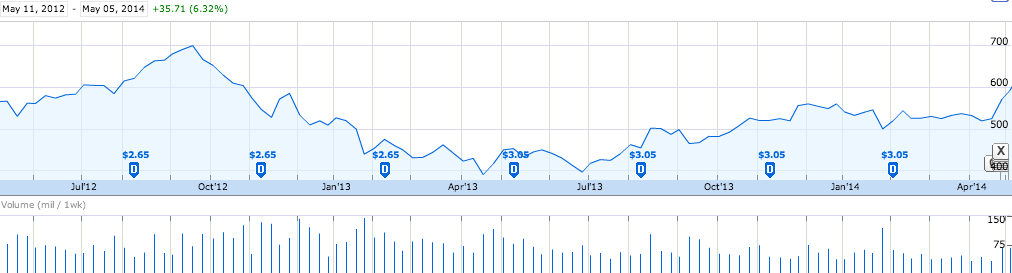

Investors are liking Apple’s direction lately, pushing the stock to $600 per share for the first time since 2012. Shares of AAPL closed at $600.96 each on Monday, a nice hike up from the under $400 price the stock was sitting at in April 2013.

Apple’s shares were up more than $8 for the day to reach the 52 week high, bringing the Cupertino-based company’s market capitalization to a hefty $517.65 billion.

It’s not new products that have pushed Apple’s stock higher – we haven’t seen the promised new product category yet – but rather continued successful quarterly performance, an increased stock buyback, and a 7-for-1 stock split that is set to take place in June.

“We’re confident in Apple’s future and see tremendous value in Apple’s stock, so we’re continuing to allocate the majority of our program to share repurchases,” Tim Cook, CEO of Apple, said in April on the company’s latest earnings call. “We’re also happy to be increasing our dividend for the second time in less than two years.”

The increased buyback was announced in April, when Apple detailed it has raised its share repurchase authorization to $90 billion from the $60 billion level announced last year. Apple expects to utilize a total of over $130 billion of cash under the expanded program by the end of calendar 2015.

The seven-for-one stock split also impressed investors, as each Apple shareholder of record at the close of business on June 2, 2014 will receive six additional shares for every share held on the record date, and trading will begin on a split-adjusted basis on June 9.

Apple’s all-time high was reached in September 2012 when shares crossed $700 for a short period, before tumbling back down.