What’s more important, smartphones shipped or smartphone profits? That question is at the heart of a debate over competing figures used to bolster Samsung or Apple. A day after a Samsung-friendly market research firm claimed the South Korean firm shipped three times as many phones, new figures show Apple profit higher than most of its rivals combined.

Sales of 33.8 million iPhones during the last quarter earned more than the mobile units of Samsung, LG, Nokia, Huawei, Lenovo and Motorola all together, according to a Wednesday report. The report also ignited a new debate over how corporate figures can be twisted to fit any preconceived notion – such as Apple’s losing battle against Android…

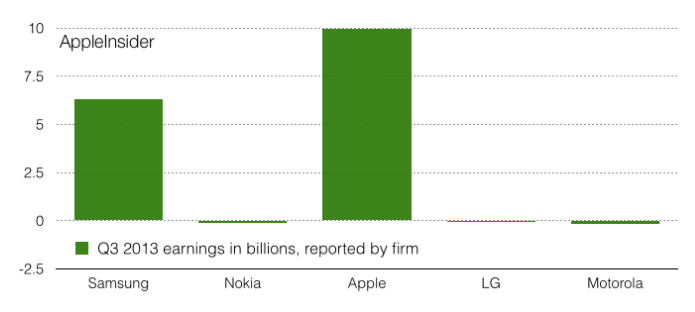

On Monday, Apple announced an operating profit of more than $10 billion. Although many media outlets reported the news as a sign that the Cupertino, California company is losing strength compared to 2012, company-centric AppleInsider noted the profit level was more than that of Samsung Mobile, and many others.

Apple actually earned enough more to have beaten not only Samsung Mobile (…$6.3 billion), but also the phone businesses of Nokia Devices and Services (-$118M), LG (-$75M) and Google’s Motorola (-$192M).

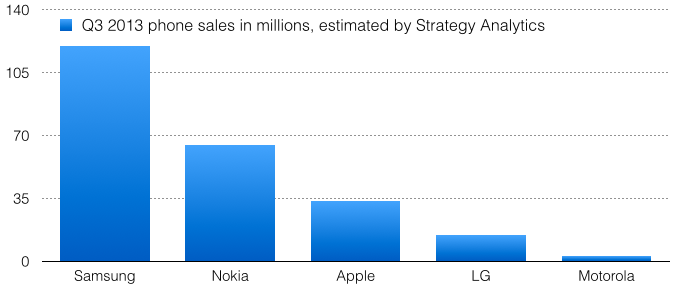

Earlier this week, Strategy Analytics, known as a Samsung supporter (the company is a client of SA), issued a press release claiming Samsung’s phone shipments of 120.1 million handsets was 3.5 times larger than Apple’s iPhone.

Assuming the estimate was correct, AppleInsider postulated:

That means that Apple’s 33.8 million iPhone sales earned more money for the company than Samsung’s 120.1 million, Nokia’s 64.6 million, LG’s 14.4 million and Huawei’s 12.1 million phones sales combined.

Dissecting the Strategy Analytics news release, the site points out that the pro-Samsung note mentions “global mobile phone” rather than smartphones. Such categorization permits Nokia to be thrown into the rankings, despite its long span on life-support and “being sold off to Microsoft for scrap.”

Additionally, the report notes much of Samsung’s gains came mass-market devices like the Galaxy Y, a 3G Android 2 smartphone “inferior to Apple’s iPhone 3G from 2008.”

As for the Galaxy S4, a Samsung device comparable to the iPhone 5 or new iPhone 5s, those sales “softened,” according to Strategy Analytics. More bluntly, sales of the S4 have been a major disappointment.

Airbrushing facts with mealy-mouth phrases such as “softening markets” to describe tanking sales is not something to be encouraged. If not called out, the practice only reinforces the maxim that numbers can be tortured to tell any story you want.

Consumers will lose confidence in press reports filled with unquestioned claims, leaving smartphone buyers to fend for themselves among slick, high-price ad campaigns.