Twitter co-founder Jack Dorsey’s other business venture, the mobile payment startup Square, has a cozy relationship with Apple.

As a case in point, not only does Square develop for iOS first, Apple itself is happy to carry Square’s $9.95 credit card reader for the iPhone and iPad and the $99.95 Square Stand for iPad on its web store.

Moreover, some of Square’s talent comes straight from Apple, including director of engineering for the iPod, iPhone and iPad accessories, Jesse Dorogusker, who recently left the company to join Square.

After allowing Google to buy smart thermostat and smoke detector maker Nest Labs back in January, pundits have observed that Apple should be wise enough to avoid repeating the same mistake twice. Be that as it may, Apple is said to have mulled an acquisition offer for Square.

The possibility of such a deal has been floated on Wednesday as rumors of both Apple and Google discussing a possible acquisition with Square continue to persist. Although CEO Jack Dorsey would reportedly prefer selling the company to Apple, not Google, a deal with Apple is wishful thinking for now…

Re/code has learned that both Apple and Google mulled buying Square in the past year, with Square’s leadership said to be willing to consider an offer north of $8 billion.

However, CEO Jack Dorsey is said to prefer a deal with Apple because Square is more aligned with Apple’s “design aesthetic and values” than Google’s.

“Jack does not want to sell to Google,” one source said flatly.

The problem is, “Apple has soured” on the prospect of making an offer to Square.

Either way, a sale to Google would disappoint Dorsey, according to multiple people familiar with his thinking. For one, he was reportedly put off by Google after being involved in acquisition talks between his former company, Twitter, and the search giant.

He also believes, sources said, that his company’s design aesthetic and values match up much more closely with Apple than Google.

Google has the cachet to get attention of successful startups like Square and can bring its tremendous scale to boost Square’s business. Square’s technology would nicely augment Google’s own mobile payment thing called Wallet.

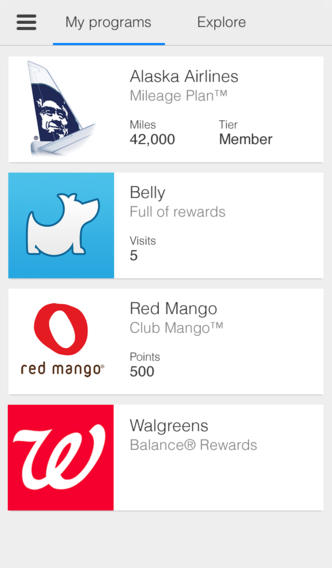

Google’s Wallet for iPhone app is available free in the App Store.

Let’s not forget that the Internet giant has proved time and again that it’s willing to spend obscene amounts of money to purchase other companies for talent and technology. Notable examples of Google’s audacious acquisitions: the $12.5 billion Motorola acquisition and the $3.2 billion all-cash Nest Labs deal.

A sale to Apple would be a no-brainer, Re/code speculates:

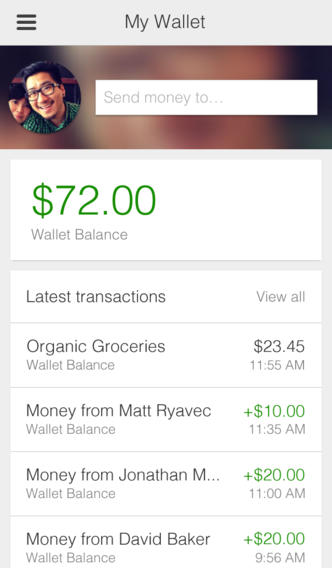

Square would immediately give Apple built-in distribution at thousands of businesses that use it to manage their payments. A deal with Apple could mean that Square could stop worrying about getting adoption for Square Wallet.

Apple already has hundreds of millions of credit cards on file through its iTunes service and could use those along with its own digital wallet Passbook as the underpinnings of its own mobile-payments offering for consumers.

Indeed, a deal with Apple would help the Cupertino firm accelerate its own mobile payment plans. On the other hand, Square isn’t necessarily a fit for Apple because its primary focus are offline payments, an area Apple reportedly isn’t interested in exploring.

The iPhone maker has been rumored to be readying a mobile payment solution of its own that would tap into the more than 500 million iTunes accounts with credit cards.

Tim Cook hinted in January that Apple is keeping an eye on this space, telling WSJ his company is “intrigued” with mobile payments and calling it “a big opportunity.”

We’re seeing that people love being able to buy content – whether it’s music or movies or books, from their iPhone using Touch ID. It’s incredibly simple and easy, and elegant, and it’s clear that there’s a lot of opportunity there.

The mobile payments area in general is one that we’ve been intrigued with. That was one of the thoughts behind Touch ID, but we’re not limiting ourselves just to that. You can tell by looking at the demographics of our customers, and the amount of commerce that goes through iOS devices versus the competition that it’s a big opportunity on the platform.

Apple could theoretically use Touch ID as a secure payment authentication method and take advantage of its Passbook and iBeacons technologies to make it easy for people to pay for physical goods using information stored in their iTunes accounts.

One of Apple’s numerous patent filings envisioning an iWallet.

It was also reported that Eddy Cue discussed Apple’s interest in handling payments for goods and services with industry executives.

Seemingly confirming its interest in the mobile payment space, the firm recently moved Jennifer Bailey from her position in Apple’s online stores into a new role, one involving building a payment business within the company.

Should Apple venture into mobile payments, do you think?

And if so, would you be willing to use an Apple-branded payment solution?