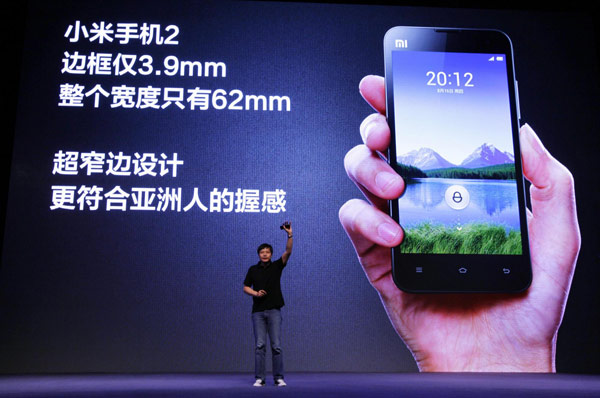

When Lei Jun, founder and CEO of China’s mobile company Xiaomi Technology, took the stage in Beijing yesterday to announce the Xiaomi Phone 2, his company’s successor to the MiOne phone, it was a familiar sight to anyone who has ever watched one of Apple’s famous theatrical product unveilings.

Clad in a black turtleneck, blue jeans and runners and standing in front of a giant screen as the audience of more than a thousand devotees cheered and clapped, the unveiling bore more than a passing resemblance to an Apple event starring Steve Jobs.

But that’s beyond the point. What matters is that Xiaomi Technology. Ever heard of the company? Founded only two years ago, it’s already worth more than BlackBerry maker Research In Motion. Its latest smartphone has better hardware than the iPhone 4S, yet sells for less than half the price.

Xiaomi’s Q1 2012 revenue was nearly $1 billion on sales on three million phones. Not bad for a two-year old handset maker doing business in the 1.33 billion people market, which recently overtook the United States in terms of iOS and Android activations. Xiaomi is one of many iPhone contenders in China whose names you’ve never heard before.

Can Apple respond to this latest local challenge to the iPhone?

Things are not black and white.

According to a new report published by China Daily late yesterday:

In China’s booming smartphone market, which is set this year to overtake the United States as the world’s largest, a host of little-known local firms are primed with cheap phones to squeeze market share from US giant Apple Inc’s iPhone.

Apple’s iPad leads the tablet market in China with an IDC-estimated Q2 share of 70 percent and the iPhone remains strong. One of the dangers Apple faces in China is that its growth mostly comes from the greater China region, where sales increased more than 100 percent year over year during the second quarter of this year.

Greater China represented about a third of Apple’s growth in the Asia-Pacific region, which grew 25 percent in the June quarter.

Put simply, the iPhone flourishes in just a handful of wealthy Chinese cities.

There are three main issues worth of note here.

This is Android Jelly Bean-driven Xiaomi Phone 2. Looks sleek, no?

First, According to Apple’s internal survey made public during the Apple v. Samsung suit, a whopping 43 percent of respondents chose Android to stay with their current provider.

The iPhone is backed in China by China Telecom and China Unicom, but the country’s and the world’s leading telco, China Mobile, which counts about 655 million subscribers, still isn’t offering the sought-after device.

Second, in addition to limited distribution, Apple only operates five stores in China, meaning one store serves an average of 216 million customers, with two additional flagship stores set to open later this year.

To put that in perspective, the company has more retail stores in Pennsylvania (population: 12.7 million) than in all of China. Reuters recently noted as much, warning that Apple’s retail expansion in China “has fallen well short of its own goals”.

Of the five stores in the country, two are in Beijing and three in Shanghai. In other words, Apple’s retail footprint is limited to the greater China region.

Though Apple is shooting to open about 25 more stores in China by the end of calendar 2012, the fact remains that Apple’s retail presence in the 1.33 billion people market sucks. The market is so huge and booming that even Apple cannot build enough stores to push its products direct to consumers.

[tube]FjkNaqFS0gw[/tube]

And third, the iPhone is a high-end play, but the real growth in China is coming from feature phone owners upgrading to low-end smartphones. These folks are going for mid-tier devices costing between $130 and $240.

IDC China analyst TZ Wong:

Apple isn’t going to rule China, simply because of the limited models they have and the price points they target. Based on these two factors, we do not think Apple will be the No. 1 smartphone player in China.

Jack Purcher of PatentlyApple disagrees:

If Apple’s next generation iPhone packs enough advancements into it like we all expect, then their sales will skyrocket like they’ve traditioinally done. These so-called analysts that are temporarily spewing their pessimist views in the press today will once again be silenced.

Apple’s legal pressure is also bound to yield some positive results for the company, Purcher opines:

And let’s not kid ourselves, if Apple gains a positive verdict in their trial against Samsung, it’ll send a powerful message to all copycatters around the globe that they’ll pay a heavy price for copying anything of Apple’s. On the other hand, if the verdict doesn’t go Apple’s way, then all bets are off that Apple will be able to remain the king of the smart device revolution.

Apple recently re-priced the iPhone 3GS below $200 unsubsidized to counter Android cheapos. The problem is, the iPhone 3GS is three years old now and devices from the likes of Xiaomi beat even the iPhone 4S in terms of speeds and fees while significantly undercutting Apple’s pricey device.

The unlocked iPhone 4S costs an equivalent of $800 and that’s about two months pay for an urban Chinese. The cheap Xiaomi Phone 2 outsmarts Apple with a 4.3-inch 720p IPS display by Sharp, Qualcomm’s Snapdragon S4 Pro APQ8064 quad-core chip, 2GB RAM, 16GB memory and runs on Android Jelly Bean.

IDC estimated that last year sub-$200 smartphones in China accounted for 40 percent of shipments. Those costing $700 and more? Just eleven percent of the market.

Faced with all these issues, in addition to strong local competition (which understands local market better than Apple) and limited retail presence, Apple is at risk of endangering the sustainability of its success in China, especially as local vendors as Xiaomi, and more established ones like Huawei and ZTE, continue to expand share and gain popularity.

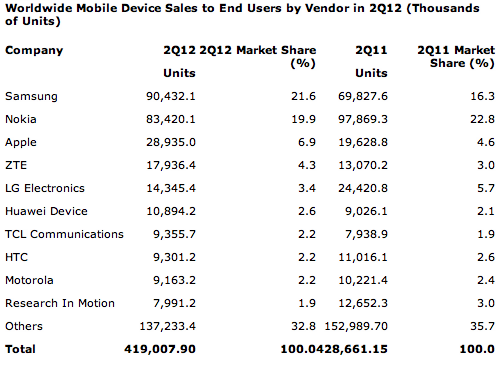

According to Gartner, China’s ZTE and Huawei were the only two non-Apple and non-Samsung brands that grew in the second quarter of this year.

In China, Apple ranked second in Q1 2012, with 17.3 percent market share, trailing Samsung’s 19.2 percent, according to Gartner.

Let’s also not forget counterfeit stores, less-than-satisfactory IP laws, rampant gray market, software piracy, all posing a whole new set of challenges for Apple’s China efforts.

Would you agree with that assessment?