Google Pay, Google’s broad mobile payment option, has been around for quite some time. But today, it’s seeing a major reimagining.

Google announced today the reworking of Google Pay. It’s going beyond its limits and welcoming in all new features. It’s also getting a major overhaul in the looks department on both Android and iOS as well. The relaunch of the Google Pay app is starting in the United States first, and Google says it’s designed around “your relationships with people and businesses”.

This app will do quite a bit of the heavy lifting when it comes to financial things. Yes, you’ll still be able to make contactless payments with your saved cards, and you’ll still be able to send money to friends and family with peer-to-peer transfers. But the new Google Pay app will also let folks see insights into the way they spend money, and it will help them save money, too. It also features “multiple layers of security” to help keep your funds safe.

A new UI

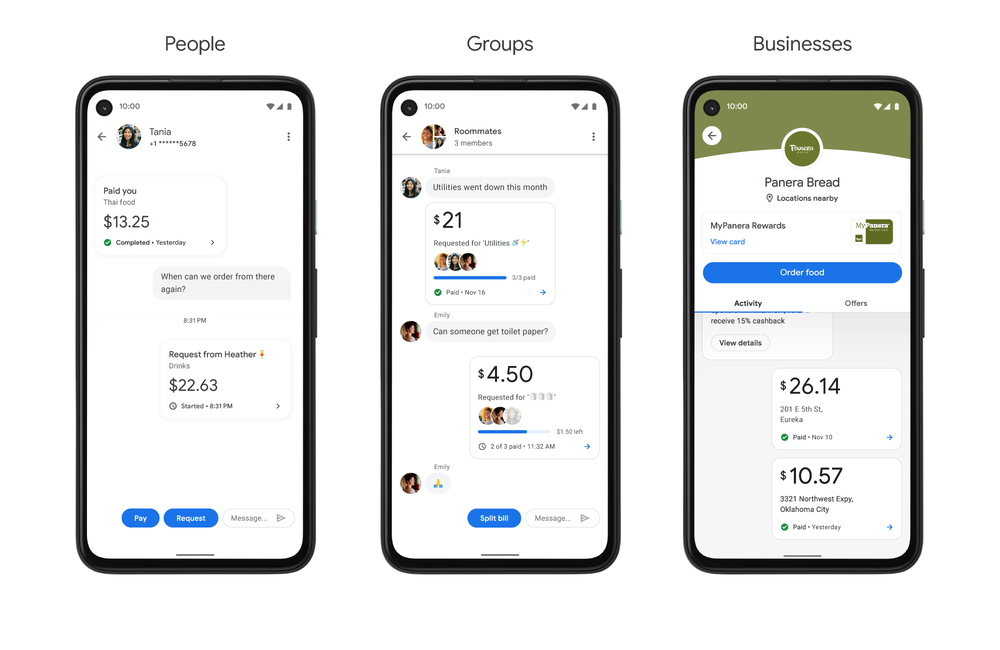

The interesting part comes in the new user interface for the app, and the way people see interactions with businesses and people. It’s all around “conversations”. You can see what that looks like in the images below.

Instead of showing a stack of cards or a long list of transactions, the new Google Pay app focuses on the friends and businesses you transact with most frequently. You can pay, see past transactions and find offers and loyalty info—all organized around conversations.

If you need to split dinner, rent or other expenses with more than one person, you can create a group, split the bill, and keep track of who’s paid in a single place. Google Pay will even help you do the math on who owes what.

You can also use Google Pay to order food at over 100,000 restaurants, buy gas at over 30,000 gas stations and pay for parking in over 400 cities, all from within the app—and more easy ways to pay are coming soon.

Saving

Saving money is part of the new effort, too. That comes in the form of redeeming available offers from assorted businesses. Google Pay will handle applying any discounts to places you shop, so you don’t have to worry about applying coupon codes or things like that. Brands like Burger King, REI Co-Cop, Target, Warby Parker, Etsy, and others will be available to choose from right within the app. And when you check-out using Google Pay, the discount will be automatically applied. This is available for in-store purchases and using the service online.

But it goes beyond that:

If you choose to connect your bank account or cards to Google Pay, the app will provide periodic spending summaries and show your trends and insights over time—giving you a clearer view of your finances.

Google Pay can also understand and automatically organize your spending. This lets you search across your transactions in new ways. For example, you can search for “food,” “last month,” or “Mexican restaurants” and Google Pay will instantly find the relevant transactions.

Privacy

Of course, making sure your funds are safe and secure is important. The service uses “advanced security”, and it will even let you know when it believes you might be paying a stranger. Users will be able to select from a wide range of privacy settings as well, for whatever fits their needs most.

And when you sign up for Google Pay, you choose whether you’d like to use your transaction history to personalize your experience within the app. That setting is off by default, but you can turn it on or try it for three months to see if you like it. At the end of three months, you can decide if you want to keep it on or off.

Google says Google Pay will never sell a user’s data to third-parties, either.

But wait, there’s Plex

Plex îs Google’s online-first banking initiative. The company is working with a variety of financial institutions to get this up and running sometime in 2021. It will be integrated directly into Google Pay, and accounts will be offered by banks and credit unions alike. There will be no overdraft charges, no monthly fees, and no minimum balance requirements.

There will be 11 banks participating with Google right out of the gate:

- Citi

- Stanford Federal Credit Union

- SEFCU

- Seattle Bank

- The Harbor Bank of Maryland

- BankMobile

- BMO

- First Independence Bank

- Green Dot

- BBVA

- Coastal Community Bank

As mentioned above, this new banking effort launches in 2021.

Meanwhile, the new Google Pay app is available beginning today for both Android and iOS.

What do you think of the new Google Pay? Think this is a direction Apple should take Apple Pay in the future?