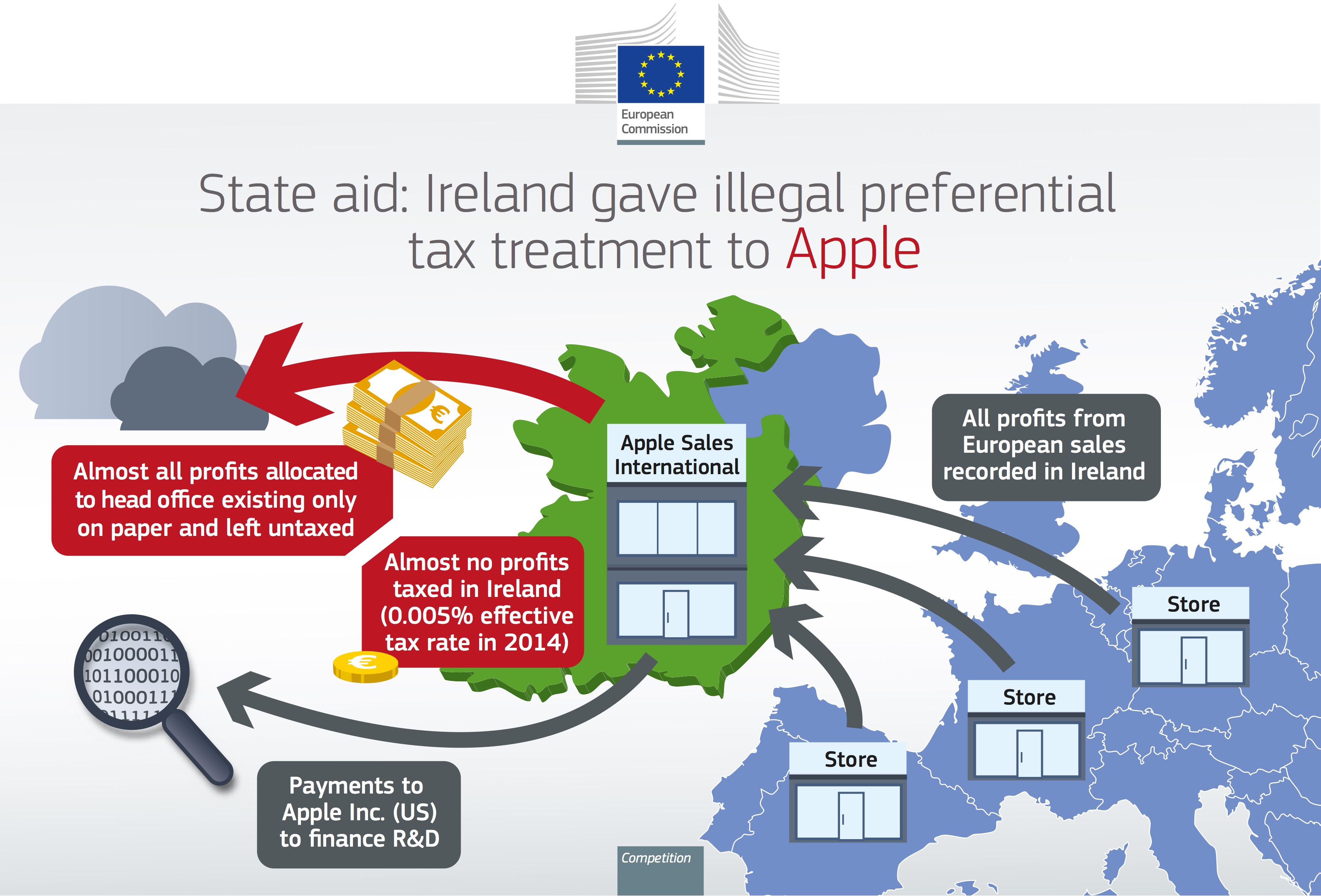

Following news earlier this week that the European Commission had ruled that Apple must pay €13 billion ($14.5 billion) in back taxes to the government of Ireland because its sweetheart deal with Dublin that lets it be subjected to a lower tax rate constitutes “illegal state aid,” the Irish government said today it would join Apple in its fight against the ruling.

“Paradoxically, Ireland is determined not to accept the tax windfall, which would be equivalent to what it spent last year on funding its struggling health service,” says the report.

Ireland fears that collecting back taxes from Apple would equal an admission of guilt, which in turn might discourage investors from creating new jobs in the country. The country’s decades-old low corporate tax policy has drawn in multinationals like Apple, helping create one in 10 jobs in the country.

Ireland’s Finance Minister Michael Noonan said the EU’s retroactive ruling was “little short of bizarre and outrageous”.

“How could any foreign direct investor come into Europe if they thought the valid arrangements they made under law could be overturned a generation later and they be liable to pay back money?”, he asked at a press conference Friday.

His colleague, Public Expenditure Minister Paschal Donohoe, told the media that Ireland stood behind its corporate tax regime as a means of creating jobs.

“This ruling has seismic and entirely negative consequences for job creation in the future,” he said.

Transport Minister Shane Ross also defended Apple.

“I think they were acting legally,” he said. “What they were doing was making use of extraordinary loopholes that existed there. Multinationals provide absolutely vital jobs to the economy… (but) multinationals should pay a fair rate of tax in Ireland.”

Irish government has about two months to lodge an appeal to the EU’s General Court. If that fails, Dublin will take the case all the way up to the European Court of Justice.

The Commission’s ruling has also ticked off Washington.

The U.S. government’s position is basically that the EU is attempting to collect tax revenue that should go to Uncle Sam. President Barack Obama will raise the tax avoidance issue at a summit of the G20 leading economies in China this weekend.

Apple CEO Tim Cook called EU’s tax bill from hell “total political crap,” insisting in an interview with the Irish news publication Independent that “no one did anything wrong here”. Part of Apple’s tax bill would be paid next year when Apple repatriates some of its offshore profits to the United States, he said.

And in his “Message to the Apple Community in Europe,” Cook expressed confidence that the tax bill will be eventually reversed and said Apple would appeal the ruling.

Source: Reuters