Last week it was reported that Square, a mobile credit card reader, had opened its doors and was available for download in the app store. Square is the brainchild of Jack Dorsey, who is also co-founder of Twitter.

The app, when used in conjunction with a small card reader that plugs into the auxiliary port, allows anyone to process credit card payments. This takes “mobile payments” to a whole new level as now small businesses and vendors can process payments without the need for a wired or complex point-of-sale system.

All you need is a compatible device (iPhone, iPad, iPod touch, or one of select Android devices), the card reader, and a signal on your device.

So what does this mean for retailers and small businesses? Is it secure to use? And what about the cost? Will this be the new method businesses large and small use? Read more to find out…

Cost

Using Square is not terribly expensive. The mobile card reader is free when you are approved for a Square account, and the transaction fee is 2.75% + .15 to swipe. It’s slightly more if keyed in. There’s no start-up fee, monthly fee, minimum fee, early-cancellation fee, or any other bizarre and ridiculous fee. Transaction fee. That’s it!

Security

When watching the demo video, the part I was most impressed with was the finger-based signature. Merchants can allay customer fears or hesitation by allowing them to hold the device, swipe it themselves, and then sign onscreen with their finger. They’ll see the transaction is complete, their information is secure (only the last 4 digits of the card will show), and they don’t need to worry. Receipts are sent immediately to their email.

Is it unreasonable to expect a jailbreak app designed to clone or retain the swiped info? Maybe not, but do thieves really want to go through the hassle of creating some kind of “business” with items or services to sell so they can dupe people into swiping their card on a phone? I run a small business, and honestly it sounds like a lot less work to learn how to pickpocket.

Convenience

Obviously, this is Square’s strongest selling point. This is a truly wireless and simple solution to credit card processing. Further, it doesn’t just make accepting credit cards easier, in some cases it makes it possible when it wasn’t before.

Think of festivals and street fairs, places where cash-only is the norm. They can now turn a bigger profit by snagging those customers that don’t carry cash or forgot to stop by the ATM (or maybe are too cheap to pay that $3 withdraw fee!)

But it’s not just small businesses and vendors that could benefit, I imagine larger companies can, too. Apple stores are a great example of mobile payment, with their own card reader and device to process payments on the spot. Now other retailers can trial out this system using Square.

It may not happen in your local department stores, but perhaps seasonal retailers that set-up shop temporarily or sell door-to-door can make use of Square’s simplicity. Maybe in the future, Square will grow to include a barcode-scanning system and inventory count for retailers.

The Downsides

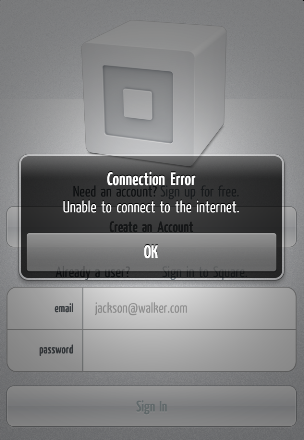

Square is still an app, and apps still crash or have bugs. Already Square’s pushed out an update to resolve some issues. And it might be discouraging to think of lost revenue or customers because AT&T’s network is having a grumpy day or your business is in a weak reception area.

And of course, phones are lost every day, which could compromise security. And then there’s the fact that Square is only as good as your device’s battery. Better keep that cord handy and make sure an outlet’s nearby.

But most of these downsides can be avoided or remedied easily. Find a bug? Let Square know. Bad reception? Invest in a Microcell. Lost your phone? Good thing you had a passcode that was set to erase the data after 10 failed attempts. (You did think to do that, right?) Didn’t charge your battery? Well then you shouldn’t be running a business because you don’t know how to plan! (I kid, I kid.)

Is This the Future?

Mobile payment processing is no doubt catching on and building buzz. Paypal has their options, and I think the field is bound to get more crowded. Crowded means competition, which is usually a good thing.

I own a small business that sells clothing at local festivals, and I have used the bank’s merchant payment processing system. It’s a cumbersome and expensive tool, and the cost hasn’t really been worth the benefit of being able to accept credit cards. Square is a greatly welcome alternative. I can’t wait to try it out.

What do you think? Would you feel comfortable swiping your credit card on a phone? Any small business owners planning to try it out? Let us know in the comments below!