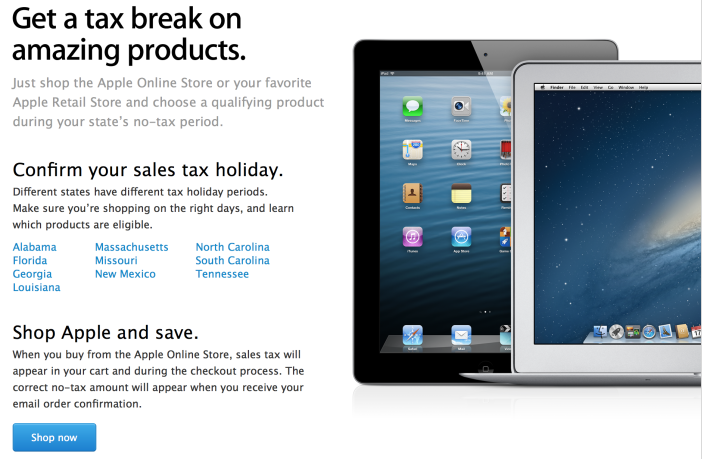

Apple is reminding customers of the upcoming sales tax free days in the United States. Specifically, as part of the back-to-school sales tax holidays, the company is reminding would-be shoppers of a not-to-be-missed opportunity to buy select Macs, iOS devices, accessories, educational software and services at a significant discount.

The Online Apple Store is now advertising a tax break on Macs and iOS devices purchased both at its brick-and-mortar outlets and online.

Even better, tax-free purchases can be combined with Apple's own 2014 Back To School promotion to net yourself up to $100 in Apple Store gift cards for Macs, iPhones and iPads...