You can put Panasonic, Sony and Sharp on your list of once mighty Japanese consumer electronics giant that are now forced to sell off billion dollars’ worth of property in an embarrassing move deemed absolutely unavoidable if these dinosaurs want to survive winter. Panasonic, the maker of the Viera brand of TVs, was previously reported as wanting to exit the television business to focus on churning out displays for portable electronics, especially Apple’s iPad.

These days, the company is working to raise $1.34 billion from offloading property and shares in other Japanese companies by end of March 2013, Reuters reported Monday. We’re talking land holdings, plants and even a 24-storey staff dorm in central Tokyo which has more than 47,300 square meters and houses about two thousand workers. Sony and Sharp, once the biggest names in electronics, are planning to follow suit…

Reuters reports that Sony and Sharp are both looking to sell buildings and businesses in a giant ‘garage sale’ that could raise a combined $3 billion.

In the case of Panasonic, the sell off will provide the company with a much-needed cash flow to pay off creditors and fund research and development “as it revamps its business portfolio”. As if that wasn’t enough, Panasonic starting April 2013 could also shut or sell businesses operating at below a five percent margin.

Contrast Panasonic to Apple, the world’s biggest company in market valuation:

Panasonic’s fixed assets of $21 billion are around 30 percent more than those of Apple Inc, and are almost double the company’s market value.

The company, founded almost a century ago as a small electrical extension socket maker, trades at around half its book value – which includes intangible assets such as patents.

Sony trades at 39 percent of book, Sharp at 30 percent.

The painful sell off is a necessity, one that could improve operating margins and cashflow. Let’s not forget that credit rating agencies downgraded all three companies recently, which has inevitably led to increased interest rates on funding on capital markets.

Fitch, for example, cut all three companies to junk status, adding to their borrowing costs. So, what does the future hold for Panasonic, Sharp and Sony?

While Panasonic is looking to revamp its business around batteries, auto parts and household appliances, Sony is doubling down on smartphones, gaming and cameras. Sharp, meanwhile, is focusing on display screens and is forging alliances with the likes of Taiwan’s Hon Hai Precision Industry and U.S. chipmaker Qualcomm Inc.

Sony may also sell off its battery business and is even considering a sale of its 37-storey New York headquarters that could raise a billion dollars. One of the potential buyers is Apple’s favorite contract manufacturer Foxconn, which is also in talks to buy TV assembly plants in China, Malaysia and Mexico for $667 million.

What’s really interesting is that the combined fixed assets of Panasonic, Sony and Sharp, which includes buildings, land and machinery, is valued at around $42 billion. Their combined market value is $24 billion versus Apple, which at the time of this writing was valued a little more than $500 billion.

Of course, strong competition from Korea, where Samsung and LG make attractive television sets, has changed the dynamics of the market amid the sunset of Japan’s TV biz. Sharp, for example, is Japan’s last major maker of television panels.

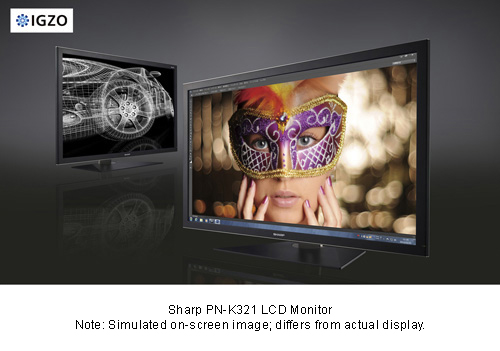

Long has Sharp been trying to turn its cutting-edge panel plant in Osaka, part owned by Foxconn, into a profitable business amid ongoing yield issues. The company recently released a pro 2K4K monitor seen above which sports IGZO screen tech Apple wanted to use for iOS devices but couldn’t due to manufacturing problems.

Foxconn wanted to throw Sharp a lifeline buying its shares, but that deal fell apart as Sharp’s shares have been losing their value continuously. Qualcomm, which now owns a five percent stake in Sharp, is its largest shareholder.

Pictured above: Panasonic’s factory where it plans to make screens for the iPad.