Dollarbird makes it possible for you to plan your monthly budget and keep an eye on your daily spending to help you avoid the dreaded “overdrawn” letter from the bank…

Design

This app is pleasant to look at and features the popular iOS 7 design. The icons are flat and brightly colored, while the background is white. Most actions are gesture based and accessing the finance analyzer is just a matter of tapping a button at the bottom of the screen.

Categories are given color-coded icons with images that represent what the finance is regarding. For example, the “eating out” category has a pink icon with a graphic of a spoon and fork.

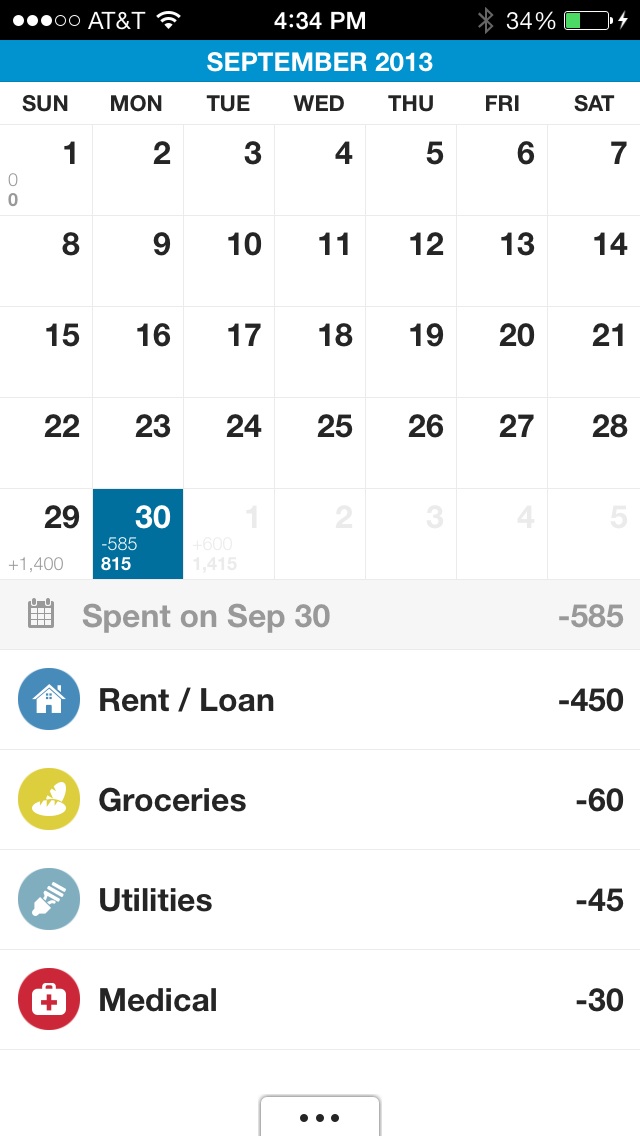

The main section of the app displays a monthly calendar with today’s date highlighted. Below the calendar are today’s expenses and planned finances. You’ll also see the daily transaction totals. The last day of each month shows how much money you have. If you add planned expenses to the calendar, you will see how fast your money goes every day and you may even be able to slow the loss by choosing not to buy something or postponing a trip until next month.

Pull down on the center of the screen below the calendar to access the finance input. Here, you will see a list of possible categories. If you don’t see the category relating to your expenditure or income, you can add it by tapping the plus (+) icon.

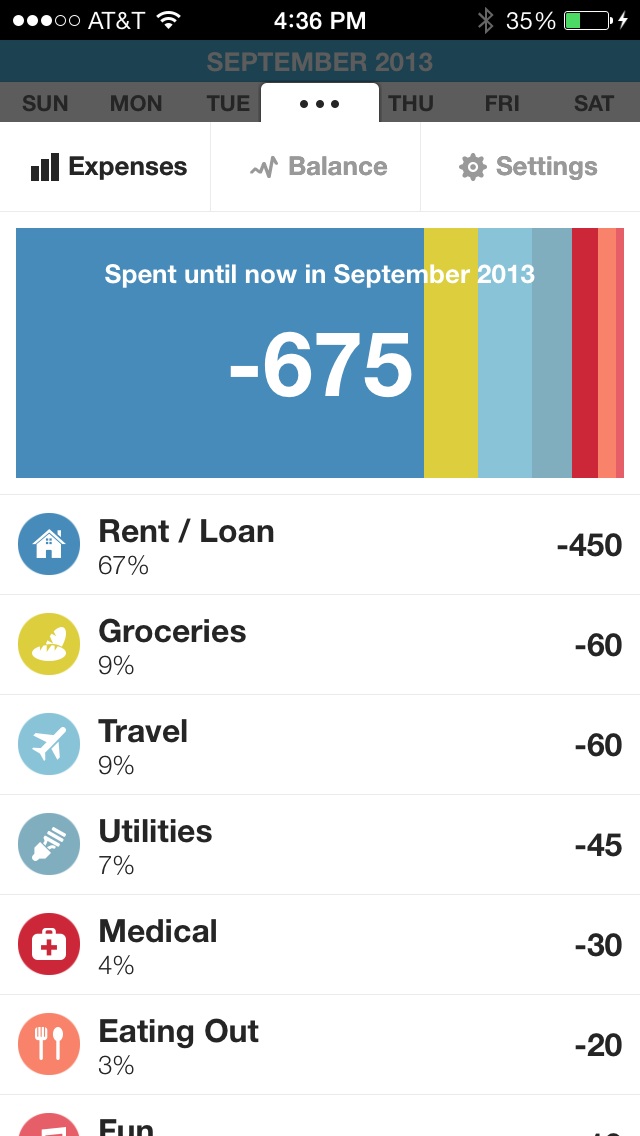

When you’ve added daily, weekly, and monthly income and expenses, you can see your finances in an easy-to-understand infograph. Tap the tab at the bottom of the screen that has three dots. It will bring up the financial analysis section. In the Expenses section, you can see your month’s expenditures with a colored graph to show you where you have spent most of your money. Your expenses will be listed below the graph with a percentage of how much of your monthly income was used for it.

The Balance section shows a graph of your cash flow each month with information showing you the changes throughout each month, as well as from month to month.

App Use

App Use

To get started tracking your monthly expenditures, begin by entering your current bank balance.

Next, you will begin tracking your expenditures. If you know that you will have to pay a bill on a specific day, tap the date on the calendar and pull down on the center of the screen to bring up the input section.

To add an income or expenditure that you know will take place on a certain day, enter the amount and tap the category. If the category you want is not listed, you can create a new one by tapping the black plus (+) icon.

To create a new category, name it, select a color, and tap the “Save” button. If you want to change the graphic, tap the tag icon at the top of the screen to call up the various graphic options.

When you have the amount and category selected, tap the check mark in the lower right corner of the screen and your new item will be saved. You can make the item recurring by tapping the recurrence arrow above the numbers keyboard. Select how often you want the income or expense item to recur from weekly or monthly and the number of weeks or months from one to 50. For example, you could set the expense to recur every two weeks or every six months.

Continue adding planned income and expenses until you are done for the month. Then, you’ll want to begin tracking your daily expenses.

Every time you spend money, add it to today’s daily balance. If you are bad at remembering this kind of stuff, set a reminder. In the Settings section, you can set a reminder at a specific time every day to enter daily transactions. You can also change the alert time for reminding you of upcoming transactions, set a passcode so that no one else can see your finances, remove the decimal if you don’t want to be so specific with your transaction entries, and export the data you are tracking as a CSV file. Access the Settings section by tapping the three dots at the bottom of the screen and then selecting “Settings” from the top of the screen.

If you keep track of your income and expenses every day, you will eventually be able to see where you are spending too much money and plan future budgets accordingly. For example, you may not have realized that you were spending 50 percent of your income on going out to eat. One easy way to reduce that particular expenditure would be to bring lunch from home each day and plan your evening meals ahead of time so you don’t end up with nothing to eat in the fridge. Overtime, you will see where you can save money so that you won’t have to live paycheck to paycheck and you may even have a bit of fun money at the end of each month.

The Good

The Good

I regularly balance a checkbook and don’t really feel like I need to keep track of my finances. However, seeing my monthly income and expenses analyzed as a simple infograph showed me that there are ways I could cut costs and increase my monthly savings.

For people that really need help with their monthly budget, this is a great way to plan for the future while tracking daily expenses at the same time.

The Bad

The save button in the input section is right where the delete button should be. I was constantly saving expenses when I meant to delete a number. They should switch the functions so that the save button is on the left side of the zero and the delete button is on the right.

Value

Dollarbird costs $1.99. This is a reasonable price for an app in the genre. Most budget apps range between $0.99 and $4.99. You get a simple-to-use financial planner with a daily income and expense balance, plus an uncomplicated budget analyzer so that you can see where you need to start saving money in the future.

Conclusion

This app is unique because it displays the information you want to see with a calendar and analyzes your income and expenses with simple infographs so that you can easily digest the information without feeling intimidated by too much financial data. Download it in the App Store today.

Related Apps

Spendee is another budget app that expresses your finances as an infograph. Wally is a free budget app that also lets you scan receipts for easy input of expense information.

App Use

App Use The Good

The Good