Wireless carrier T-Mobile on Wednesday quietly unveiled a mobile banking service of its own, T-Mobile Money, available as a free mobile app for iPhone and Android.

While not officially announced, Domain Name Wire has discovered the official website at t-mobilemoney.com which launched today complete with T-Mobile branding and details. The service was also added to Google Pay’s master list of US banks and credit card companies.

As part of T-Mobile’s typosquatting prevention plan, it yesterday registered more than 70 typos and variations of the t-mobilemoney.com and tmobilemoney.com domains, which Domain Name Wire thinks shows that the carrier is going big on this new service. T-Mobile is promising no account fees, no maintenance fees and no minimum balances.

Accounts are operated by BankMobile, a division of Customers Bank, so it works like a typical bank. The only major downside to T-Mobile Money is the lack of a simple way to deposit cash. “Instead, you’ll need to get a money order or cashier’s check and use mobile deposit, or deposit into another bank and move those funds to your T-Mobile Money account,” writes 9to5Google.

The pitch goes something like this:

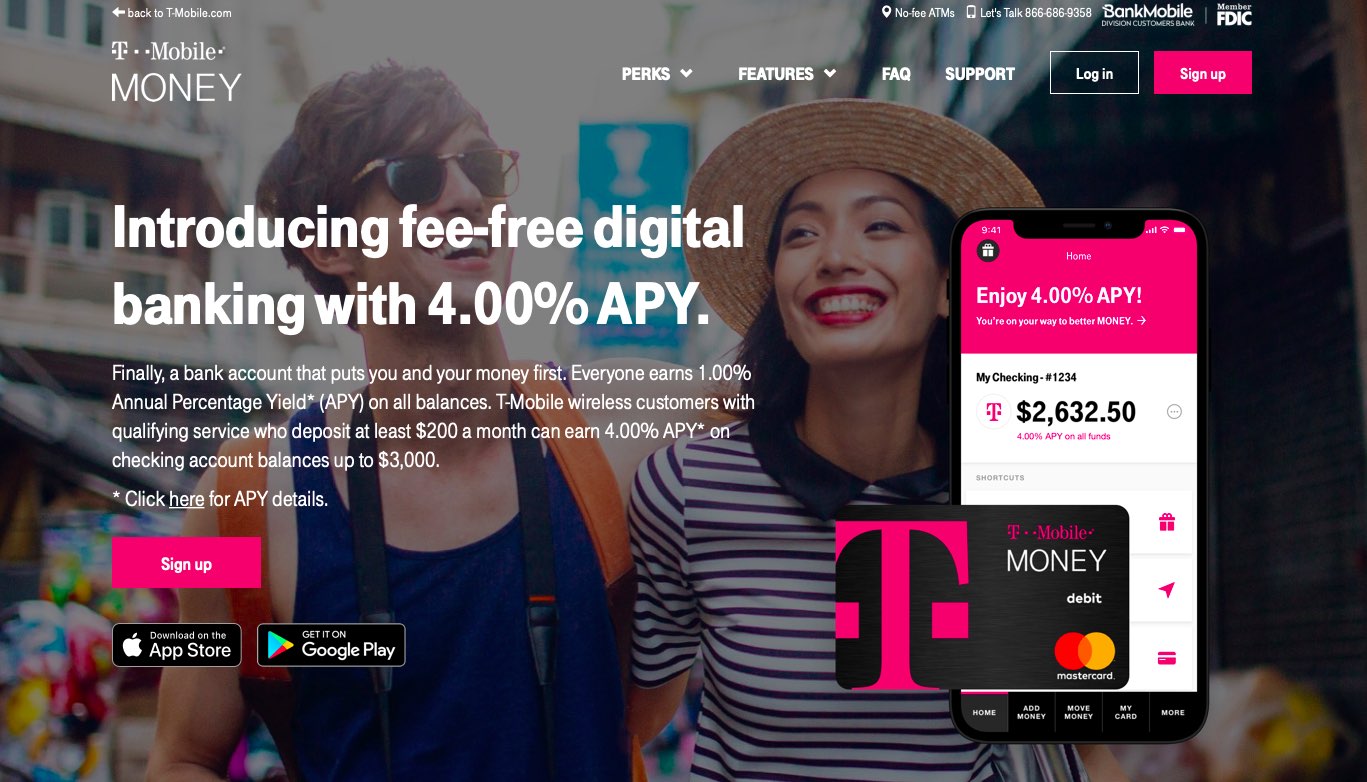

T‑Mobile Money is the bank account that puts you and your money first. Everyone earns 1.00% Annual Percentage Yield (APY) on all balances and T‑Mobile wireless customers with qualifying service who deposit at least $200 a month can earn an industry-leading 4.00% APY on checking account balances up to $3,000.

This comes with some caveats so be sure to read the FAQ.

For instance, you earn the aforementioned APY yield on balances up to $3,000 each calendar month if you have a qualifying wireless plan, have registered for perks with your T‑Mobile ID and have deposited at least $200 in qualifying deposits to your checking account within the current calendar month.

“If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met,” notes the carrier. Balances above $3,000 in the checking account earn 1.00% APY.

The digital finance service works with Google Pay, Apple Pay and Samsung Pay.

Other features include full access to bank accounts, including mobile deposits, an ATM locator, access to 55,000+ fee-free ATMs worldwide with the Allpoint ATM Network and more.

Here are the key features of the mobile app:

- Pay the way you want. Your T‑Mobile Money account includes a debit card with EMV chip, plus it works with Apple Pay.

- Hassle-free mobile banking. Easily transfer money to and from your external accounts for free. Send a check, pay bills, or direct deposit a portion or all of your paycheck to your account – all with just a few taps in your T‑Mobile Money app.

- Stay connected to your money. Access your money anytime with the app and enjoy 24/7 customer support.

- Safe and secure. Prevent unauthorized account access with multi-factor authentication. Log in with Touch ID and Face ID. Enable or disable your debit card remotely if it’s lost or stolen. Accounts are FDIC-insured up to $250,000. Plus, with Zero Liability Protection from Mastercard® you’re protected when fraud occurs.

The company’s mobile banking program for the unbanked, called Mobile Money, was phased out in 2016 so it seems that what we’re having here is a new initiative with a similar name.