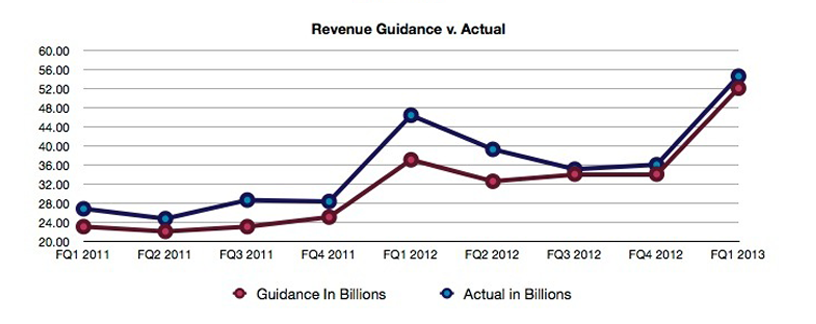

Like the first hints of green during a long-awaited spring, some sanity regarding Apple’s fiscal future is poking its head above ground. Wild speculation that the iPhone maker was washed up has been replaced with realism. The latest example: calm predictions that Apple’s second quarter income will be down – but with record projected revenue.

Fortune reports a Wall Street consensus of $10.18 per share, down from $12.30 for the second quarter of 2012. At the same time, Apple is projecting record quarterly revenues of $41 billion to $43 billion. If there is a “problem,” it may be lower margins from all the new products Apple introduced…

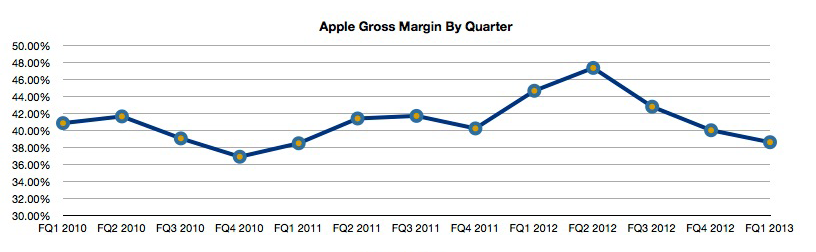

Gross margin is an important metric because it represents a measure of the efficiency with which a company turns revenue into profits.

“Judging from the performance of Apple’s shares since early March, the smart money has been pouring back into the company for the past three weeks,” writes Philip Elmer-DeWitt of Fortune.

Instead, some analysts are concerned with a decline in Apple’s enviable gross margins – a decline that could foretell good news for the company.

During the second quarter of 2012, Apple had a gross margin of 47.37 percent. That compares to this quarter’s margins of between 37.5 percent and 38.5 percent.

Apple’s margin took a hit not because product demand fell of a cliff, or consumers suddenly fell back in love with feature phones, but because of the slew of new iPhones, iPads and Macs introduced. With each new product introduction – and Apple refreshed virtually all of its major product lines since last fall – margins inevitably drop because of the costs associated with manufacturing ramp up, yields and high initial investments in factory tooling.

Wall Street also believes Apple’s margins have bottomed-out and will increase within the next year. Not the sort of doom-and-gloom that’s become a drum beat. But the stark contrast in messages may partially be Apple’s own fault.

The building of the Apple “myth” as a company that can expand without limit, combined with reporting which offers few hard facts offers “a perfect study in how conjecture and misunderstanding can trump actual knowledge when it comes to evaluating a company,” Michael Hiltzick wrote in Friday’s Los Angeles Times.

“When the company is as much the focus of worldwide attention and as uncommunicative about its own plans as Apple, the effect is even sharper,” he added.

While it is unlikely we’ll see fewer rumors from Wall Street about individual stocks, this whole overheated episode may temper Apple’s penchant to allow rumors to drive buzz.

Although I don’t envision Apple spokespersons to become chatty, company representatives need to expand beyond ‘no comment’ when speaking publicly.