Despite the interest rate increase, the Apple Card savings account’s APY still lags behind other banks like UFB (5.25%) and PNC (4.65%).

The annual percentage yield (APY) is the real rate of return earned on your funds that takes into account the effect of compounding interest.

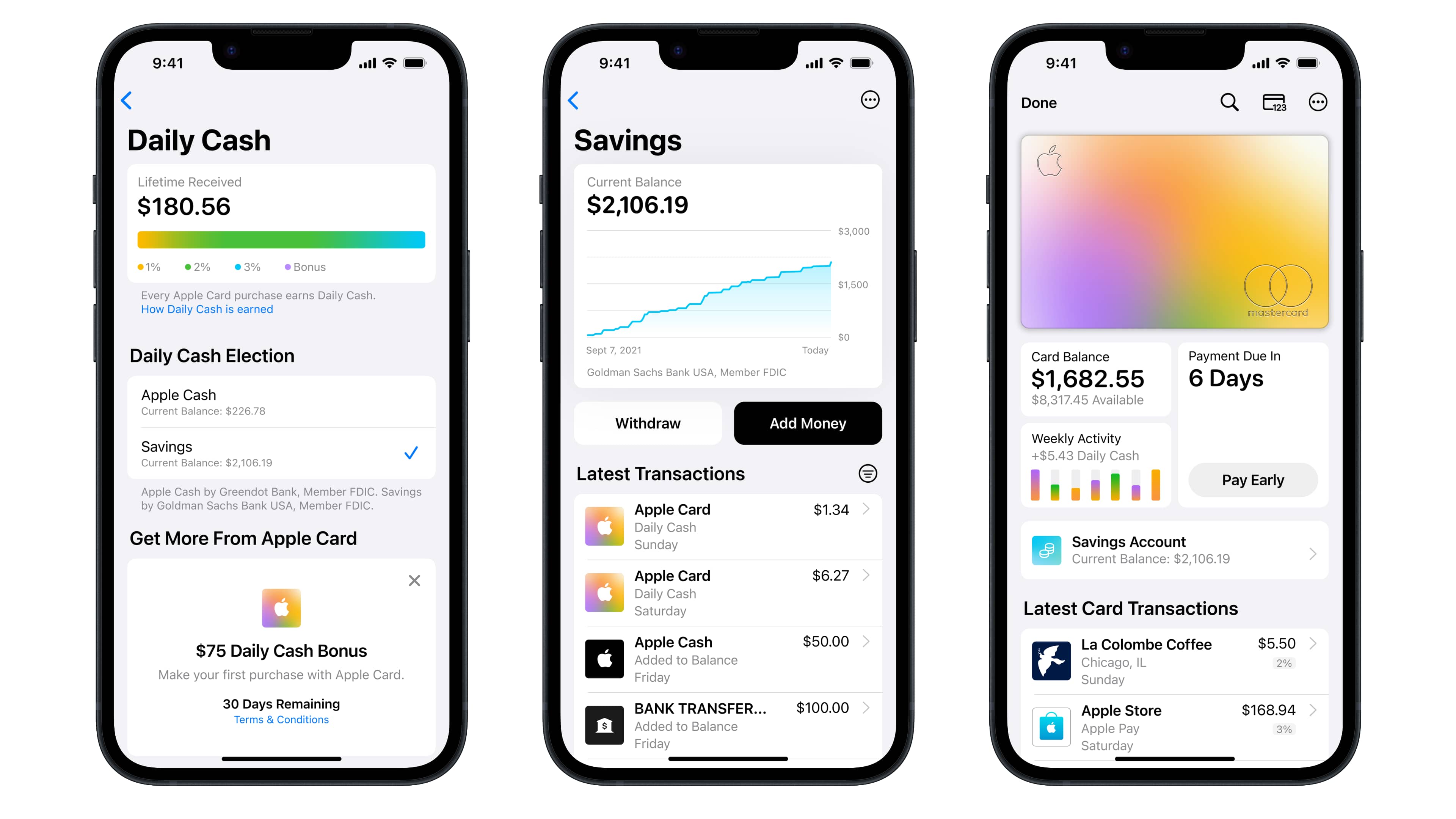

The Apple Card savings account launched in April 2023 in the United States, with Goldman Sachs backing the service. This is the first increase of the APY since the savings account debuted. The service is available exclusively to Apple Card holders, with the interest compounded daily and paid at the end of the month.

Apple Card savings account gets an increased 4.25% APY

The company sent a push notification to all Apple Card holders, informing them of an APY increase. Just eight months ago, an APY of 4.15% was considered competitive, but that’s no longer true. Even with the increased API of 4.25%, the Apple Card still hasn’t caught up with rivals boosting their APYs regularly.

Goldman Sachs allegedly wants to end its partnership with Apple as its foray into consumer banking hasn’t proved as successful as internal projections. Despite capturing 10 billion in deposits as of August, Goldman also had to set aside about 7% of projected sales to cover expected losses, Reuters has it.

The Wall Street Journal recently reported that Apple is looking to end the Goldman partnership in the next 12 to 15 months. The Cupertino firm may be forced to update its terms to give a new partner a higher cut of profits.