 2012 and halfway through 2013, Apple’s share of the corporate cash pie grew from 9.5 percent to 10 percent.

At the same time, Apple’s cash horde at home and abroad hit $146.6 billion.

Where or where should Apple spend all that cash?

To the rescue comes Icahn, pictured below.

In 2012, after earlier talk that Apple should give back to investors some of its huge cash holdings, Cook announced dividends, plus $10 billion in repurchased shares. By 2013, that $10 billion grew to a $100 billion buyback through 2015.

Then came the U.S. government’s equivalent of the Wrath of Khan.

The U.S. Senate hauled Cook in front of committees investigating Apple’s apparent financial shell game, including filtering the company’s cash through Ireland and other low-tax European nations.

Like Cook wants to go through that again.

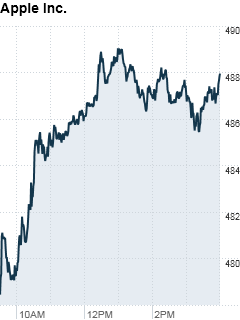

Per Fortune, AAPL gained $17 billion in market value in just over an hour on the strength of two tweets from Icahn.

Even if Apple’s execs tell Icahn to take a walk, the investor could still see a profit.

Reports indicate Apple is looking to bring in-house development of speech-recognition service Siri. However, if Apple bought Nuance – which provides Siri’s voice – Icahn would profit, too.

Icahn holds about sixteen percent of Nuance.

In other words, don’t cry for Carl.

In the end, what’s interesting about this whole Dinner with Icahn episode is not so much the $150 billion buyback being pushed, but the “testy” pushback from Cook and friends.

Everyone’s feeling out Cook’s management style and how it differs from the charismatic pitchman Steve Jobs. Icahn may have learned that the new Apple leader is no pushover.