Apple’s iPhone 5 accounts for just over half of the company’s smartphone sales, with 48 percent coming from the iPhone 4S and iPhone 4, according to new research. That compares to the iPhone 4S which comprised about 75 percent of Apple sales almost a year after launch.

The figures illustrate how a larger portion of Apple’s smartphone revenue is being generated by lower-cost iPhone models, a concern for investors heading into Tuesday’s third-quarter financial report…

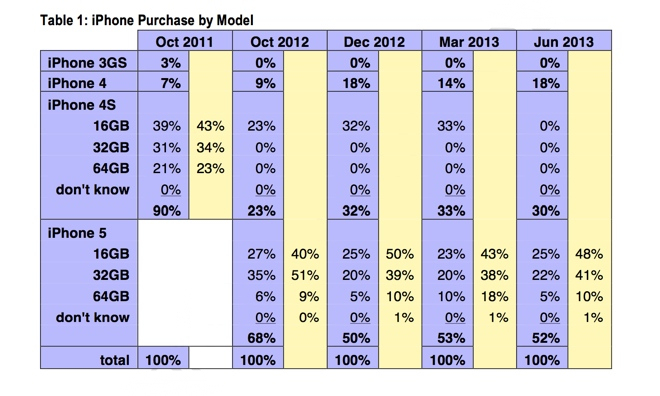

Although the iPhone 5’s share of sales briefly rose to 68 percent in October 2012, the level fell to 50 percent by December, rising to 52 percent in June 2013, according to Consumer Intelligence Research Partners, via AllThingsD.

The iPhone 4S – which had 23 percent of iPhone sales in October 2012 – rose to 30 percent of Apple handset sales by June of this year.

Likewise, the iPhone 4 saw its portion of Apple sales double between October 2012 to June 2013, according to the CIRP figures.

iPhone 5 appears to have settled in at about half of all iPhone sales, nine months after its initial launch. In contrast, the earlier flagship model, iPhone 4S, accounted for almost three-quarters of iPhones sales almost a year after its launch.

Furthermore, iPhone 4S had 90 percent of all iPhone sales in the period immediately after launch, compared to 70 percent for iPhone 5.

In other words, the iPhone 4S saw greater initial demand and longer-lasting demand than the iPhone 5.

But why?

One reason for the difference may have been due to the view by consumers that the iPhone 4S had enough new features to be worthy of upgrading the handset.

In another sign that iPhone 4S owners felt there wasn’t enough reason to upgrade to the iPhone 5, the majority of people buying an iPhone either came from Android (26 percent) or from simple feature phones (24 percent.)

Only thirteen percent of iPhone buyers were upgrading from the iPhone 4S.

The findings come as U.S. carriers attempt to spark more smartphone sales by offering more flexible upgrade terms. The new data shows only T-Mobile, which just recently began offering iPhones, is attracting iPhone buyers.

AT&T, Verizon and Sprint saw their percentage of Apple handset sales fall between March and June. Verizon has announced it may owe Apple billions for unsold iPhones it had pledged to buy.

The numbers also suggest both Apple and the carriers have much to gain by offering an iPhone 5S that is significantly different than the iPhone 5. Perhaps the best feature could be a lower price. There has also been much talk about a mid-range iPhone that could attract price-conscious buyers in emerging markets.

As we’ve seen with the iPhone 4S and iPhone 4, those marked-down handsets have proved popular both in the U.S. and elsewhere, such as China and India. Likewise, T-Mobile could take advantage of a low-cost handset, since the carrier has positioned itself as the low-cost alternative to the other three wireless providers.