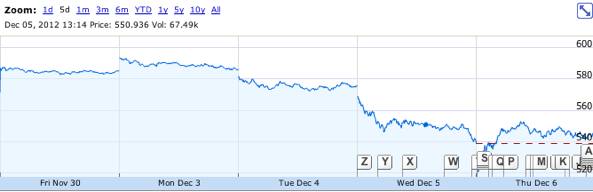

Questions about Apple’s future lead to heavy trading in the technology giant Wednesday afternoon, prompting a 4.2 percent drop to $551.50 per share and an almost 22 percent decline since it’s all-time high of $705 in September. More than 17 million shares were traded during midday action on Wall Street. Among questions facing investors: can Apple management perform without Steve Jobs, can the company produce another hit product, and can the iPad maker fend off Android…

“This is a management test, of how well [Apple] can perform without (deceased former chief executive) Steve Jobs,” Brian Battle, director of Chicago-based Performance Trust Capital Partners, told Reuters.

Apple needs “another product that hits it out of the park,” he said. If that doesn’t happen, there could be a “gradual grind-down in confidence.”

Also of concern is a Wednesday report from IDC forecasting Apple’s iPad could lose ground to Android rivals. As we reported, Apple’s market share in 2012 could fall to 53.8 percent, down from 56.3 in 2011. By contrast, Android could increase its share to 42.7 percent, up from 39.8 percent a year ago.

Another factor weighing on investors is news that Nokia has inked a deal with China Mobile, a partnership that could eat into the iPhone’s share of the China market.

If that wasn’t enough, worry over whether tax breaks on capital gains could survive negotiations over the U.S. ‘fiscal cliff’ is also prompting some shareholders to sell-off, the report notes.