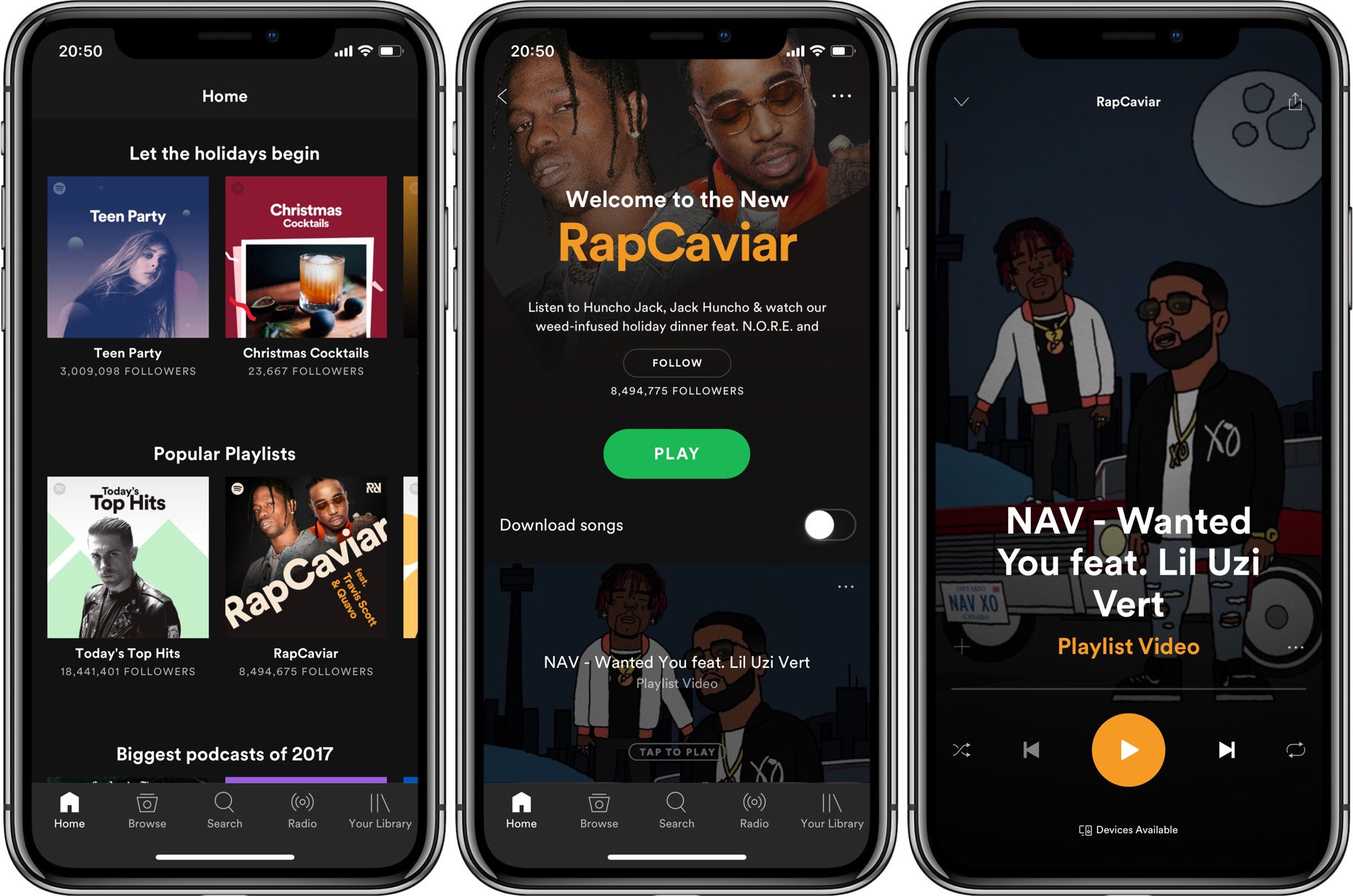

The US Securities and Exchange Commission (SEC) has given the #1 music-streaming service Spotify preliminary approval for a new type of “underwriter-less” initial public offering (IPO).

The Wall Street Journal reported Friday that this is expected to happen in the Spring 2018, allowing Spotify to avoid a traditional IPO that can be quite costly.

Spotify wants to list its shares on the NYSE via a so-called direct listing.

Here’s how that would work:

In a direct listing, a company transfers its shares to an exchange without raising money as is done in a typical IPO. Companies have shied away from the unusual process in part because there is a greater risk that the shares could flop since there are no underwriters to set and prop up the price.

Among the draws: Direct listings enable companies to save on the hefty underwriting fees associated with traditional IPOs, and there aren’t restrictions on when insiders can sell shares.

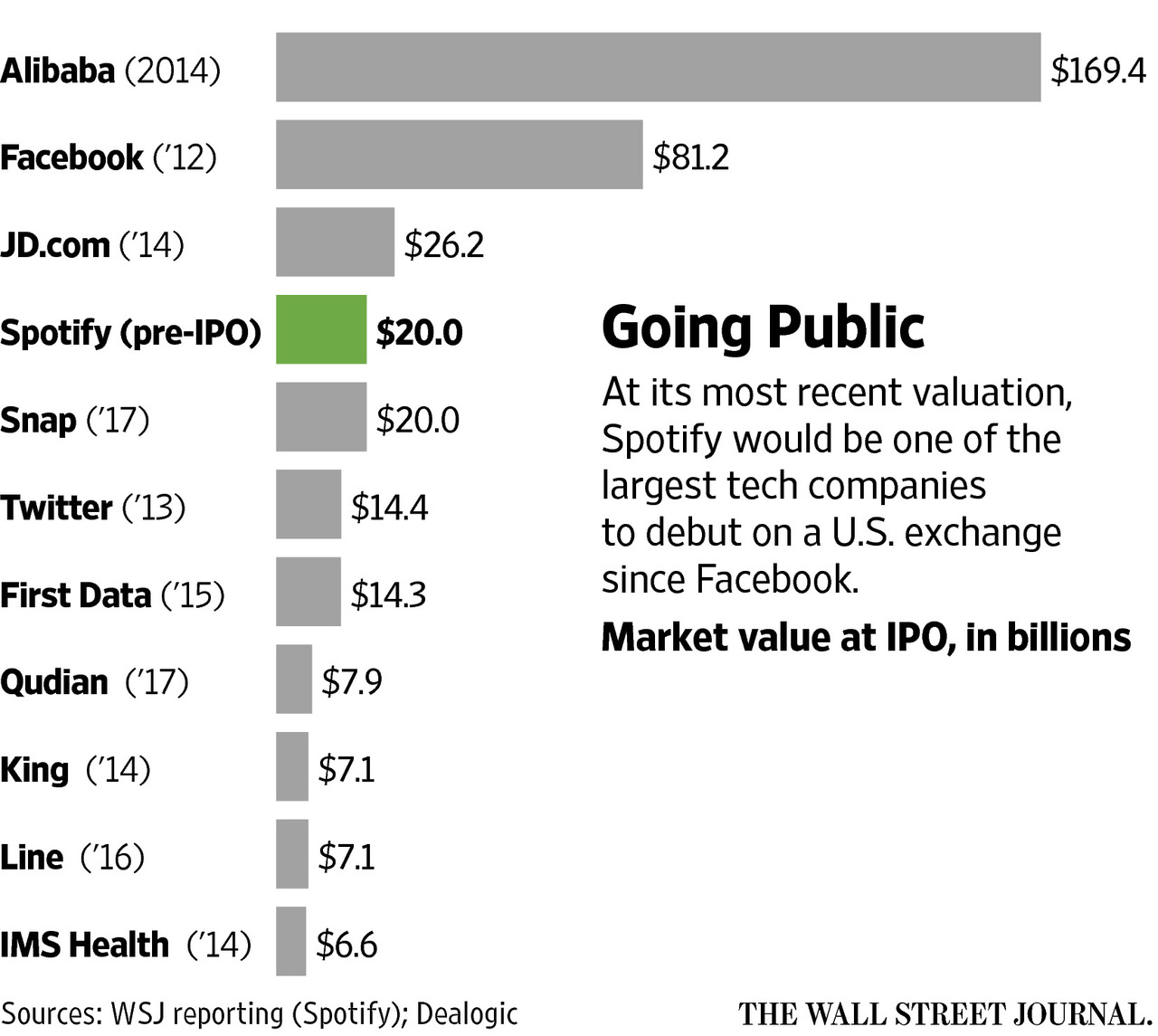

If everything goes according to the plan, Spotify’s example might encourage other startups to pursue direct listings. Spotify’s market valuation at post time was around $20 billion.

The SEC has not yet made an official decision on the New York Stock Exchange’s proposal, which is necessary to change the NYSE rules. The NYSE has reportedly applied for such a change and the SEC has indicated to Spotify it’s likely to approve.