If you try to use your credit card to fund an Apple Pay person-to-person payment over iMessage, Apple will tack on a 3% fee, reports Recode. The fee is standard among similar P2P services, and necessary to cover credit card transaction costs, but it’s worth pointing out to potential users.

If you don’t want to incur the 3% fee, simply use your debit card to fund the Apple Pay P2P payment, as this method is completely free.

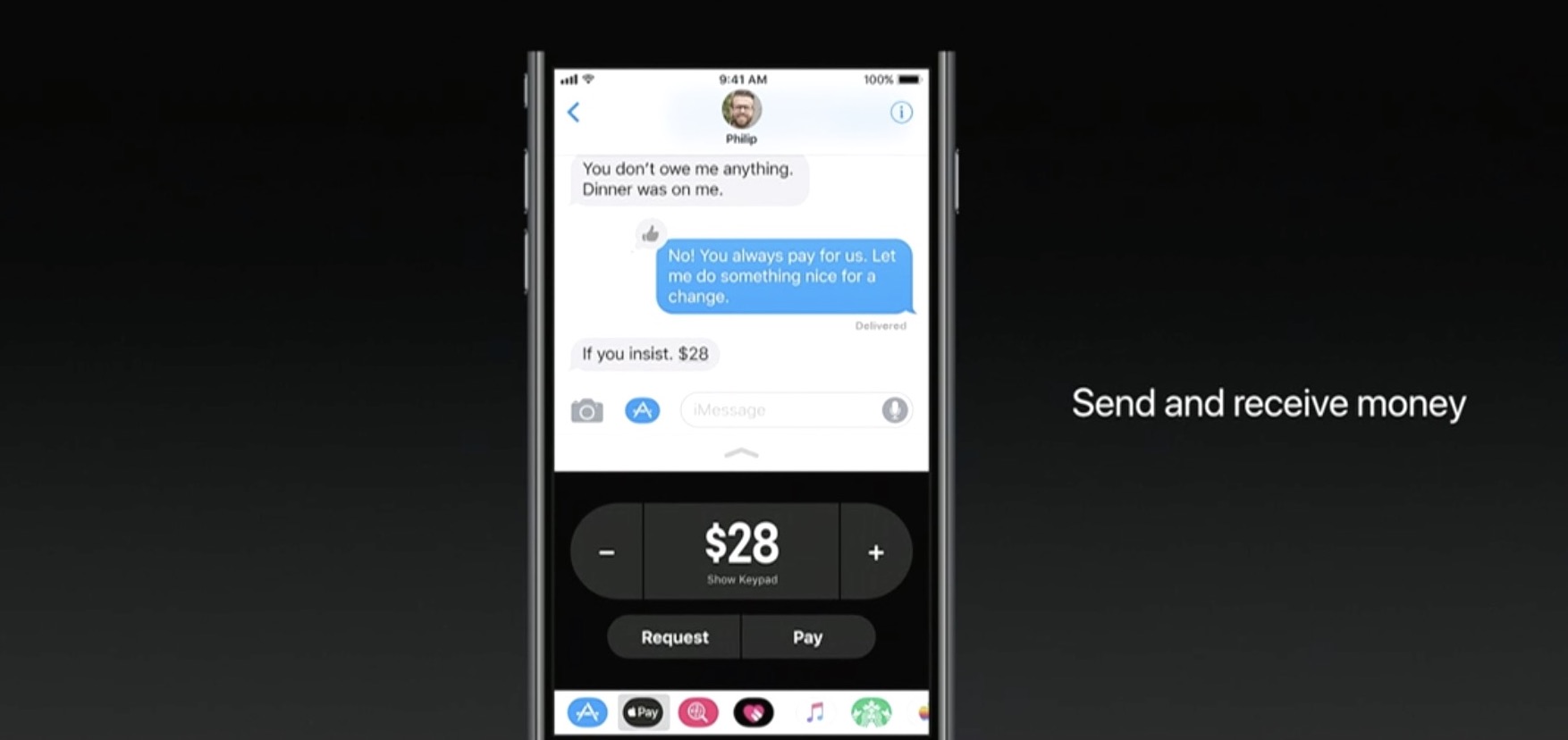

Apple announced the new iMessage-based service during its WWDC keynote earlier this week. With it, you’ll be able to use any card stored in Apple Pay to send money to other users. Once sent, the money loads onto a prepaid Apple Pay Cash card, where it can be spent or withdrawn.

Apple Pay Cash will go live after Apple publicly launches iOS 11 this fall.

Source: Recode