A story published this past weekend by a website called SemiAccurate has renewed speculation of Apple’s supposed interest in producing the engine for iDevices at a plant of its own, as opposed to simply designing silicon blueprints in-house and commissioning others to build the chips, as has been the case since 2010.

So if Apple really bought into a fab, as the exclusive story alleges, the non-trivial move would span years to complete while costing billions of dollars.

Worse, Apple would expose itself to unforeseen difficulties not limited to yield issues: running a sophisticated chip-making factory requires a disciplined approach to attracting and retaining highly-trained engineers, one analyst cautioned Monday…

According to Piper Jaffray’s resident Apple analyst Gene Munster (via AppleInsider), Apple would be better served focusing on chip process development rather than the actual fabrication.

Focusing on its own chip development facility for the cutting-edge 10-nanometer silicon process would come with a $2 billion price tag attached to it.

But should Apple build its own full-fledged chip-making facility, the company would need to cough up at least $7 billion, Munster noted.

As a result, Munster believes it would be in Apple’s best interest to develop its own logic process technology rather than buying a factory.

He also believes Apple could license its own custom process to a variety of foundries to keep costs down, but that sounds very unlike-Apple to me.

SemiAccurate said Apple has bought into an unnamed chip fab potentially owned by United Microelectronics Corporation (UMC). Munster isn’t convinced because UMC’s process technology is behind the likes of Intel, Samsung, IBM and Global Foundries.

What Apple could do instead is buy IBM’s process development operations, rumored to be up for sale, Munster added.

Apple could also tailor manufacture processes to their needs as opposed to a broad base of customers.

IBM has developed a finFET transistor on fully depleted silicon on insulator process (FD-SOI). We believe this is the best process for low power SoC and it would best fit Apple’s needs.

Apple in the past ran its own factory that assembled Macintosh computes in California and confirmed it will assemble the upcoming next-generation Mac Pro in the United States so it’s not like the company is a stranger to factories. On the other hand, assembling products does not compare to churning out tiny cutting-edge chips.

Samsung’s advanced fabrication facility in Austin, Texas is where A-series mobile processors for Apple are being built.

The Wall Street Journal last week confirmed Apple and TSMC inked a major deal to produce A-series chips, starting with the 20-nanometer A8 chip next year, with the future A9/A9X chips also mentioned as being included.

Contradicting that report, The Korea Times heard from sources that – despite the epic legal/smartphone Apple-Samsung battle – the two sides have managed to grit their teeth and sign a deal for the 14-nanometer A9 chips aimed for an iPhone 7 in 2015.

Samsung, the world’s largest chip maker after Intel, reportedly was able to develop a “state-of-the-art 14-nanometer A9 models ahead of its rival TSMC, regaining the order from Apple”.

There’s no doubt that entering the complicated and risky fab industry would be a double-edged sword requiring a massive capital expenditure. It takes billions of dollars to just build a semiconductor plant and many billions more in maintenance, engineering and R&D costs.

Apple with its nearly $150 billion cash pile is perhaps best poised for such undertaking, but given the recent stock woes, dwindling sales and lack of major new products, I doubt investors and analysts would approve of such a move.

Looking at the big picture, Apple can’t really control its chip destiny unless it has a silicon fab. Samsung spent billions on equipment and capacity upgrades at its Austin, Texas plant just to meet Apple’s ever-growing demands.

In turn, the South Korean conglomerate has a unique insight into Apple’s technological roadmap, even though its executives insist its components arm doesn’t reveal secrets to the mobile division.

And therein, my friends, lies the catch 22.

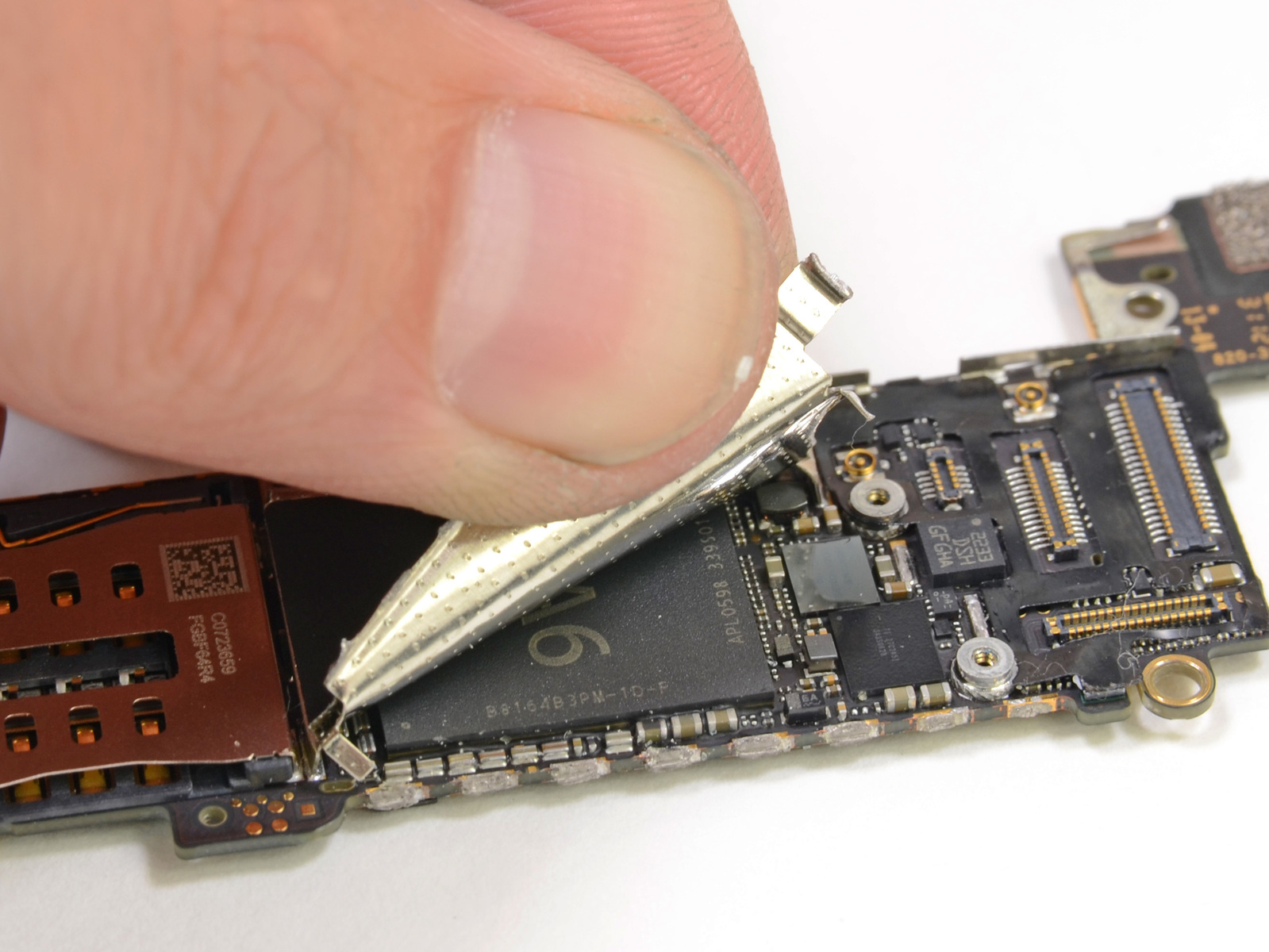

Image top of post via iFixit.