Yesterday, the unconfirmed news broke out about a surprise tie-in between Apple and GlobalFoundries, the world’s top semiconductor foundry second only to Taiwan Semiconductor Manufacturing Company (TSMC) which counts Nvidia, Broadcom, Qualcomm and AMD as its clients.

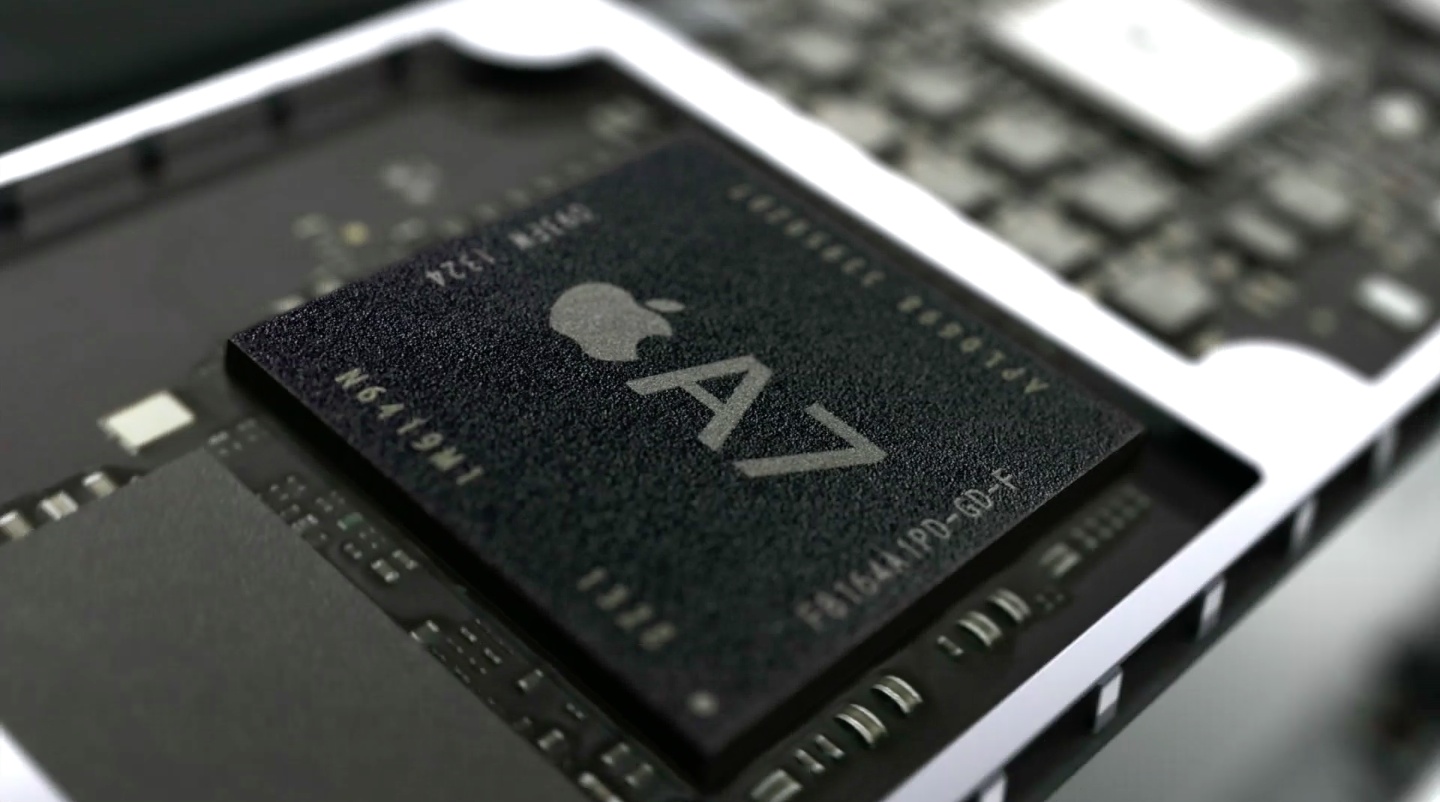

The Albany Times Union newspaper asserted that GlobalFoundries will build Apple’s A-series chips for iOS devices at a new $6 billion facility in upstate New York. The development has led some folks to conjure up that Apple could be finally ditching Samsung for semiconductor manufacture, but that’s not really the case at all. Read on…

According to Arik Hesseldahl of AllThingsD, the Apple-GlobalFoundries deal is simply Apple minimizing risk as Samsung will remain the primary manufacturer of the engine which powers the iPhone and iPad.

We learned yesterday that Samsung will be sending a small team to GlobalFoundries’ Fab 8 plant in Malta, New York. Samsung’s engineers with be bringing Apple’s chip-making “recipes” to help GlobalFoundries set up the manufacturing processes.

According to AllThingsD, Samsung will use GlobalFoundries for what is known as “flex capacity”.

I’ll let Arik do the talking:

Sources close to the situation said the deal that appears to be taking shape looks more like this: Samsung will use GlobalFoundries for what is known as “flex capacity.”

This is a long-standing industry practice under which a chip manufacturer pays to occasionally use another company’s factories when demand on their own factory is running higher than they would like, and they need a little help.

Interestingly, the author has learned that Samsung’s $14 billion fabrication facility in Austin, Texas isn’t exclusively dedicated to churning out processors for Apple as it “also turns out chips for Samsung”, adding:

Occasionally there will be times when Samsung has to balance the demand on that fab in order to meet both the needs of its primary foundry customer — Apple — as well as its own internal needs for smartphone and tablet chips.

In that regard, Samsung will be subcontracting some of the iDevice chip production to GlobalFoundries on an as-needed basis, likely at peak times when the Austin plant may be unable to meet both Samsung’s and Apple’s volume needs.

“This is a very different business relationship than, say, if Apple were to tap GlobalFoundries as a ‘second source’ for chips,” the article explains.

So there you have it: Apple is simply seeking to minimize its exposure to a sole manufacturing partner by adding new foundries to its supply chain.

If anything, the GlobalFoundries tie-in ensures Apple can count on a second U.S. supplier of iDevice processors, if need be.

TSMC is the world’s largest foundry company, followed by GlobalFoundries (comprising the manufacturing arm of AMD and Chartered Semiconductor) and third-placed Samsung, according to research firm IC Insights.