If first Apple Card reviews are anything to go by, the new credit card from Apple is off to a great start. And to help it hit the ground running, the iPhone maker yesterday via its official YouTube channel released the inaugural ad for the Goldman Sachs-powered credit card. And just as you’d expect, that Apple Card isn’t exactly about Daily Cash rewards, strong security, no fees or the elegance of the laser‑etched titanium card seems to be lost on the Apple commentariat.

Former Apple engineer Jean-Louis Gassée in his Monday Note:

For a sufficiently large number of Apple customers, the new payment system is a classic How vs. What proposition — and the ‘How’ wins. The Wallet app offers complete control over purchases, payments, rebates, timing and security, all in one place.

There’s something to be said about the on-boarding process, too:

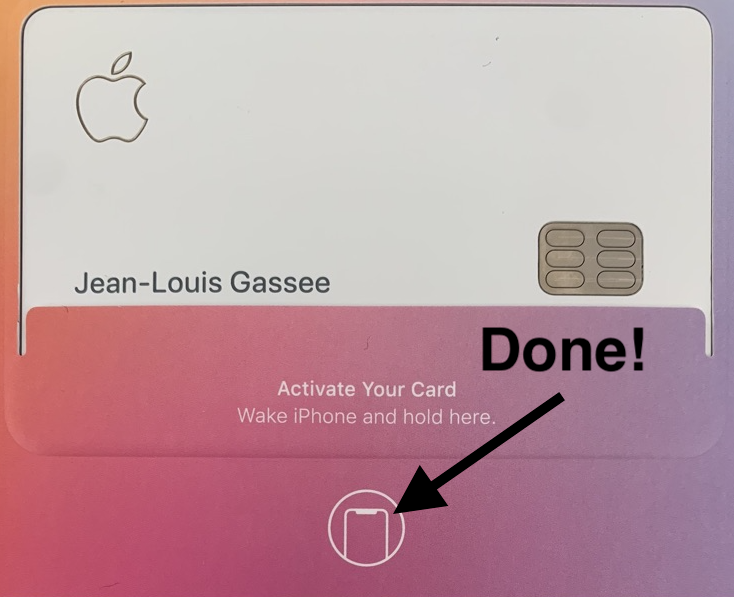

When I got my physical card four days later, I experienced another instance of simple on-boarding: place your phone at the bottom of the white (of course) envelope containing the card and you’re done, card activated.

Yup, just like pairing your AirPods.

To be sure, this requires NFC. But what about older pre-NFC iPhone models? According to The Loop‘s Dave Mark, there are actually two different on-boarding methods, one for NFC-enabled iPhones and the other used as a fallback on older iPhones without NFC.

Titanium Apple Card has two different on-boarding methods.

Mine required me to use my iPhone to activate.

As pointed out by @gassee, his wife’s just appeared in her wallet.

Anyone know why?

Side note: @gassee’s take on Apple Card is a solid read:https://t.co/tmQIqe1IhF pic.twitter.com/8oYm9lm5t8

— Dark Mode Dave (@davemark) August 27, 2019

So, what about those rewards?

When it comes to rewards, the critics are correct: none of the Apple Card features and benefits top what other cards offer in this diverse, fast-moving industry. And this is where the kommentariat get it wrong. Rewards isn’t the game that Apple Card is playing.

As I said in the opening paragraph, Apple yesterday released the very first Apple Card ad.

The short video runs only thirty seconds long but nonetheless manages to hit all the right notes. There are several nice closeups showcasing the titanium card and the ad also includes screens of the Wallet app with female voiceover reminds us of the key Apple Card benefits, like same-day cash back, seamless iPhone integration and elevated security, to name a few.

What you won’t find in this ad is any mention of simplicity or ease of use. Instead, those things are implied because that’s what people expect from the Apple brand. Yet still, it doesn’t cease to amuse me how the credit card industry has largely failed to reach a point when their product would become seamlessly integrated with our technology and super easy to use.

Applying for Apple Card is a great example of ease of use

https://www.youtube.com/watch?v=TbAt9mf56gc

Song: “Jeans” by Rubi

To apply for your card, open the Wallet app on your iPhone with iOS 12.4 or newer, tap the Apple Card banner and follow the onscreen instructions. You will need to provide your first and last name along with your social security number and a few other personal details.

If you pass credit check, a virtual MasterCard-branded credit card will be added to the Wallet app and immediately, at which point you can start using it with Apple Pay to pay for things while you’re waiting for your titanium card to arrive.

After less than two weeks, I find the experience pleasant and well orchestrated. I particularly appreciate being able to pay off my balance quickly and easily. Being French and formerly poor, I can’t stand credit card interest.

Think about it, Apple issues a software update and all of a sudden hundreds of millions of customers have a gestating Apple Card that had silently landed in their Wallet app. It only takes a few taps to receive a credit line from Goldman and start spending. I mean, how cool is that?

What does the consumer finance industry think about Apple’s foray into their world? There’s no hard evidence, but after I started using my Apple Card, I noticed more aggressive credit card ads almost everywhere I navigate on line. The new player from Cupertino must be making an impression.

The physical titanium card must be ordered manually via the Wallet app and can be used anywhere in the world MasterCard is accepted. For instance, you may use your physical card to pay for goods in stores, on the web and in apps that don’t yet accept Apple Pay.

To elevate. your security and make tracking spending easier, Apple Card uses three different numbers. One number is associated with the Apple Card in the Wallet app – that’s actually a virtual Mastercard credit card. Your physical card has a number of its own and a third number is associated with Apple Card in Apple Pay.

As for security, three different card numbers track purchases made with the physical card, with a card number on line, or with Apple Pay on your Watch or iPhone. No need to use a special third party app, such as the excellent Mint. Everything is built into the Wallet, itself built in every iPhone and iPad.

Needles to say, Apple Card isn’t all peachy.

Early adopters have complained about several issues, from the fact that blue jeans might transfer some of its coloring onto the card to the lack of a web-based Wallet app that would make it possible to pay your Apple Card bill if you lose your phone, without having to call Apple.

The most important grumble is that there are plenty of credit cards already, cards that offer better rebates, sign-on bonuses, airline miles, access to lounges, special treatment of expense categories, interest rates, grace periods. The credit card industry is better known for its tricks than for its transparency and bonhomie. Credit card issuers present themselves with big smiles, but we know they have sharp teeth.

But then again, all new Apple products have their fair share of misses and Apple Card is no exception in that regard. What people don’t seem to get about Apple Card (by comparing its perks to other cards) is the fact that Apple, Goldman and Mastercard are in it for the long run — I have absolutely no doubt in my mind whatsoever that we’ll get a web-based Wallet app. I even think Apple will offer a range of credit and debit cards backed by other banks.

As Jean-Louis Gassée himself wrapped up, “Is this a trial run, and for whom?”

Thoughts?