You can’t get a better financial advisor than Warren Buffett. The so-called ‘Oracle of Omaha’ Monday weighed in on what Apple should do, faced with low stock prices and one investor’s call to use the iPhone maker’s billions in cash. Although Buffett’s appearance Monday morning on CNBC lasted three hours, the short version is this:

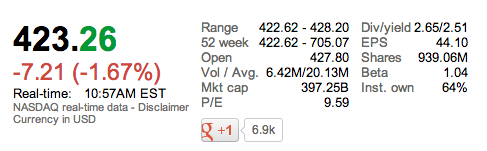

Apple CEO Tim Cook should buy his company’s stock while cheap. It’s uncertain whether the financial whiz will have any luck, seeing Cook’s predecessor Steve Jobs supposedly ignored similar advice. Coincidentally or not, Apple’s market capitalization dropped below $400 billion in early trading Monday, the first such drop since January 2012…

The Berkshire Hathaway founder claimed on the network’s Squawk Box show, via Fortune:

“When Steve called me, I said, Is your stock cheap? He said, yes. I said, Do you have more cash than you need? He said, a little. [laughs] I said, then buy back your stock. He didn’t.

Now, when our stock went from $90,000 to $40,000 to $45,000, I wrote about, we wanted to buy the stock. We didn’t quite manage to.

“But if you could buy dollar bills for 80 cents, it’s a very good thing to do,” the famous investor remarked.

In early trading Monday morning, Apple’s market capitalization has dropped below $400 billion. AAPL first passed $400 billion in January 2012, hitting a peak of nearly $700 billion in September 2012.

However, shares have been under lots of pressure and declining in recent months.

In answering how Apple should respond to depressed stock prices, Buffett said:

The best thing you can do with a business is run it well, and the shares will respond.

The investor – who says he does not now nor has ever owned Apple shares – recommended Apple CEO Tim Cook ignore calls for Apple to issue preferred shares.

Before withdrawing his lawsuit, Greenlight Capital founder David Einhorn had pressed Apple to issue preferred shares that would have given investors a four percent cash dividend.

“I would ignore him,” Buffett said. “I would run the business in such a manner as to create the most value over the next five to 10 years. You can’t run a business to push the stock price up on a daily basis.”

He said Berkshire shares have fallen 50 percent four times.

“When that happens, if you’ve got the money you buy it.” But if you could buy dollar bills for 80 cents, it’s a very good thing to do.”

While acknowledging Apple “may have too much cash,” Buffett noted one reason for the cash horde “is two thirds of it has not yet been taxed.”