The top court of the European Union has determined that e-books shouldn’t be treated like their printed counterparts when it comes to taxes and therefore should be subject to higher tax rates, The Wall Street Journal reported Thursday.

“But the European Commission signaled it may change the rules next year to allow for equal taxation of books in any form,” reads the report.

But why shouldn’t e-books be treated like their dead-tree counterparts?

Well, the court has determined that e-books should be considered “electronically supplied services”, not physical goods. According to EU law, reduced value-added tax (VAT) rates can only apply to goods, not electronic services.

“France and Luxembourg said they would comply with the verdict, but that they would push for an overhaul of EU rules on VAT in order to align rates between physical books and e-books,” WSJ wrote.

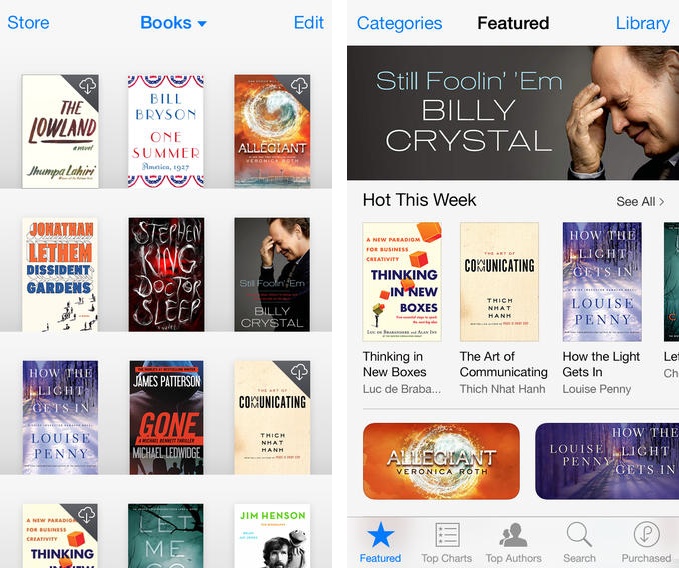

As a result of the ruling, Apple, which operates its iBooks Store across EU member states, is expected to slap tax rates on iBooks sold in the iBooks Store based on the European country where the customer is located.

The vast majority of the EU’s 28 countries levy VAT rates ranging from 18 to 25 percent, according to Commission data. By contrast, VAT on paper books ranges from zero to ten percent, Reuters noted.

Changes in EU taxation laws have already forced Amazon to apply the VAT rate on e-books sold in Europe applicable to the customer’s country of residence. The online retail giant previously used its Luxembourg office to levy a VAT rate of just three percent on e-books sold across Europe.

E-book sales in Europe are expected to account for a Statista-estimated one-fifth of book sales in Europe in 2017 compared with 4.5 percent in 2013.

Apple last December had to institute price hikes on apps sold in Europe.

Rather than treat apps it sells throughout the European Union to the same tax rate of 22 percent like in the past, now iPhone, iPad and Mac software being sold in Europe through the App Store and Mac App Store is subject to a country-specific tax rate.

In other words, Apple is now calculating app prices based on whatever tax rate is being levied in each customer’s home country.

Source: The Wall Street Journal