Different stats and market research all point to the same conclusion: that the mobile market is being reduced to a two-horse race between iOS and Android (or Apple and Samsung, specifically) as once great incumbents such as RIM and Nokia get pushed aside, their market shares seriously declining.

In fact, it’s fairly safe to say that on the fifth anniversary of iPhone, both RIM and Nokia are fighting for survival, quite possibly their lifecycle coming to an end. Meanwhile, only four companies are turning profit in the increasingly crowded smartphone space…

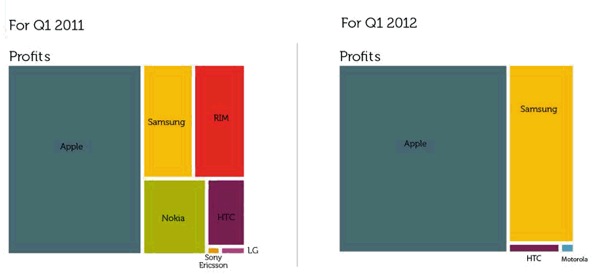

We’ve seen pretty charts before, courtesy of Asmyco, that illustrate unit sales versus revenues versus profits. This new chart by market research firm VisionMobile (via InfoWorld) really tops it off by visualizing drastic changes in this fast-paced space in just twelve months. Check out the bottom right box representing who’s making money in smartphones this year.

The smartphone market in 2011 and 2012. Click to enlarge.

Motorola Mobility, now a Google subsidiary, is barely a blip on the radar and HTC’s been seriously hurt over the past twelve months following several consequential money-losing quarters.

It’s astounding to me that of all branded vendors, only Apple, Samsung, Motorola and HTC are turning profit by selling smartphones. For everyone else, it’s a money-sucking affair.

It’s easy to forget that companies are in it for the money. That’s why unsuccessful vendors often brag about their platform’s market share (i.e. HTC) and unit sales (case in point: Nokia).

At the end of the day, however, investors and shareholders only care about a single metric: profits. What good are millions of units sold (i.e. Motorola) if your balance sheet is in the red instead of the black?

Asymco has put together a nice set of charts depicting a five-year track record of phone market shares for Apple, Samsung, Nokia, Motorola, HTC, LG, RIM, Sony Ericsson,

That’s why everyone is racing to beat Apple. Despite its relatively modest smartphone market share hovering around 20 to 25 percent, depending on who you ask, the company reaps a remarkable chunk of the profits.

This begs a crucial question: how long before Nokia and RIM, once two leading phone vendors globally, file for bankruptcy or sell off their assets.

Microsoft-Nokia?

According to Nomura analysts, the Finnish handset maker is expected to sell 34 million Windows phones in 2012, down 41 percent from their previous estimates.

BlackBerry 10 OS?

It won’t help RIM much offset the long decline.

It’s simple: Both Nokia and RIM are in a very difficult position, with no end in sight to their plummeting sales and profits and without a hero product on the horizon to turn their fortunes around.

The Sunday Times has it that RIM is considering a plan to split its struggling BlackBerry hardware business and messaging network into two separate companies, with Facebook and Amazon appearing as potential buyers.

Another astonishing, somewhat related nugget: in the five years since the iPhone launched, Apple created a total of 35,852 retail jobs. This illustrates high demand for the iPhone and iPad, which now account for more than an astounding three-quarters of Apple’s total revenue.

I’m convinced we need more competition in the smartphone space so the Apples and Googles and Microsofts of this world continue innovating.

I would hate to see the mobile phone market reduced to a three-horse race between Apple, Google and Microsoft. Unfortunately, it’s increasingly looking that’s exactly where we’re heading.

On the other hand, an astute watchers could ask themselves if the world really needs more than three smartphone platforms?