Those who sold their shares of Apple last October did not make the wisest move, but all is not lost. AAPL closed yesterday at $618.63 a share (more than a 32GB WiFi iPad, mind you) for a market cap of $577 billion. As the company’s quarterly earnings report looms, analysts are running their spreadsheets and upping targets. So, how long until Apple zooms past the $1 trillion market cap milestone?

According to one analyst, it could be sooner than you think – in less than two years – as Apple drains market cap from rivals and profits from more money being poured into tech stocks. By a growing number of credible estimates, Apple is on track to become the first public company in the world with a $1 trillion market cap.

Phew, what a difference a few years make…

As Philip Elmer-DeWitt noted over at Fortune magazine, Microsoft holds the previous record for the largest market cap of $619 billion set in 1999. Now, according to Piper Jaffray analyst Gene Munster, Apple will get its next $400-plus billion in market cap in two ways.

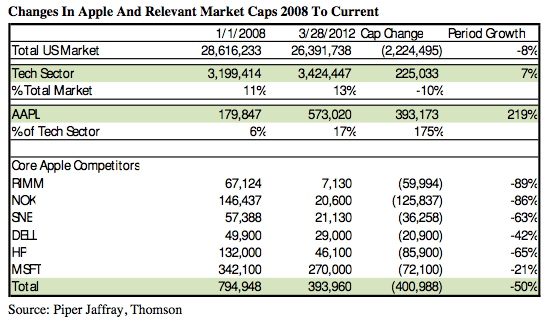

Citing historic data, Munster explained in a note to clients Tuesday that Apple’s market cap in the past four years has ballooned by more than $390 billion. At the same time, market cap of rivals Research in Motion, Nokia, Sony, Dell, Hewlett-Packard and Microsoft decreased by more than $400 billion.

It could be premature to conclude that Apple is draining market cap from rivals, but evidently none of these companies benefited from Apple’s successes in mobile, computers and digital media – quite the contrary.

The other half would come from tech stocks, the analyst explains:

If we assume that 25 percent of large cap tech income funds buy AAPL (which we estimate to be about $150 billion), that would add around $40 billion to Apple’s market cap or ten percent of the total market cap increase needed to get to a $1,000 share price. That said, we believe many income funds have already bought shares of AAPL, so the more likely impact is closer to a five percent benefit.

Munster raised his 12-month price target for shares of Apple to $910, up from his previous $718 price target. The iPhone will remain the key growth driver for the company, he noted, as at least 70 percent of iPhone owners upgrade their handset:

That suggests 33 percent of iPhones in a given quarter through 2015 are ‘in the bag’ We believe this is conservative given it expects an average iPhone life of 24 months. If we assume an average iPhone life of 21 months, and 85 percent of users upgrade to a new iPhone, that implies 45 percent of iPhones through 2105 are ‘in the bag’.

The analyst is projecting 33 million iPhone shipments for the March quarter with an average selling price of $630, up from his previous estimate of 30 million units. For comparison, Apple in its blowout holiday quarter sold an astounding 37 million iPhones.

Other analysts are following suit. Topkea Capital Markets’ Brian White projected yesterday that Apple will trade at staggering $1,001 a share. White’s projection assumes Apple’s entrance in the $100 billion television market with a full-blown HD TV set of its own some time in 2013.

J.P. Morgan’s Mark Moskowitz also upped his 12-month target to $715, an increase over his previous estimate of $625 a share.

Apple will hold the March 2012 quarter earnings call on April 24 after markets close.

Disclosure: Yours truly does not own shares of Apple or any other company.

What’s your call? Is a trillion dollar valuation just a pipe dream or real possibility?