Veteran Apple chip architect Manu Gulati is now a Lead SoC Architect at Google, reveals his LinkedIn profile which states that he started in his new Google role in May.

According to Variety, Gulati has been tasked with leading the effort to build highly optimized chips for Google's Pixel smartphones in-house.

He had been spearheading Apple’s own chip developments for close to eight years.

By hiring an industry expert, Google is hoping to distance itself from the rest of the pack. Like other flagship Android devices, Pixel smartphones use Qualcomm's Snapdragon 821 processor.

This makes it harder for Google to differentiate Pixel devices from other Android phones.

“In addition to Gulati’s hire, Google is now looking to hire additional chip experts to tightly control future Pixel hardware,” Variety learned from sources familiar with the hire.

A custom chip would allow Google to develop a more secure smartphone with better camera features, advanced biometric authentication, optimized power consumption and so forth.

iPhone 7, for example, is six times faster at image recognition than Google’s Pixel phone because its 64-bit A10 Fusion chip has a highly-optimized Image Signal Processor.

And with iOS 11, Apple is integrating features like Metal 2, machine learning and augmented reality directly into a phone’s main chip, which would have been impossible if the company hadn't closely controlled chip design.

For those wondering, Apple's Senior Vice President of Hardware Technologies, Johny Srouji, oversees the company's semiconductor and wireless teams, reporting directly to CEO Tim Cook.

“Johny has built one of the world’s strongest and most innovative teams of silicon and technology engineers, overseeing breakthrough custom silicon and hardware technologies including batteries, application processors, storage controllers, sensors silicon, display silicon and other chipsets across Apple’s entire product line,” according to his bio page on the Apple Leadership website.

Johny joined Apple in 2008 to lead development of the A4, the first Apple-designed system on a chip powering iPhone 4 and the original iPad.

Apple's semiconductor team is comprised of engineers who worked at startups like P.A. Semi that Apple acquired after releasing the original iPhone. Apple's logic was simple: it wanted to take its chip destiny into its own hands to tightly integrate the hardware and software, optimize device performance and power consumption and enable hardware features simply not possible on devices that use off-the-shel parts that are readily available to all vendors.

Incredibly, the strategy paid off big time.

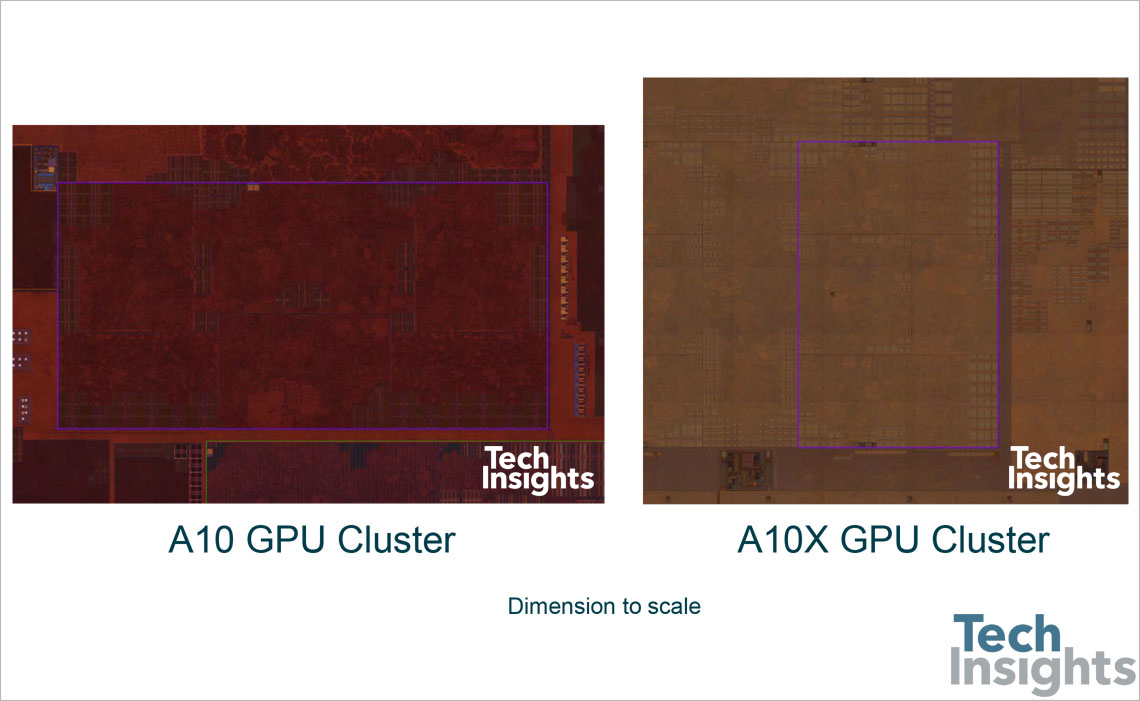

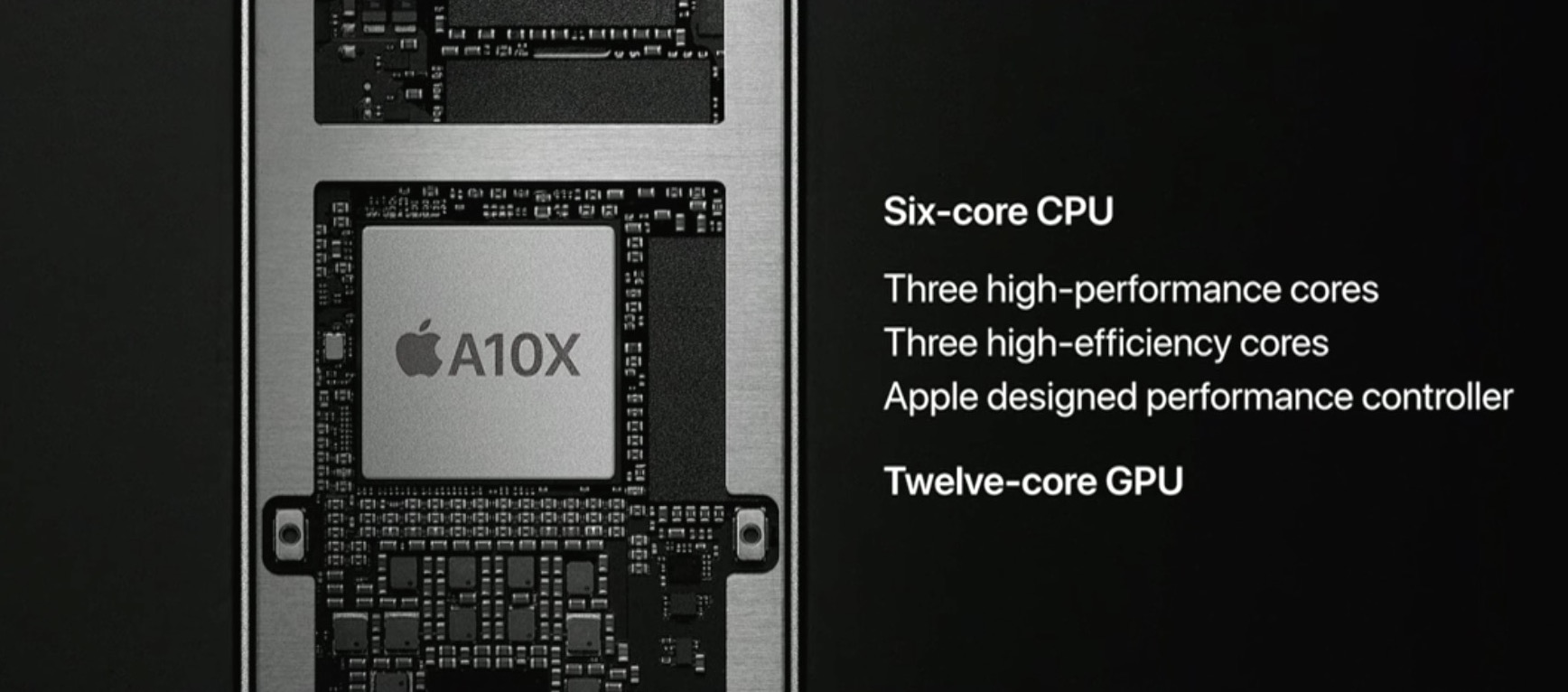

Even the last-generation A9 processor inside iPhone 6s smokes competition in single-core performance, for instance. The A10 Fusion chip in the iPhone 7 family is even faster and Apple's latest chip, the A10X Fusion inside the new iPad Pros, features 30 percent faster CPU performance and forty percent faster graphics than the previous generation.