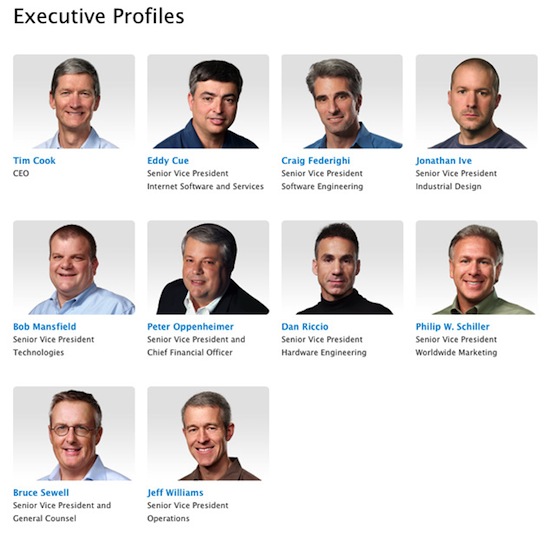

Spring is just around the corner, the sun is shining and new concerns about Apple suppliers appear like so many dandelions. Never mind CEO Tim Cook said it's impossible to determine the health of the iPhone maker simply by looking at suppliers.

Just as Washington, DC trades in political rumors, Wall Street and Silicon Valley are back with new scuttlebutt about Apple's supply chain.

As a result, Apple's stock dipped lower Monday on word that orders to suppliers were the worst on record - at least for one analyst. Others believe higher sales of iPad minis versus the larger tablet is cause for concern, while still others forecast a slow summer and then return to profitability...