So… Exxon passed Apple to reclaim the title of the World’s Most Valuable Corporation. But how much did Wall Street’s prognosticators have to do with Apple’s drop in value following its earnings report earlier this week?

While investors realize the company is facing stiff competition and potentially lower profits, a number of financial observers were way off in the predictions ahead of Wednesday results. Indeed, while Apple reported $54 billion in fourth-quarter revenue, analysts had forecast between $51.7 billion and $65.69 billion.

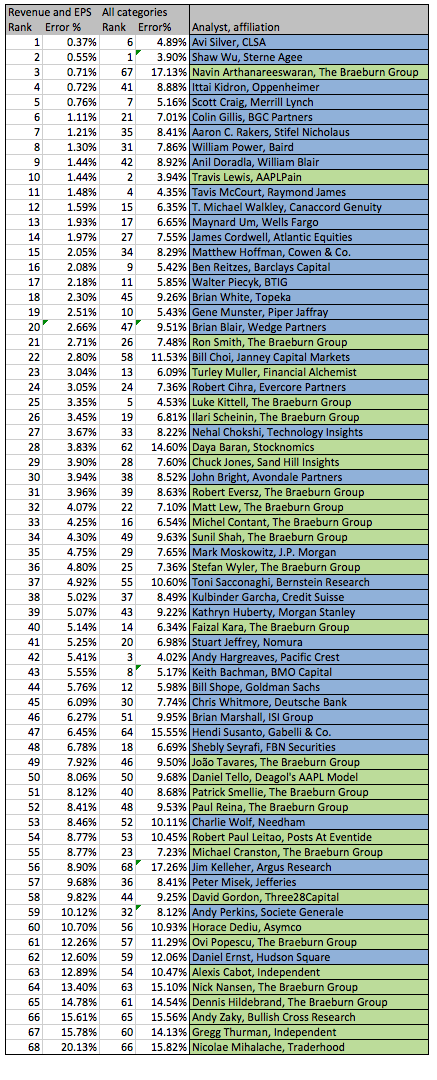

According to Fortune, some analysts were up to 17 percent wrong, while some well-known Wall Street Apple watchers came within 3 percent of the iPhone maker’s final numbers. Partially as a result of such wildly-varying forecasts, Apple is changing the way to releases its revenue guidance…

“The company didn’t have a bad quarter,” Fortune’s Philip Elmer-DeWitt writes.

In fact, it posted its best quarter ever… But the stock market is an expectations game and Apple is expected to blow past analysts’ expectations, not miss them.

So how did the 68 analysts Elmer-DeWitt do in projecting Wednesday’s outcome?

Avi Silver of CLSA had the best showing forecasting Apple revenue, missing the mark by just 0.37 percent off the fourth-quarter number. Sterne Agee’s Shaw Wu was the overall winner, his forecasts only 3.9 percent off.

By comparison, many of the analysts used to Apple blowing the doors off its guidance figures performed badly. Here’s a snapshot of DeWitt’s analysis of Apple analysts.

Asymco’s Horace Dediu and Andy Zaky of Bullish Cross landed in the cellar. Meanwhile, Traderhood’s Nicolae Mihalache was overly optimistic in earnings, revenue and iPhone sales, according to Fortune.

Also, Jim Kelleher of Argus Research undershot both Apple’s revenue and iPad sales.

To help prevent such future departures from reality, Apple reportedly is changing how it releases its guidance before quarterly reports.

Instead of issuing just one “conservative” figure – which analysts presume will always be vastly lower than the final figures, the company will release a guidance range, letting analysts come to their own forecasts.

Here’s the outspoken Jim Cramer on AAPL.

For those not in the know, Cramer is a well-known and stock market manipulation veteran (your video proof is right here).

At the end of the day, reality must eventually set in. The days when Apple had the smartphone market practically to itself is gone. So are the huge sales and revenue figures which came as consumers adopted smartphones.

Now that much of North America and Europe have smartphones, the focus is turning to emerging countries, such as China. Not only does Apple now have Samsung to contend with, but the company must also learn how to produce the same quality products but at lower prices.

Ironically, while many observers felt the introduction of the iPhone 5 and the iPad mini would compress Apple’s luxurious gross margins, the consumer technology giant surprised analysts, announcing a 38.6 percent gross margin.

Analysts had expected Apple to report a gross margin between 37.5 and 38.5 percent. However, among the talk of “Apple’s toast,” this stat was hardly mentioned.