China’s influence over Apple’s financial health is growing. In fiscal 2011, the country accounted for sixteen percent of Apple’s revenues. But is Apple’s growth in China sustainable?

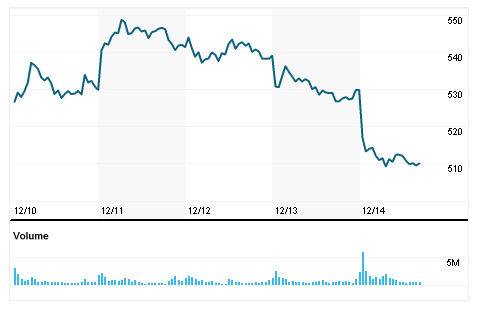

Friday, two analyst reduce forecasts amid what one described as a ‘muted’ response to today’s iPhone 5 release in the world’s largest market. As a result, Apple shares fell 3.9 percent to a ten-month low.

The decline also hurt a number of Apple’s suppliers as the firm is thought to be cutting orders in order “to balance excess inventory”. For example, Broadcom is down 3.13 percent and Qualcomm dropped 4.7 percent.

As a result, Jefferies analyst Peter Misek cut his iPhone shipment estimate for the first three months of 2013 to 48 million, down from 52 million. He also trimmed Apple’s expected gross profit margin to 40 percent, down two percentage points…

According to Reuters, Misek said Apple “had started cutting orders to suppliers to balance excess inventory”. The news gathering organization reports the analyst told clients that yesterday’s iPhone 5 launch in China “has been surprisingly muted”.

He was unsure how much heavy snow in the north may have affected the limited purchases. Another possible damper on sales: Apple’s requirement that customer pre-order devices, a procedure put in place to avoid earlier riots.

Whatever the cause, UBS analyst Steven Milunovich said Friday the iPhone 5 may not beat previous iPhones sold in China.

Apple and other tech stocks associated with it are down hard today…

— Christian Zibreg (@dujkan) December 14, 2012

“Some of our Chinese sources do not expect the iPhone 5 to do as well as the iPhone 4S”, the analyst told clients. Since the iPhone 4S hit China a year ago, a number of popular local brands like the Coolpad as well as a plethora inexpensive Android devices were released in the 1.33 billion people market, pushing Apple out of China’s top 5 list.

http://www.youtube.com/watch?v=1RSaS5lVOVY

UBS reduced its price target on Apple stock to $700, down from $780 based on concern of lower iPhone and iPad shipments. As a result of the worries, Apple suppliers, including Qualcomm, Cirrus Logic and Jabil Circuit, also saw their shares fall in value during early morning trading.

Ironically, many believed the iPhone 5 would be warmly received by Chinese consumers.

The iPad mini hit China last Friday and is said to have prompted “nearly nonexistent” crowds. Today’s start of iPhone 5 sales in China was seen as the real test of the new Apple products.

http://www.youtube.com/watch?v=sdEd911YTn8

In another twist of fate, analysts are using sales of the iPhone 4S as the yardstick to judge demand in China for the iPhone 5.

It was that introduction – along with the iPad 2 and the resulting riots which temporarily halted sales – that prompted the additional pre-ordering requirement. That requirement is now being given as a possible reason for lower-than-expected iPhone 5 sale in China.

Is Apple hobbling demand by requiring Chinese consumers register before purchasing its products?