Dan Riccio, Apple’s recently promoted Senior Vice President of Hardware Engineering, sold 20,726 shares of stock in the last two days. The transaction netted him a cool $10.7 million, with a thousand shares worth approximately half a million going to an unnamed charity. That another SVP of Apple is unloading shares (though he didn’t touch his stock options) doesn’t mean he’s potentially being fired, as some critics have jokingly speculated…

Seasoned watchers offer one viable explanation: it’s a prudent and legitimate decision ahead of potential capital gains tax hikes that could hit as early as next year.

In case you were wondering, capital gains rates are supposed to go from 15 percent to 20 percent next year.

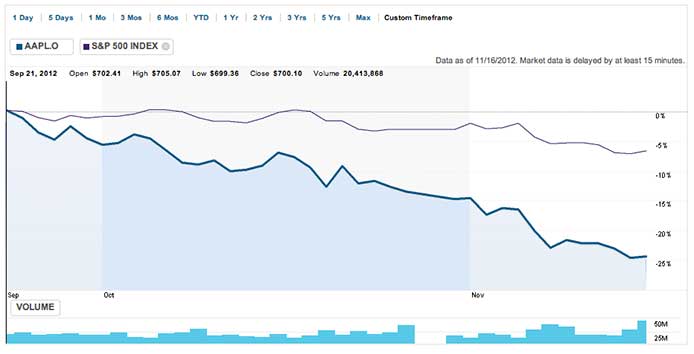

Many Wall Street analysts increasingly suspect the rumored increase in tax rates is pushing investors to bail out, causing an unprecedented drop that the Apple stock’s been plagued with for eight weeks straight now.

Cnet first discovered Riccio’s transaction in a regulatory filing.

Apple’s stock closed Friday at $527.68, a far cry over an all-time high of $705 in September. As a result, the company’s market valuation dropped below $500 billion, which is still more than Microsoft ($223 billion), Google ($212 billion), Yahoo! ($21 billion), RIM ($5 billion) and Nokia ($10 billion) combined.

For more on why Apple fell so hard, check out Philip Elmer-DeWitt’s post over at Fortune.

@dujkan don’t say I didn’t say this was going to happen

— Anshel Sag (@anshelsag) November 15, 2012

Now, critics say that selling at a time when the stock is down 25 percent from its high indicates lack of confidence in the company. The finger of blame is also pointed at Apple board member Arthur D. Levinson and the company’s General Counsel Bruce Sewell, who both sold a combined 18,225 shares in the last month.

Indeed, what’s the market supposed to think when high-ranked execs begin to dump their shares when the stock’s already lost 25 percent of its value? Maybe they figured the time is right in light of talk of tax rate hikes. Or, perhaps they fear the stock hasn’t bottomed out yet, which begs a frightening ‘why’ of their reasoning which I dare not fathom at this time.

A comparison of Apple’s stock performance and S&P 500.

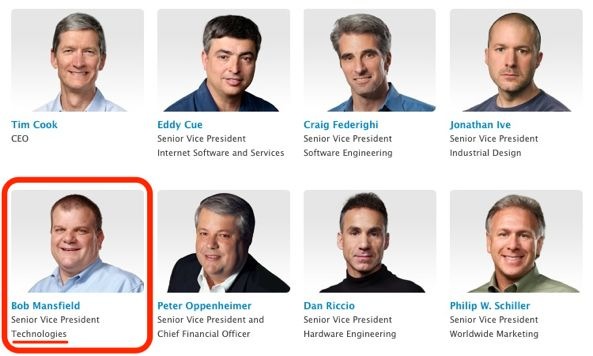

Dan Riccio was appointed Apple’s SVP of all Hardware Engineering back in August, after the company two months earlier announced an unexpected retirement of its then long-time hardware boss Bob Mansfield. As a bonus, the exec was awarded 75,000 shares of restricted stock that vest over the next three years.

Cook said at the time that Dan “has been one of Bob’s key lieutenants for a very long time and is very well respected within Apple and by the industry”.

As Mansfield has been such an authoritative figure whose hardware excellence never came into question, he was soon un-retired as Cook’s adviser. Apple’s boss reportedly lured the chubby hardware whiz with a two-year agreement worth an astounding $2 million a month.

As you know, the recent management shake-up which took place at Apple saw Mansfield take over the newly set up Technologies division which combines Apple’s wireless and semiconductor teams. According to Bloomberg, Mansfield is also tasked with finding chip alternatives as Apple looks to drop Intel silicon in Macs.

Dan, thought to be Mansfield’s right-hand man, now leads the Mac, iPhone, iPad and iPod engineering teams. As he assumed new responsibilities, the company’s gradually been giving him more spotlight, though Bloomberg claimed several senior engineers felt Riccio was “unprepared for the magnitude of the role”.

As Riccio can be seen in Apple’s promotional clips detailing the iPhone 5 and third-generation iPad, it’s not like the company wasn’t grooming him for the role.

Riccio joined Apple in 1998 as Vice President of Product Design and in 2010 was named Vice President of iPad Hardware Engineering. The executive holds a bachelor’s degree in Mechanical Engineering from the University of Massachusetts Amherst. Prior to Apple, he was Compaq’s Senior Manager of Mechanical Engineering.

It is both unsettling and intriguing that Apple execs are now unloading shares.

Perhaps you could weigh in on this in the comments?