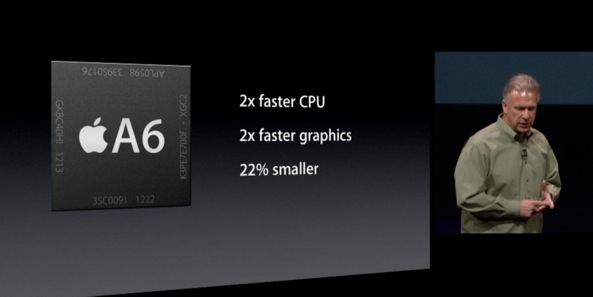

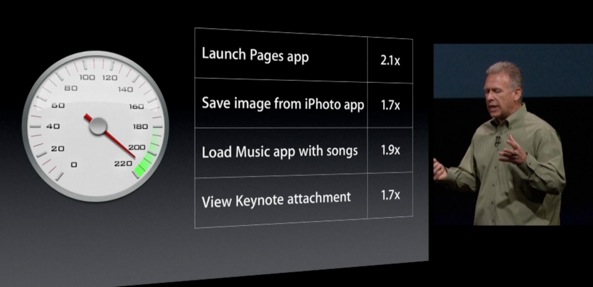

The iPhone 5 comes with a brand new Apple-designed A6 chip for a twofold jump in CPU/GPU performance. In fact, the iPhone 5 could easily be the first ARM Cortex-A15 smartphone on the market. The A6 is likely manufactured on Samsung’s 32-nanometer process, but probably not for long as Apple has been looking to take its chip contract elsewhere.

There ain’t many places to go: Intel sucks at power management and Samsung is #2 chip vendor in the world. Taiwan Semiconductor Manufacturing Company (TSMC), however, is the world’s largest dedicated independent semiconductor foundry and Apple could be closer than previously thought to shifting production contracts away from Samsung and towards TSMC.

Can you say “stock plunge”?

According to the somewhat reliable DigiTimes (they’re good at semiconductor and supply chain news), back chatter in Asia suggests that Apple and TSMC are “about ready to enter the design-in phase”.

The report also goes on to note that Apple is believed to have “reduced its orders with Samsung and raised the proportion of purchases from other suppliers including SK Hynix, Toshiba and Elpida Memory”.

The claimed iPhone 5 logic board that leaked 24 hours ahead of Apple’s keynote shows NAND flash chips by SK Hynix, a long-time Apple supplier. And back in May, Samsung denied rumors asserting Apple had secured half the manufacturing output from Elpida, the third-largest maker of dynamic random access memory chips.

“Apple is definitely using our chips”, an unnamed Samsung executive allegedly said.

IHS iSuppli estimates Apple could sell as much as 149 million iPhones and about 60 million iPads in the calendar year 2012. That’s a lot of chips to make – 209 million iPhone and iPad processors, to be precise.

And why is this important?

Because the $1 billion in damages a U.S. judge awarded to Cupertino in the high-profile Apple v. Samsung case could be a drop in the bucket compared to billions in lost orders should Apple take its chip contracts elsewhere.

Samsung is safe so far and even dropped $4 billion towards renovating its Austin, Texas plant in order to boost production of ARM-based chips, mainly for Apple, its biggest client.

DigiTimes wrote back in May that TSMC has a “good chance” of winning Apple’s chip biz in 2014. Apple is thought to be moving chip production to TSMC’s 28-nanometer process, but the semiconductor foundry is currently struggling to provide sufficient capacity to its existing 28nm customers.

Today’s report states that TSMC’s 16-nanometer double-gate FinFET process could be Apple’s most likely choice.

Note that TSMC already makes Qualcomm’s 4G LTE baseband package used inside the iPhone 5, generating an estimated ten bucks in per-device revenue for TSMC (see the full iPhone 5 bill of material estimate here).

TSMC also provides foundry services for other iPhone component suppliers such as Broadcom, STMicroelectronics, NXP and OmniVision.

Qualcomm and Apple both offered $1 billion for exclusive access to TSMC’s production output, but the company turned down the offers to “retain control of its plants”, its finance chief adding that TSMC “doesn’t want to sell part of itself and doesn’t need cash for investments”.

The way I read this: Samsung will build one more iteration of the iPhone and iPad processor (perhaps the A6X) and TSMC gets to build the A7 chip that should go into 2014 iOS devices.

Or, Apple could be simply looking to diversify its supplier base.

Either way, it will be Samsung’s loss.

Make sense?