Apple’s been distancing itself from Samsung for quite some time, by purchasing components elsewhere. The company recently added new display and battery providers to its supply chain.

This summer, it started increasing spending on Elpida memory chip at Samsung’s expense.

But as Apple increasingly sources major components from other suppliers, it has yet to make a switch to a non-Samsung silicon foundry. According to the latest chatter from Asia, Tim Cook and Co. remain adamant to take Apple’s chip making contract to Taiwan Semiconductor Manufacturing Company (TSMC) as early as possible.

But though TSMC, the world’s largest dedicated independent semiconductor foundry, has enough capacity to make the 200 million+ processors Apple needs annually for iPhones, iPads and iPods, such a move bears a significant risk of upsetting TSMC’s major buyers such as Nvidia and Qualcomm…

According to supply chain sources that talked to DigiTimes, an Asian trade publication with a hit-and-miss track record, massive chip orders from Apple raise concerns over TSMC’s profitability.

The semiconductor industry is now more concerned about how TSMC is going to distribute its production capacity, and what proportion of revenues and profits it can generate if it receives CPU orders from Apple in 2013.

TSMC, which has its headquarters and main operations located in the Hsinchu Science and Industrial Park in Hsinchu, Taiwan, also makes chips for the likes of Qualcomm and Nvidia. TSMC reportedly “does not want to upset its existing major clients” so allocating efficiently its production capacity will be a focus for the foundry in 2013.

The company recently broke ground for the sixth-phase construction of its Fab 14, a twelve-inch wafer plant, that will become its first fab to mass-produce silicon on a 20-nanometer process, as well as make 16-nanometer FinFET chips.

To produce the 200 million Apple chips, TSMC must produce at least 200,000 twelve-inch wafers.

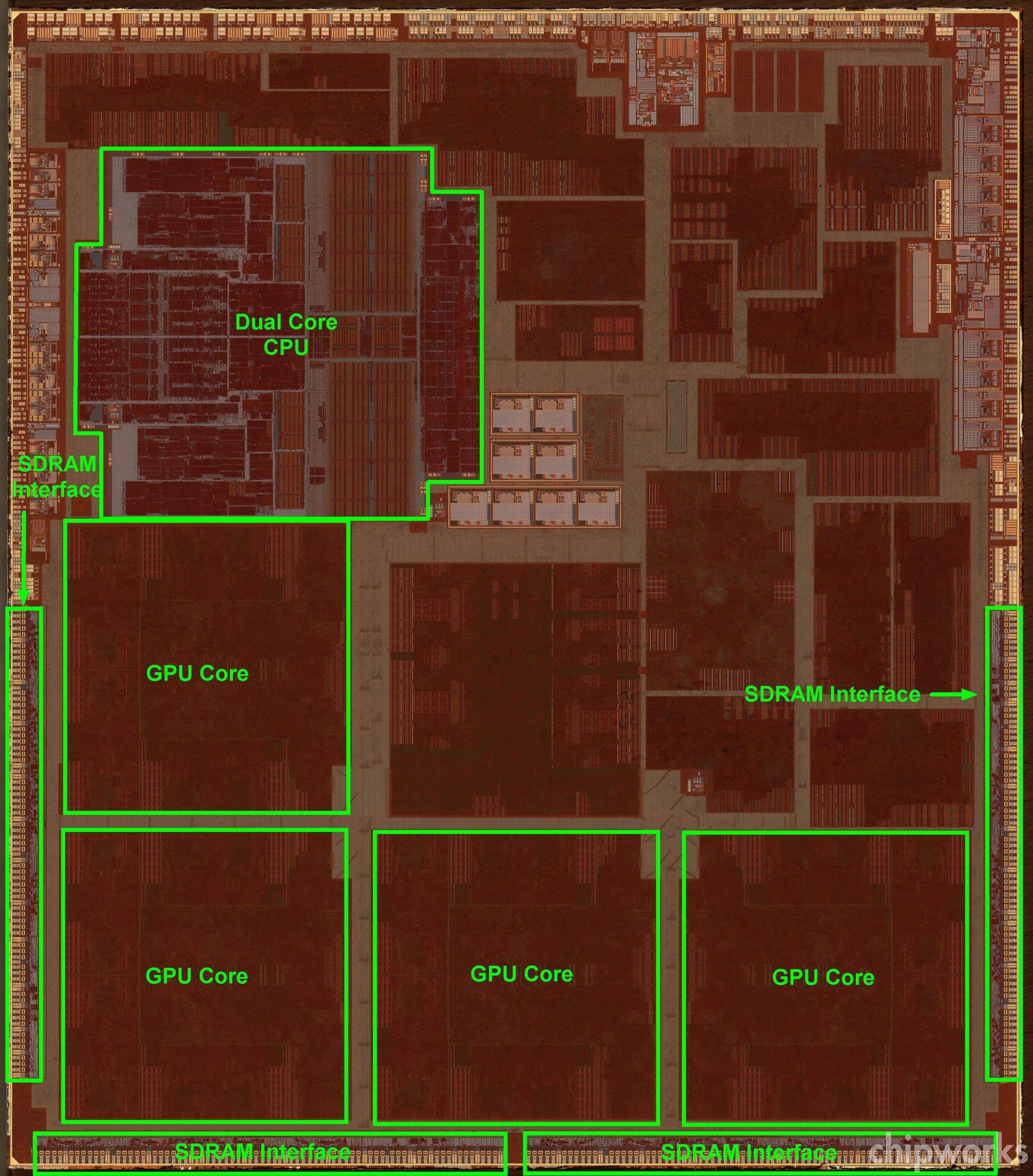

The A6X chip, which powers the fourth-gen iPad, under a microscope

SMC previously turned down Apple’s $1 billion offer for exclusive access to TSMC’s production output because the Taiwanese foundry doesn’t want “to sell part of itself and doesn’t need cash for investments”, according to its finance chief Lora Ho.

While Samsung exclusively produces chips for Apple’s iOS devices in its Austin, Texas semiconductor facility, sources tell DigiTimes that the Galaxy maker’s component arm will lose that contract as early as 2013, a year sooner than expected.

In a denial of the rumored 20 percent price hike for Apple silicon, an unnamed Samsung executive told the Korean newspaper Hankyoreh that “prices are set at the beginning of the year and aren’t changed easily”, suggesting Samsung will continue churning out iPhone and iPad processors through 2013.

Apple’s hostile legal tactics has reportedly prompted Samsung to become “more assertive” in price negotiations.

The Galaxy maker is scheduled to gather 200 executives for an annual meeting next month and litigation strategy in light of Apple’s $1.05 billion patent case win is reportedly going to be one of the topics of conversation.

Do you think Apple will shoot itself in the foot by pushing forward with such a major brain transplant in terms of switching the critical chip making biz from Samsung to TSMC?