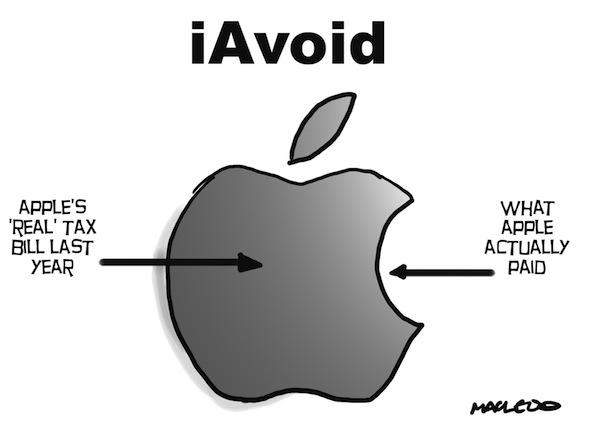

Not even Apple can avoid taxes – although it tries. According to a Friday report, the Cupertino, California company owes the Australian Tax Office a nice 28.5 million Australian dollars in back taxes, or approximately $29 million in US currency. Apple’s tax bill for the entire fiscal year 2012, which ended September 24, sits at $94.7 million on $4.9 billion in revenue in local currency. Earlier this week, the French government demanded Amazon pay $252 million in back taxes. The government charged the online retail giant operated a network of smaller units, including a Luxembourgh-based tax haven…

The Sydney Morning Herald has the story:

According to company documents filed with Australian, European and Asian authorities, the Australian arms of Apple, Google and eBay are part of complex networks of subsidiaries, held by their US parents through intermediary companies located in tax havens.

Apple pays just a two-percent tax on $36.8 billion in profits made outside the US, according to a report published earlier this month.

The practice appears to be perfectly legal with companies using subsidiaries to avoid heavily-taxed nations. In one instance, Apple’s UK unit is actually operated in Ireland, away from UK tax laws.

Meanwhile, the tech giant is receiving tax breaks for locating plants and launching sales in the US and elsewhere.

In March, Russia reclassified the iPad as a PC, removing a five-percent import tax on tablets. Earlier this year, the city leaders of Austin, Texas reportedly offered Apple $7.4 million in tax breaks in exchange for building offices there.

It’s only natural for companies to try to save money.

But has Apple’s enormous wealth made these attempts at avoiding taxes unseemly – particularly during these hard economic times?

What’s your take?