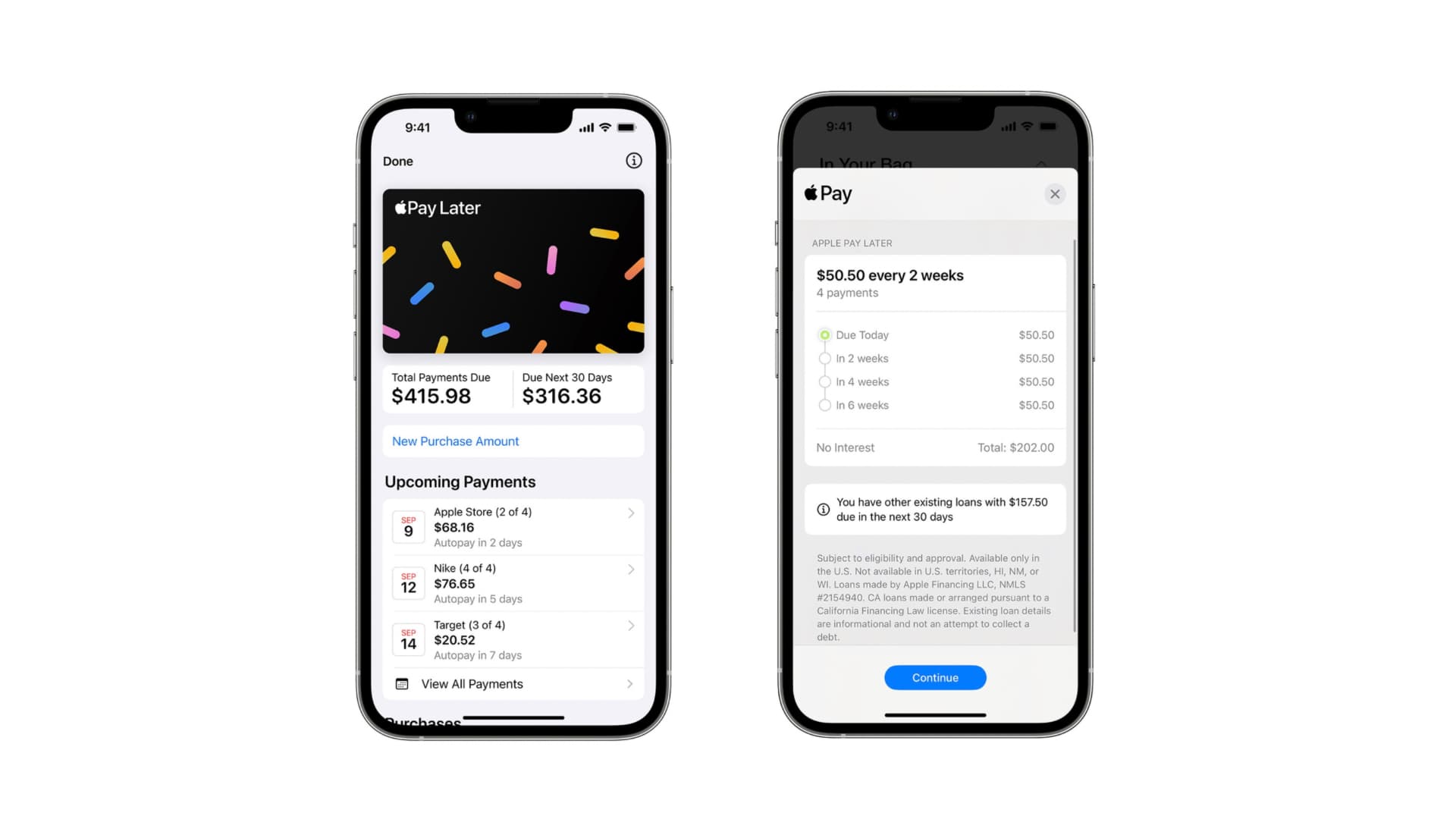

Apple Pay Later is a service offered by Apple that works a lot like any other buy now pay later (BNPL) service — buy something you can’t afford now, and pay it back in four smaller payments.

Of course, Apple Pay Later took a staggered release approach, slowly rolling out to select users this year in waves. Fortunately for anyone who wanted to use this service and never received the offer, Apple appears to have opened the feature to all users starting today.

Those wanting to take advantage of Apple Pay Later can set it up in the Apple Wallet app. It’s good for purchases of between $75 and $1,000 , and lets users split that payment into four bi-weekly payments — or two months in total — without interest.

It’s worth noting that PayPal’s buy now pay later feature supports borrowing up to $1,500 by comparison. Different lenders may offer more or less leeway.

Apple Pay Later, much like other Apple services, strives to be a user-friendly service that makes it clear what you owe and makes paying your bills easier while keeping privacy and security at the forefront of its core functionality. You can use it anywhere Apple Pay is accepted, including in-person merchants and online.

Apple Pay Later integrates seamlessly into Apple Pay as an alternative payment option, however you will still need to dedicate a payment method for auto-pay, which is likely going to be one of your bank debit cards since credit cards aren’t supported.

For worry warts, Apple Pay Later has many of the same protections that you would expect from a credit card, which includes protection from unauthorized purchases.

The requirements to use Apple Pay Later are fairly standard, and include the following:

- Being at least 18 years of age

- Being a U.S. citizen or a lawful resident with a valid, physical U.S. address that isn’t a P.O. Box

- Setting up Apple Pay with an eligible debit card

- Setting up two-factor authentication for your Apple ID and updating to the latest version of iOS or iPadOS

- Potentially having to verify your identity with driver’s license or state-issued I.D.

Buy now pay later services of this nature are appealing to people who might have poor credit or can’t afford the interest of credit cards, but some say that these services make buying things you can’t afford all too easy, sometimes feeding into shopping addictions.

You can learn more about Apple Pay Later by visiting Apple’s new dedicated webpage about the feature.

Will you be taking advantage of Apple Pay Later? Let us know why or why not in the comments section down below.