The iOS 17.5 update provides support for downloading iPhone apps from developer websites but only for customers in the European Union (EU).

iOS 17.5 brings support for downloading iPhone apps directly from websites

The iOS 17.5 update provides support for downloading iPhone apps from developer websites but only for customers in the European Union (EU).

Apple is reportedly preparing to allow customers to sideload iPhone apps from alternative app stores beginning in the first half of 2024.

Ahead of new EU regulations next year, Apple's iOS 17 software will reportedly pave the way for app sideloading and alternative app stores on the iPhone.

There’s been a lot of talk lately about Apple switching from their existing Lightning port on iPhones to the USB-C port on future models instead. In fact, legislation in the European Union last year effectively ensures that Apple will sell iPhones with a USB-C port by 2024. So should you be excited? Let’s discuss…

The first version of the upcoming contact tracing APIs that enable interoperability between Android and iOS devices using apps from public health authorities is coming earlier than expected, on April 28, according to Apple's chief executive.

Major video-streaming platforms like Netflix, Google-owned YouTube and Amazon's Prime Video have reduced streaming quality in the European Union to avoid straining the Internet as millions of employees switch to teleworking amid the coronavirus pandemic.

The European Union's competition authority is launching an antitrust probe into Apple’s conduct after considering Spotify's competition complaint which alleges that Apple's own music-streaming service gives the iPhone maker an unfair advantage over rivals.

Even though Apple added a toggle to iOS which disables the controversial CPU throttling and offered consumers discounted battery replacements, the Italian watchdog has fined the Cupertino technology giant ten million euros, which works out to about $11.4 million bucks, over using software updates to slow down iPhones and push people into buying new models.

As expected, the European Union antitrust regulators have officially approved Apple's planned acquisition of Shazam, the British music discovery app, for a reported $400 million.

Apple's acquisition of the British music identification service Shazam should be approved by the European Commission antitrust regulators after all, a new report has alleged.

The European Commission on Wednesday slapped Google with a record $5 billion fine claiming that the internet giant is anticompetitive and abuses its power when it comes to Android. As it readies an appeal, the company is now wondering why Apple's closed iOS system isn't being more scrutinized.

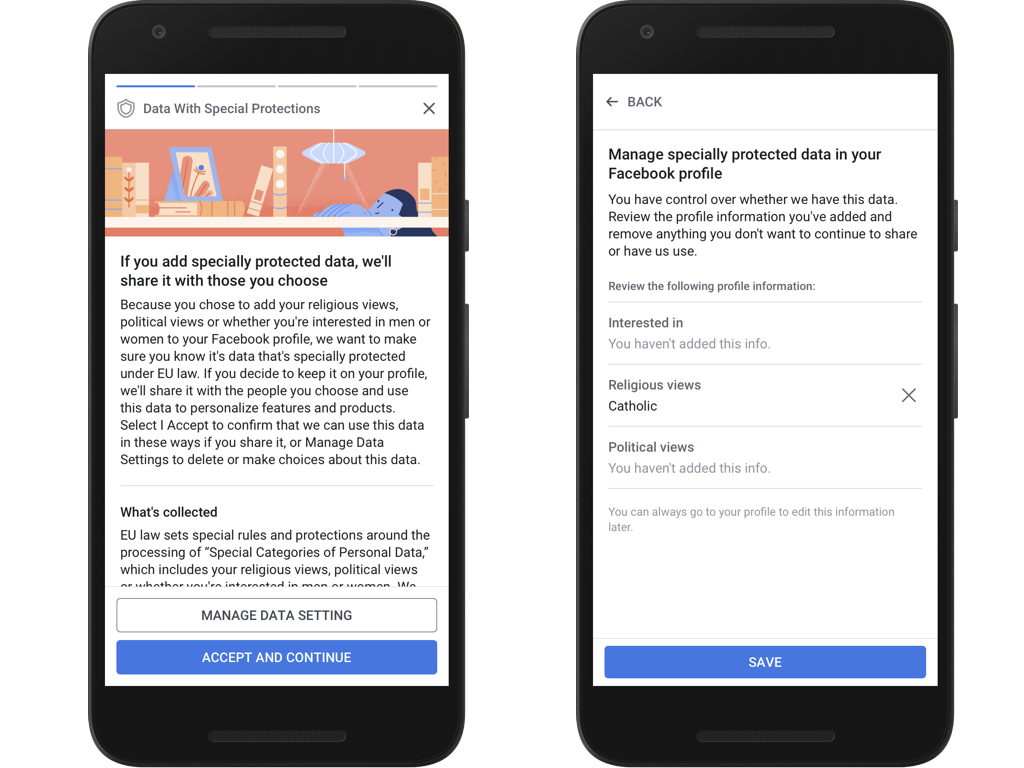

Facebook is launching new privacy controls following the Cambridge Analytica scandal.