Samsung Electronics on Thursday posted financial results for the first calendar quarter ended March 31, 2017. While the South Korean conglomerate increased both revenue and profit from the year-ago quarter, the growth is attributed mainly to Samsung’s lucrative components business as its mobile segment actually shrank year-over-year.

The firm appears worried about Apple’s upcoming iPhone 8, cautioning that its mobile unit could suffer as “market competition is expected to intensify” in the second half of 2017.

“Revenue from the mobile business decreased due to a decline in flagship product sales and price adjustment of Galaxy S7,” said the firm. Samsung discounted the Galaxy S7 series in the aftermath of Note 7 fiasco and ahead of Galaxy S8. Speaking of which, Galaxy S8/Plus, which arrived April 21, “show robust initial sales.”

Samsung’s mobile business should grow in the second quarter following the global rollout of the Galaxy S8 lineup. “For the mobile business, market competition is expected to intensify in the second half.” The firm added it will strive to maintain profitability through robust sales of the Galaxy S8 series and “the launch of a new flagship smartphone in the second half.”

Samsung is expected to make another flagship product announcement in the second half of 2017 as it preps to unveil a next-generation Note phablet.

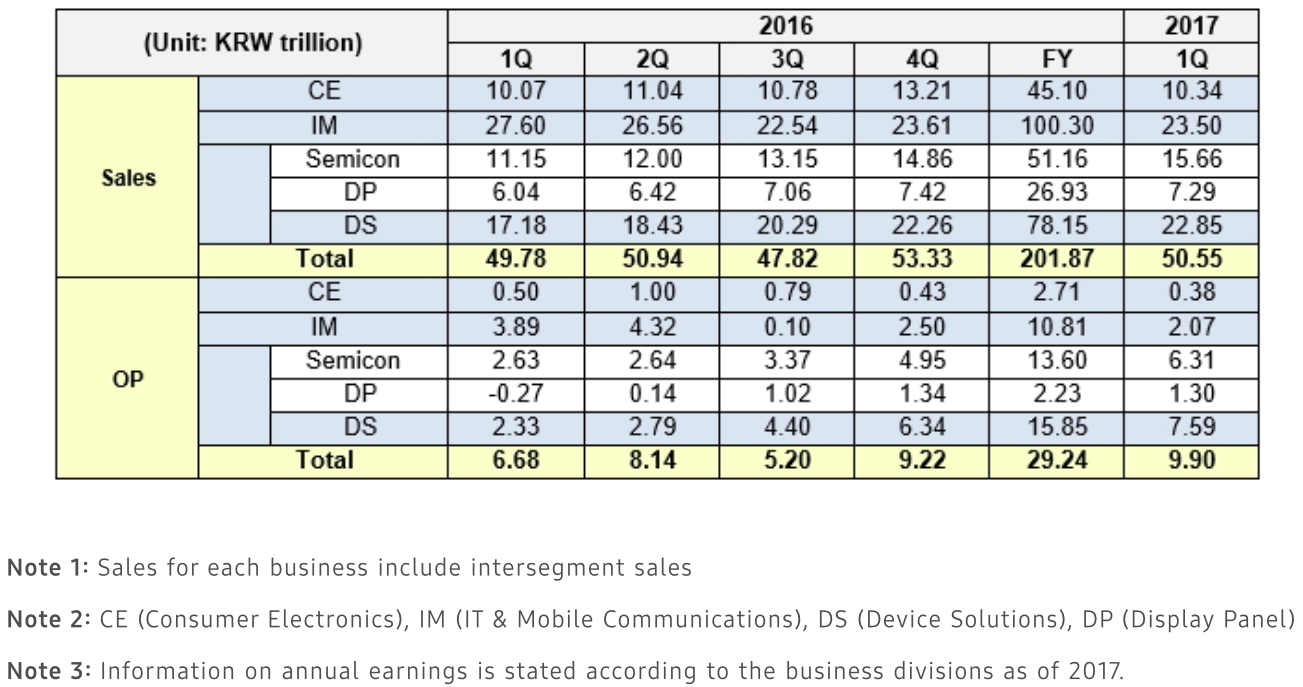

For the first three months of 2017, Samsung reported profits of 9.9 trillion won (or about $8.7 billion) on revenue of 50.55 trillion won, or approximately $44.7 billion. Both figures represent Samsung’s best first quarter so far in terms of revenue and profit.

“Profits were driven by the components businesses, namely the semiconductor division and the display panel segment,” noted the company. First-quarter sales for the memory/display units were up on higher average selling prices and strong sales of premium products.

Samsung’s memory business posted significant earnings growth, both annually and sequentially, thanks to the sales growth of premium high-density enterprise SSDs.

Its semiconductor business benefited from increased sales of chips for flagship smartphones and greater demand for image sensors and display driver integrated circuitry.

As the world’s #1 producer of OLED panels for smartphones and tablets, Samsung accounts for more than 90 percent of global OLED sales. Its OLED performance improved annually as sales of new flexible OLED panels found in Samsung’s own Galaxy devices shot up.

It’s been reported that Samsung Display will be Apple’s exclusive OLED panel provider for iPhone 8 for at least two years or until other suppliers ramp up their OLED production. “Looking to the second quarter, Samsung plans to actively address the expected continuous rise in demand for OLED panels, including flexible displays,” reads the press release.

https://www.youtube.com/watch?v=fKyDhYVThjA

Samsung expects its semiconductor earnings to keep growing thanks to solid demand for high-density DRAM and SSD memory products in the server market, increased shipments of ten-nanometer processors and sustained strong demand for image sensors.

The company will double-down on its 1xnm DRAM and 64-layer V-NAND memory chips as it expects the industry’s supply of 3D NAND flash chips to increase in the second half of 2017.

Source: Samsung